Advertisement

Advertisement

Malaysia Records All-Time High in Illegal Crypto Mining in 2021

Updated: Feb 22, 2022, 18:30 GMT+00:00

In 2021 alone, around $13 million worth of crypto mining equipment were seized and 528 people were arrested in connection with illegal mining operations.

Illegal cryptocurrency mining in Malaysia hit an all-time high in 2021, compared to its previous year, Bukit Aman Criminal Investigation Department (CID) chief Datuk Seri Abd Jalil Hassan said.

Around $13 million worth of mining equipment was confiscated in 2021, compared to $301K worth of seizure in 2020. As a result, Malaysia saw an exponential 4,200% increase in seized items from 2020 to last year.

Additionally, the chief noted that 2021 saw 570 investigation papers opened, 528 arrests relating to illegal crypto mining. While in 2020, there were only 20 papers opened and 26 people arrested.

Per the MalayMail report on Monday, the availability of surplus electricity at lower costs is among the factors that contributed to this massive drive. As a result, electricity theft has been booming in Malaysia, with a total of 7,209 cases being reported from 2018 to 2021, said Hassan.

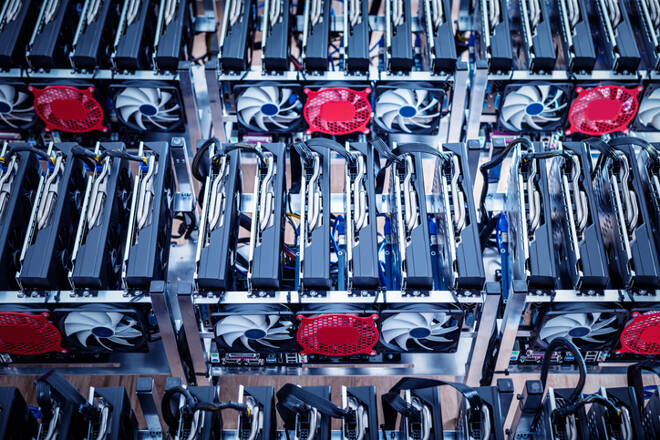

“The suspects find business areas that are hidden so the public won’t hear the noise or feel the heat coming from the mining rigs,” he added.

Last year, Malaysian authorities had destroyed 1,069 seized Bitcoin mining machines by steamrolling them. The mining machines were worth $1.2 million. In addition, eight were arrested for stealing the equivalent of $2 million worth of electricity to power the energy-hungry computers.

Is Crypto Mining Legal in Malaysia?

Since the central bank of Malaysia declared that cryptocurrencies are not legal tender in the country, Bitcoin mining would fall into the gray areas. However, to date, the authorities have not given a clear answer on the legality of crypto mining.

However still, crypto mining is considered legal in Malaysia. According to the national electricity board – TNB operations head Wan Nazmy Wan Mahmood, crypto mining activities are not an offense. Interested companies and individuals have to submit their applications to TNB.

Luno, one of Malaysia’s regulated crypto exchanges, told FX Empire that Malaysian authorities might need to regulate and ensure a conducive environment for Bitcoin mining.

“A healthy mining industry in Malaysia could lead to increased revenues for the country, additional foreign direct investments into Malaysia, and also create highly-skilled jobs for our population.”

Existing Bitcoin Mining Operations

Last year, a Malaysian mall operator and property developer, Hatten Land, said it would install and run 1,000 crypto mining rigs on its Malaysian properties. The realtor signed an agreement with Singapore-based Frontier Digital Asset Management to carry out the operations.

The rigs will mine Bitcoin initially and will include alternative coins in the future, the Group said at the time.

Hatten Land is undertaking green crypto mining enabled by solar power and is also looking to include tokens and non-fungible tokens (NFTs) and other digital initiatives.

The Group is not concerned about possible regulatory issues as it obtained a legal opinion that Malaysian laws do not prohibit cryptocurrency mining, the firm’s executive chairman and managing director Colin Tan said.

However, according to Luno exchange, regulations are “crucial” as they lay the groundwork to develop relationships with regulatory bodies.

“Regulations make it easier to identify key players and enable relevant parties to share their knowledge on how to create a healthy cryptocurrency ecosystem in Malaysia,” a Luno spokesperson said via email.

Malaysia’s CBDC Moves

Malaysia’s de-facto central bank, Bank Negara Malaysia (BNM), said early this year that it is “actively accessing” a central bank digital currency (CBDC) study.

The research aims to focus on enhancing technical and policy capabilities “should the need to issue CBDC arise in the future,” the bank said at the time. Malaysia, however, does not have immediate plans to launch a CBDC.

It is essential to remain aware that introducing regulated digital money will not come with a one-size-fits-all action plan, and BNM, like any other country’s central bank, is proceeding with caution to mitigate any risks on their economy’s stability.

Last September, Malaysia joined forces with the Bank for International Settlements, Australia, Singapore, and South Africa to develop a proof-of-concept CBDC pilot dubbed “Project Dunbar.”

“We fully support cooperation and interaction between government-issued currency and cryptocurrency,” Aaron Tang, Country Manager, Luno Malaysia, said via mail to FX Empire.

“We believe CBDCs bolster the need for truly decentralized, trustless, and permissionless cryptocurrencies that offer cheaper, faster, secure, and more inclusive access to money,” he noted.

About the Author

Sujha Sundararajanauthor

Sujha Sundararajan is a writer-journalist with 7+ years of experience in Blockchain, Cryptocurrency and in general, FinTech news reporting. Her articles have featured in multiple journals such as CoinDesk, Protos, Bitcoin Magazine, CCN, Asia Blockchain Review, BeInCrypto and EconoTimes to name a few. She holds a Master’s in Journalism from the Indian Institute of Journalism and New Media and is also an accomplished Indian classical singer.

Advertisement