Advertisement

Advertisement

Marketmind: Consumer drain as banks gain

By:

A look at the day ahead in U.S. and global markets from Mike Dolan.

A look at the day ahead in U.S. and global markets from Mike Dolan.

This year’s inflation and interest rate shock to consumers is mirrored by the massive windfall for the world’s leading banks – the political optics of which rankle as central banks are set to push borrowing rates even higher.

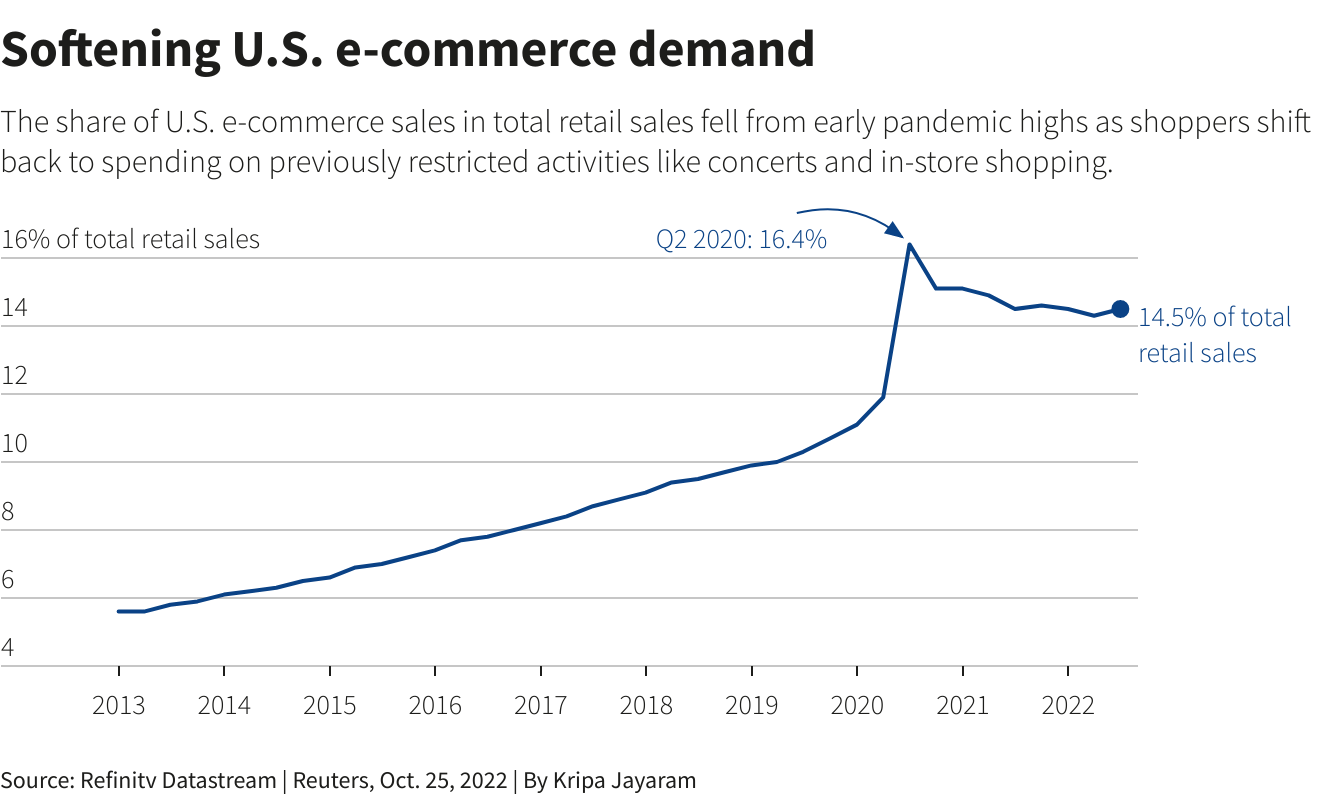

Deep in the weeds of the third-quarter earnings season, Big Tech and other consumer favourites are clearly feeling the chill of the cost of living crisis as well as a higher dollar and supply chain disruptions – upping global recession fears as financial conditions tighten.

