Advertisement

Advertisement

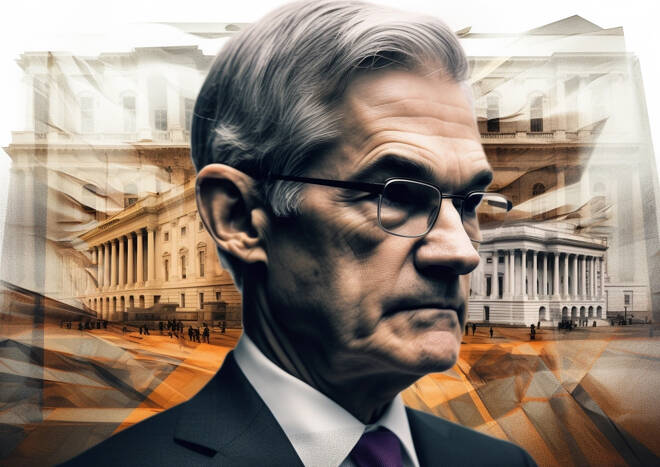

Powell Says Recent Data Did Not Change His View On General Inflation Trends

By:

Key Points:

- Powell noted that the federal funds rate was likely at its peak.

- The recent inflation data did not change Powell's views on general inflation trends.

- Powell believes that interest rates would not get back to the very low levels seen before the start of the latest rate hike cycle.

On March 20, 2024, Fed Chair Jerome Powell spoke at the press conference after the release of the Fed decision.

Powell noted that labor market remains tight, but supply and demand was coming into better balance due to the increase in supply of workers.

According to Powell, the federal funds rate is likely at its peak, and Fed will start cutting rates sometime this year. As usual, Fed is prepared to keep rates at high levels if appropriate. The Fed will slow the pace of sales from its balance sheet to prepare money markets for the upcoming rate cuts.

Interestingly, Powell talked about two-sided risks of being too hawkish or too dovish. The Fed has a dual mandate of targeting inflation and maintaining maximum employment and wants to strike a balance between these two goals.

Powell that recent inflation data did not show anything dramatic, and that he believed that data showed that inflation was still moving lower. This is an important comment as traders worried that recent inflation data could change Powell’s view on current inflation trends.

When asked about higher federal funds rate projections for 2025 and 2026, Powell said that rates would not get back to the very low levels that were seen before Fed started its rate hike cycle.

U.S. Dollar Index pulled back towards the 103.40 level as Powell noted that inflation was moving lower and signaled that Fed was ready to start cutting rates.

Gold rallied towards the $2180 level, supported by weaker dollar and Powell’s comments. Gold traders bet that the rate cut cycle would start soon, which is bullish for gold and other precious metals that pay no interest.

SP500 tested historic highs above the 5220 level as traders reacted to Powell’s dovish comments.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement