Opinions

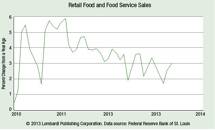

If you really want to measure economic growth, keep your eye on one statistic—consumer spending. One of the key determinants to economic growth in America is the level of consumer spending. That’s because consumer spending accounts for approximately 70% of the overall gross domestic product (GDP). This makes it imperative

- FX Empire Editorial Board

Federal Reserve Chairman Ben Bernanke testified to the House Financial Services Committee last Wednesday, and there was nothing surprising in what he said. He stated that the money printing will continue until there’s improvement in the economic recovery and the jobs market. Bernanke again repeated that the Federal Reserve might

- FX Empire Editorial Board

It seems like every day we’re seeing the stock market advance higher, which makes me wonder if traders are just trigger-happy and trading on the momentum in the market—and, trust me, there’s plenty of it. Whether you are a day, swing, or longer-term trader, there’s easy money to be made.

- FX Empire Editorial Board

I know many of you probably don’t even look at Chinese stocks anymore. I wouldn’t be surprised given the years of fraudulent reporting by numerous China-based companies that decided to come here and steal your money through deception. The reality is that the flow of new Chinese initial public offerings

- FX Empire Editorial Board

Long-time readers of this column know of my affinity for railroad stocks. I like keeping things domestic; I like keeping things simple; and I like consistent growth—in revenues, earnings, and dividends. Railroad stocks are benchmarks on the North American economy. What they report is real, definitely worthwhile noting, and a

- FX Empire Editorial Board

In an ironic twist, the subprime credit crisis was probably what was needed to save the banking sector. The failure of Lehman Brothers that drove the financial crisis and recession also prompted the government to force big banks to clean up their business. I still recall when Citigroup Inc. (NYSE/C)

- FX Empire Editorial Board

The cement business is as good a benchmark as you are going to get on the U.S. economy. And if this company is any indication, cement sales are accelerating at a double-digit rate. Texas Industries, Inc. (TXI) sells cement and aggregates mostly in Texas and California, the two largest cement

- FX Empire Editorial Board

Face it: there is no real economic growth in the U.S. economy. The only reasons the key stock indices keep rising are nothing more than easy money and false optimism. They are anything but a key indicator, and you should not use them as one. The reality of the U.S.

- FX Empire Editorial Board

The eurozone is still a mess. Instead of improvements, I just see more troubles. Economic slowdown in the region’s debt-infested nations is already staggering, but even those that were able to fight it are now experiencing huge problems. Around this time last year, the European Central Bank (ECB) was very

- FX Empire Editorial Board

In what can only be described as another excellent quarter of performance and growth, Johnson & Johnson (JNJ) once again beat Wall Street consensus with its earnings. The company defied the odds and posted genuine business growth—not just domestically, but abroad as well. Similar to its first-quarter performance, the company

- FX Empire Editorial Board

I just filled my gas-guzzling SUV that only uses premium gasoline; trust me when I say it wasn’t pleasant. And I know I will need to visit the gas station again in just a few days. I accept that, but what I don’t understand is the surging increase in oil

- FX Empire Editorial Board

The Federal Reserve has made it very clear that it wants to stop quantitative easing. But it has also made it just as clear that it won’t begin to taper its quantitative easing program until certain conditions are met. While speaking in front of the Committee on Financial Service, here’s

- FX Empire Editorial Board

In the first quarter of 2013, we saw an interesting and unexpected development. While the corporate earnings of S&P 500 companies were better than expected, their revenues weren’t nearly as impressive. Just 46% of S&P 500 companies reported revenues above estimates. (Source: FactSet, May 31, 2013.) And the second-quarter corporate

- FX Empire Editorial Board

At this point, what the stock market needs is a little time for reflection. And by that I mean that the market participants really need to sit back, pause, and examine the situation. As you already know, I was disappointed that the correction in June was not deeper—I was waiting

- FX Empire Editorial Board

“Impressive” is the only word I can think of to describe the moves of the S&P 500 and Dow Jones Industrial Average to new record highs last Thursday. Call it the “Bernanke bounce” if you want, but if you didn’t believe the Federal Reserve’s easy monetary policy was behind the

You’ve got to change with the times. One point that I’ve reiterated several times is that it’s vital to deploy an investment strategy that incorporates the current market environment when determining how to allocate one’s portfolio. A great example of that has been the recent climb and rapid drop in

One of the most common problems new investors face is learning that at certain points in an economic cycle, bad news can be seen as good news. The recent speech by the Federal Reserve chairman Ben Bernanke regarding monetary policy was seen as bullish for investor sentiment, even though he

- FX Empire Editorial Board

The equity market continues to trade while hanging on the Federal Reserve’s every word. There continues to be buoyancy in investor sentiment, and it’s flying in the face of what can only be described as modest earnings results so far. And the fervor that institutional investors have to be buyers

- FX Empire Editorial Board

Mark my words—gold bullion has a great future ahead. As the prices for gold bullion face severe headwinds in the short term, the fundamentals are getting stronger. The most important sign that makes me believe it is that central banks continue to buy more in spite of a sharp decline.

- FX Empire Editorial Board

Back in late 2011, I created a widely circulated video that included six predictions. I hit it on the head with five of those predictions. But the winners are not what are important to my readers today; it’s the prediction I didn’t get right that’s vital now Back then, I