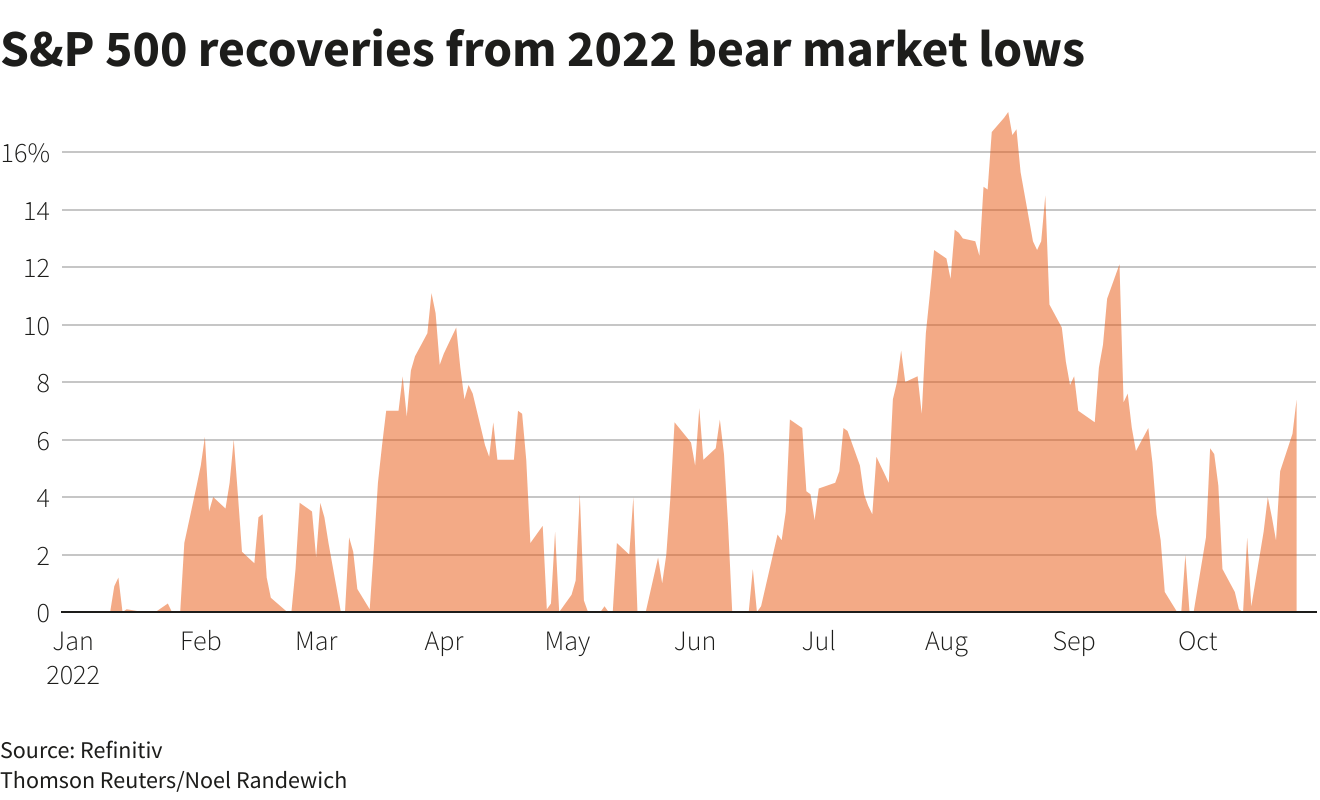

Quarterly results from mega caps Microsoft and Google-parent Alphabet disappointed late Tuesday and sent both their shares down about 7% after the bell, cutting across an earlier surge in Wall St stock benchmarks. S&P500 futures were down almost 1% on Wednesday, halving Tuesday’s index gain.

Google’s results in particular bode ill for Facebook parent Meta Platforms, especially reliant on advertising and reporting its results late on Wednesday. Apple and Amazon detail how their businesses fared on Thursday.

