Advertisement

Advertisement

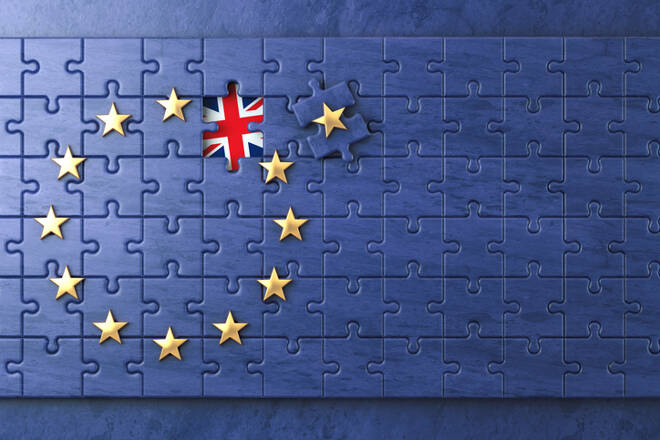

The Brexit Conundrum: How the UK Holds the Forex Market Hostage

Updated: Jan 7, 2019, 19:37 GMT+00:00

On June 23, 2016, the UK decided to leave the European Union. This has made a lot of people very angry and been widely regarded as a bad move.

The exact terms of the agreement are being settled to this day, with both the UK and the EU diplomats being unable to find a middle ground on the subjects of taxation, border control, etc. But the political issues aside, Brexit has been an absolute wreck to the markets too. For the entire two-year span, the GBP and EUR positions have been highly unstable and prone to tipping over whenever another wave of Brexit news hit. And while it was rather beneficial for traders in the short run, the market eventually became completely hostile to the traders.

How Brexit Ruined Daytrading

The daily Forex trading is affected the most — while on the longer timeframes, the traders can wait until the market swings back, the shorter ones don’t provide this privilege. The bears are specifically hurt by this situation since they have a hard deadline for every order.

The GBP/EUR market suffers too. Until the beginning of November, it was at least generally bearish, and the bull rushes were rather clumsy. Not anymore — ever since Theresa May reinforced her positions and survived the Votum of No Confidence, the market is completely at the mercy of the mass media. And while it still retains the downward tendency, the bullrushes are now powerful enough to close most bearish orders by StopLoss — which makes even the most desperate bears tread carefully.

The Future of Brexit

Theresa May insisted that Brexit will be resolved and all agreements will be reached by November 2018. If you haven’t been following the news as of late — it didn’t happen. Moreover, May managed to lose the key diplomats involved in the agreement and had to postpone the vote on the project since the Parliament was hostile towards it.

The only reason May herself remains in the chair of the Prime Minister is the lack of other leaders in the country. While the Vote of No Confidence against her failed, it is only because of the recent memories of David Cameron leaving the country headless in the aftermath of the first Brexit referendum. May seems to understand it too since she agreed to leave the government in 2021.

Overall, the situation is not likely to change anytime soon. The European Union is firm and isn’t likely to offer a further compromise — while the UK won’t accept the current conditions that limit their possibilities even further. It is likely that this situation will continue well in 2019 — or even resolve with the UK remaining in the EU.

How to Trade During Brexit

Remember “WarGames”? The only winning move is not to play. And while you can trade on the GBP during Brexit using technical analysis, you really shouldn’t. The patterns are depending on the adequate, predictable market, and do not work for the markets that are in a state of constant panic.

If you are not ready for substantial risks, you should switch to a less volatile or at least more predictable currency pair, i.e., USD/CAD and USD/JPY. While they are also affected by the weakening USD, at least the other currency remains more or less stable.

However, if you still want to trade GBP, you should carefully review your strategy and prepare for the large risks. Also, consider finding a broker with tighter spreads — it will help you maximize your profits. Ideally, sign up for a JustForex ECN Zero account or any other account without spreads. This is a trustworthy company which has been working on market since 2012 and has millions of clients in 197 countries.

About the Author

FX Empire editorial team consists of professional analysts with a combined experience of over 45 years in the financial markets, spanning various fields including the equity, forex, commodities, futures and cryptocurrencies markets.

Advertisement