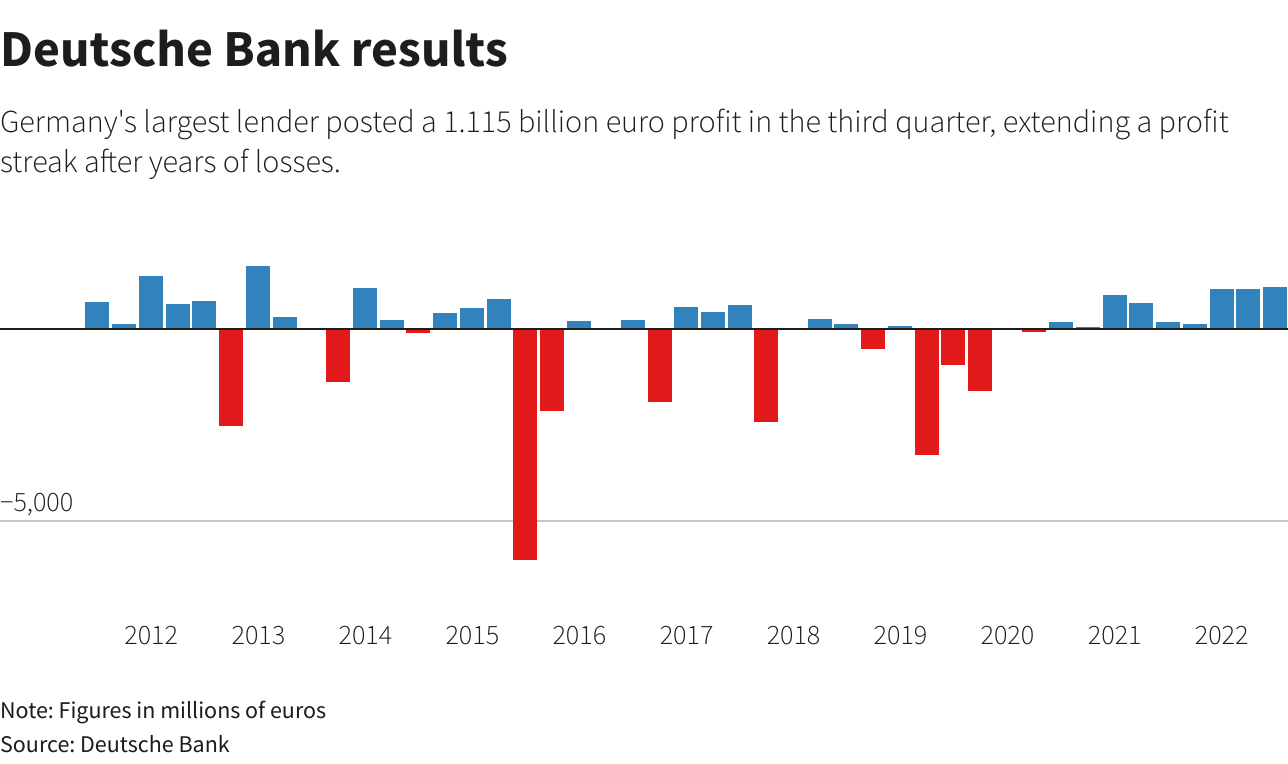

Consumer blues contrasted with bumper earnings from banks who are raking in huge windfalls from rising interest rates – direct cash injections from reserves they hold at central banks along with higher net interest margins and trading revenues flattered by volatile markets.

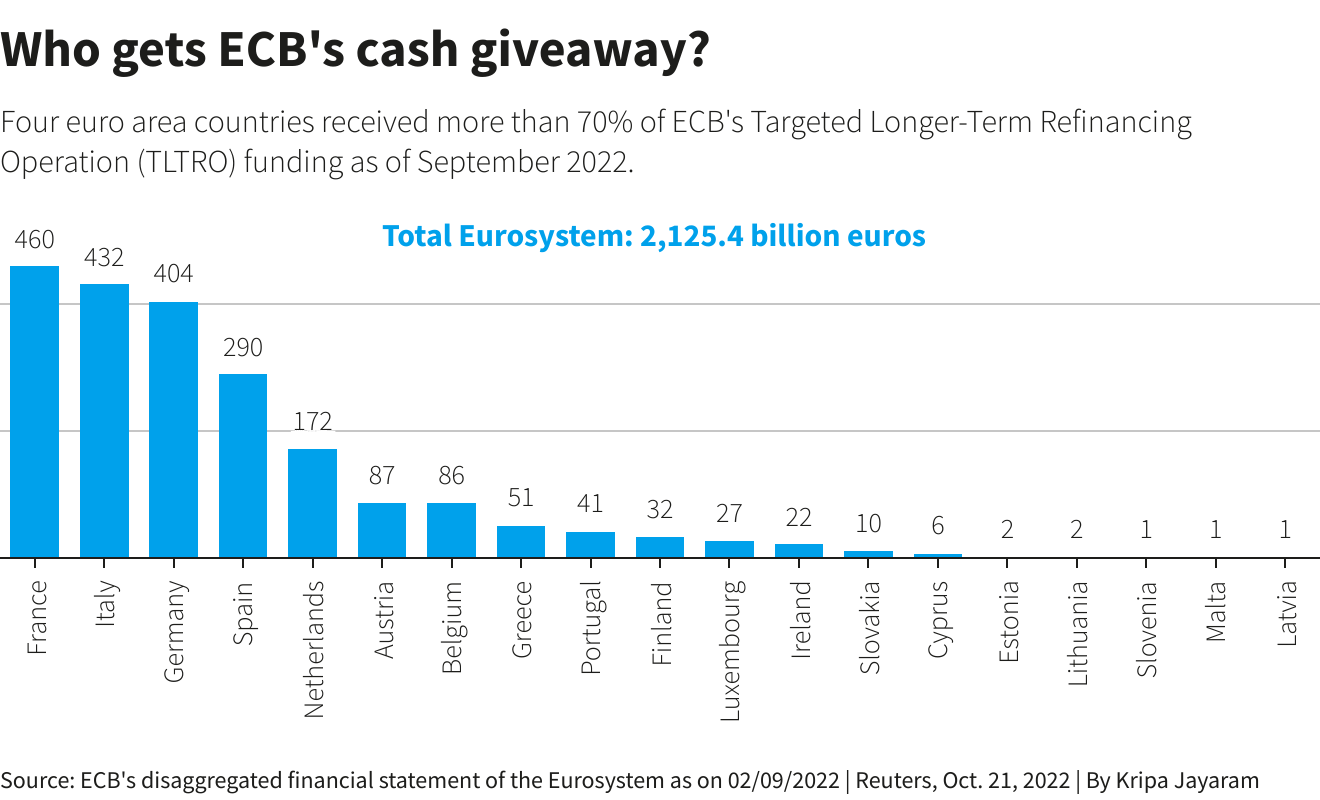

European banks reporting this week matched Wall St counterparts on that score, raising conundrums for the European Central Bank meeting this week and Bank of England and U.S. Federal Reserve gatherings next week. They all plan further policy rate rises to rein in inflation – but this also involves direct transfers to their banks and potentially a drain on government finances.

The Bank of Canada is expected to lift rates by another three-quarters of a percentage point to a fresh 14-year high later on Wednesday, and Canada’s dollar climbed sharply in advance of the decision.

The darkening economic skies responsible for the dour real sector earnings were still clear in downbeat U.S. consumer confidence and housing readings on Tuesday, and mounting recession fears have raised speculation about whether the U.S. Federal Reserve will soon be forced to slow the blistering pace of credit tightening.

With energy price rises also easing back gradually, especially Russia-squeezed natural gas costs in Europe, hopes for some Fed respite fears dragged long-term bond yields and the U.S. dollar back lower again too.

Ten-year Treasury yields have lunged back close to 4% over the past 24 hours, more than 30 basis points below Friday’s peak. The dollar recoiled across the world against the euro, yen, sterling and yuan – sliding back through parity versus the euro for the first since in over a month.

Chinese shares finally stabilised on Wednesday after this week’s withering slide on worries about the economic and political direction of reconfirmed President Xi Jinping’s new cabinet. The offshore yuan rebounded from record lows against a weaker dollar.

Sterling also caught the slipstream of a falling greenback but UK government borrowing rates edged back up on reports Britain’s new Prime Minister Rishi Sunak could delay the announcement of a plan to repair the country’s public finances beyond the expected Oct 31.

Key developments that should provide more direction to U.S. markets later on Wednesday:

* U.S. Sept new home sales, trade balance, wholesale inventories. Eurozone Sept credit and money supply,

* Bank of Canada policy decision

* U.S. Treasury auctions 5-year notes, 2-year FRNs.

* Bank of England Director for Financial Stability, Strategy and Risk Lee Foulger speaks in London

* French President Emmanuel Macron and German Chancellor Olaf Scholz hold a press conference following talks in Paris

* U.S. corp earnings: Meta, Ford, General Dynamics, Boston Scientific, Bristol Myers Squibb, Kraft Heinz, Hilton Worldwide, Norfolk Southern, Fortive, Amphenol, Waste Management, Rollins, Garmin, Teledyne, Avery Dennison, Hess, Thermo Fisher Scientific, Align Technology, Molina Healthcare, ADP, EQT, CME, IDEX, Globe Life, Everest Re, United Rentals, Roper Tech, Otis Worldwide, Old Dominion Freight Line, UDR, KLA, O’Reilly Automotive, Raymond James Financial, Fortune Brands, Invitation Homes

(By Mike Dolan, editing by XXX mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement