- OKEX

- OFFICIAL SITE

- Coins Available3Accepted Countries195Payment Methods1

OKEXReview

Our Verdict

OKX is a hugely popular crypto exchange based in the Seychelles. Founded in 2017, it rebranded from OKEx to OKX in 2022. Based on our testing, it supports over 300 tokens and 500 trading pairs. Its competitive fees and advanced trading functionalities make it a perfect match for serious traders.

However, due to OKX’s efforts to comply with regulations, its selection of tokens and trading features can be more limited in some regions compared to other exchanges.

| Pros | Cons |

|

|

Is OKX Right For You?

Not all traders are the same. Some seek easy apps for trading on the go, while others look for advanced features like leverage or social trading. When reviewing exchanges, we cater to all types of traders, from occasional to frequent. We divided all traders into seven main target groups.

Our thorough yet straightforward method ensures a clear understanding of trading strategies and their requirements. By assessing, ranking, and recording key factors, we determine how well the exchange meets the needs of each target group. We use three types of rankings: perfect match, good choice, and not recommended. Here’s our verdict:

Casual Traders: Perfect Match

OKX is a perfect match for casual traders, offering lower fees, robust FAQs, educational resources, and numerous tools for various trading strategies. While the user experience is straightforward, selling crypto for fiat isn’t possible in some regions like the UK. The strict compliance process, though ensuring security, can be cumbersome.

| Pros | Cons |

|

|

Day Traders: Perfect Match

OKX is a perfect match for day traders. It offers an excellent desktop experience, low fees, leverage options, and access to over 300 crypto tokens, setting a high standard comparable to Binance. Plus, the exchange has never been hacked, provides solid proof of reserves with monthly audits, and scores high on security with 2FA and multi-factor biometric scanning.

| Pros | Cons |

|

|

Hodlers & Position Traders: Perfect Match

OKX is a perfect match for crypto holders and position traders. It seamlessly integrates with its decentralized self-custodial wallet, letting you control your assets while enjoying centralized exchange benefits. Plus, it’s super transparent, with some of the best proof of reserves in the industry. The platform has updated its POR reports monthly.

OKX also boasts an excellent security record—it has never been hacked, with solid proof of reserves, monthly audits, 2FA, and multi-factor biometric scanning. The platform also supports a range of staking and borrowing options for long—to medium-term investments.

| Pros | Cons |

|

|

Leverage & Derivative Traders: Perfect Match

OKX is a perfect match for leverage and derivative traders. It offers a top-notch desktop experience, low fees, and leverage options of up to 10x leverage on the spot and up to 100x on futures, with access to over 300 crypto tokens and margin trading available for spot, futures, perpetual futures, and options, covering all bases.

OKX has a stellar security record — never hacked, solid proof of reserves with monthly audits, and high security with 2FA and multi-factor biometric scanning.

| Pros | Cons |

|

|

Bot, Social & Copy Traders: Perfect Match

OKX is a perfect match for bot, social, and copy traders. As a market leader in these fields, OKX offers an attractive and user-friendly platform to follow and stay updated with your favorite traders, featuring robust social and copy trading mechanics. The platform also actively supports bot trading with a comprehensive interface, pre-configured trading bots, and educational resources to help you get started.

| Pros | Cons |

|

|

Algorithmic Traders: Perfect Match

OKX is a perfect match for algorithmic traders. It offers everything they need: API access, low fees, trading bots, high-speed and frequency trading capabilities, and even an API sandbox environment for testing. It boasts some of the highest liquidity among top centralized exchanges like Coinbase and Binance.

It’s a one-stop shop for serious algorithmic traders looking for a capable platform. Its API call rates and limits are competitive with other top exchanges, varying by endpoint and account type. Make sure to check out their API documentation for specifics.

| Pros | Cons |

|

|

Dollar Cost Averaging (DCA) Investing: Not Recommended

We do not generally recommend OKX for DCA (Dollar-Cost Averaging) investing because it doesn’t offer an option for automated recurring buys.

While you can use a trading bot for the task, they’re geographically restricted in some areas on OKX. Plus, unless you’re experienced with trading bots, the learning curve can be pretty steep. Remember, getting around these restrictions with a VPN will permanently ban your account, so it’s not worth the risk.

For a smoother experience, consider exchanges like Coinbase or Binance, which offer recurring buy options for hassle-free DCA investing. But if you’re lucky enough to be an advanced DCA bot trader living in a non-restricted region, this exchange could be a good fit for you!

Supported Countries and Regions

Due to the rollout of worldwide crypto regulations, OKX has been increasingly restricted. It has faced bans and restrictions in whole swathes of the markets it previously operated in freely.

No official OKX documentation specifies its most up-to-date coverage, but an OKX representative told us they support approximately 100 countries and regions worldwide. This still gives them a significant international presence.

- Europe: OKX is supported in most but not all European countries; some countries support the exchange but impose geographical restrictions on some services.

- Asia: Similar to Europe, OKX is supported in many countries, such as Hong Kong, Japan, South Korea, Singapore, and India, but it’s also banned in others.

- North America: Canada is the only country in North America where OKX still operates. However, new regulations make the platform unavailable to new customers.

- Australia: OKX is fully supported within Australia with no restrictions.

- Africa: OKX is supported throughout Africa, including Nigeria, South Africa, Kenya, and the Seychelles, where it is headquartered.

- South America: In 2024, OKX expanded its operations to encompass Argentina, one of the fastest-growing crypto markets in Latin America.

Partially Restricted Countries

- Canada: Existing users can access OKX, but new account registrations are prohibited.

- Hong Kong: Derivatives-related services are restricted.

- Singapore: Margin and derivatives-related services are restricted.

- United Kingdom: Retail users are restricted from using derivatives-related services, including trading bots and other advanced features.

- Ireland: Derivatives-related services are restricted.

Fully Banned Countries

- United States and its territories (Puerto Rico, American Samoa, Guam, Northern Mariana Islands, U.S. Virgin Islands)

- Belgium

- France and its territories

- Japan

- The Bahamas

- The Netherlands

- Bangladesh

- Bolivia

- Malta

- Crimea, Donetsk and Luhansk regions

OKX Bonuses and Special Offers

Online Giveaways: The exchange often runs engaging online competitions and giveaways. To catch these events, I recommend following their account on X.

OKX Referral Program: Unlike many other exchanges where new users need to deposit crypto to earn rewards, OKX has a unique approach. When someone signs up using your referral link, you get a mystery box that could be worth up to 50 USDT, without them needing to make a deposit.

Cashback Rewards: OKX runs periodic competitions and challenges with cashback rewards. Their Winter 2023 campaign rewarded 500 users with the highest derivatives and/or spot trading volumes with £20 cashback.

Exchange Background

Establishment: OKX was founded in 2017 around the first significant crypto bull run to gain mainstream attention. In January 2022, it rebranded from OKEx to OKX, bringing a fresh look and a new strategic direction.

Leadership: OKX is owned by the OK Group, founded and managed by Mingxing “Star” Xu in 2013. Star Xu is a notable Chinese entrepreneur with a Bachelor’s degree in Applied Physics from the University of Science and Technology Beijing.

Availability: OKX has a broad global presence, operating in over 100 countries across Europe, Asia, North and Latin America, Australia, and Africa.

Mission and Vision: OKX envisions a future where “Crypto will reshape our money, our financial system, our internet, and our society, ultimately contributing to every individual’s freedom and dignity.” Their mission is to “Take care of our team, promote and advance crypto globally, and empower every individual in the world.”

Security and Transparency

During our testing, we found OKX’s security practices to be among the best on the market. The platform adheres to various best practices and regulatory requirements, earning a solid CER ranking of A. OKX has never experienced a public security breach in its seven years of operation. However, it’s disappointing that insurance does not cover user funds, so third-party insurance is advisable.

OKX claims a 1:1 ratio for all user assets, with auditable proof of reserves for at least 200 of its most popular cryptocurrencies. Unlike most exchanges that release POR reports quarterly or annually, OKX provides monthly updates for added transparency. The strict KYC process ensures compliance and enhances security. Despite these strengths, users should remain vigilant due to the ever-volatile nature of the crypto market.

| OKX Security Overview | Details |

| Proof of Reserves (PoR) | 1:1 for all user assets. |

| Insurance | Deposits are not covered by insurance. |

| KYC Verification | KYC is required for all deposits. |

| Security Audits | Monthy |

| Account Security |

2FA, MBA, Biometric Authentication, Email/SMS Recovery, Jailbreak/Root Detection, Hold Mode/Time-Outs, Device Binding, etc. |

OKX could be more explicit about the transparency of its daily operations. There’s some vagueness about the exact regions in which it operates. For instance, a staff member on the X platform we spoke to mentioned it operates in “an approximate number of 100 countries.”

OKX doesn’t offer crypto or fiat deposit insurance for its customers. However, it does maintain separate insurance funds for its margins, futures, options, and perpetual contracts, which adds a layer of security. While there’s no direct mention of an active in-house bug bounty program from OKX, it works with Hackenproof, a leading Web3 bug bounty platform. So far, Hackenproof has recorded over $50,000 in rewards paid, with top rewards going up to $1 million, one of the industry’s highest rewards.

Independent Security Rankings

| Ranking | Score |

| Coinmarketcap | 7.6 |

| Skynet.certik.com | A |

| Cer.live | A |

| Coingecko | 10 |

| CryptoCompare | A |

Is OKX Safe to Trade With?

The collapse of FTX in 2022 showed that even the most popular crypto exchanges aren’t entirely safe. However, OKX has a solid track record. While many of its competitors often “live on the edge” of regulatory boundaries, OKX has been overly cautious, striving to meet the highest international standards. They’ve met various international regulatory standards and have been approved by the UK’s Financial Conduct Authority (FCA), known for having some of the strictest measures worldwide.

However, our testing found it could be much more transparent regarding the jurisdictions in which it operates and its Corporate Communication Structure.

In summary, our findings indicate that OKX demonstrates a high level of trust and stability due to the following factors:

- Industry-leading proof of reserves

- Strong cyber security measures

- It has never been hacked

- Strict regulatory compliance

Trading Experience

OKX integrates both basic and professional features into a unified user experience on the desktop, eliminating the need for separate applications or browsers. Mobile app users can switch between a simple and advanced trading interface. Suitable for both novice and seasoned traders, the platform’s intuitive navigation ensures new users can quickly become proficient.

While the exchange excels in facilitating rapid and efficient crypto-to-crypto transactions, it faces geographical limitations with on-ramping and off-ramping fiat currency.

When conducting this view, I was based in the United Kingdom and used the Google Chrome Browser.

| Trading options and additional features | Availability |

| Conditional orders |

|

| Derivatives Trading | Yes |

| Lending & Borrowing | Yes |

| Leverage Trading | Yes |

| Staking | Yes |

| Copy/Social Trading | Yes |

| tradingview.com Integration | Yes |

| Auto Trading (Bots) | Yes |

| API Access | Yes |

| P2P Trading | Yes |

| Demo account | Yes |

Trading test

For our trading test, we tried out setting up and funding an OKX account. This included the whole shebang: signing up, going through the KYC process, logging in, and depositing funds. We also checked out how the trading works, exploring different trading pairs and conversions, and then looked into the fees for transfers and withdrawals.

Step 1: Setting Up and Funding Your Account

Signing up with OKX is quick and easy. The exchange has a strict compliance policy, requiring you to provide proof of identity via an identity form. In our test, the signup process was a breeze, similar to other exchanges. Once signed up, you’re automatically logged in and can start exploring the exchange, but you must complete the KYC (know your customer) process before trading.

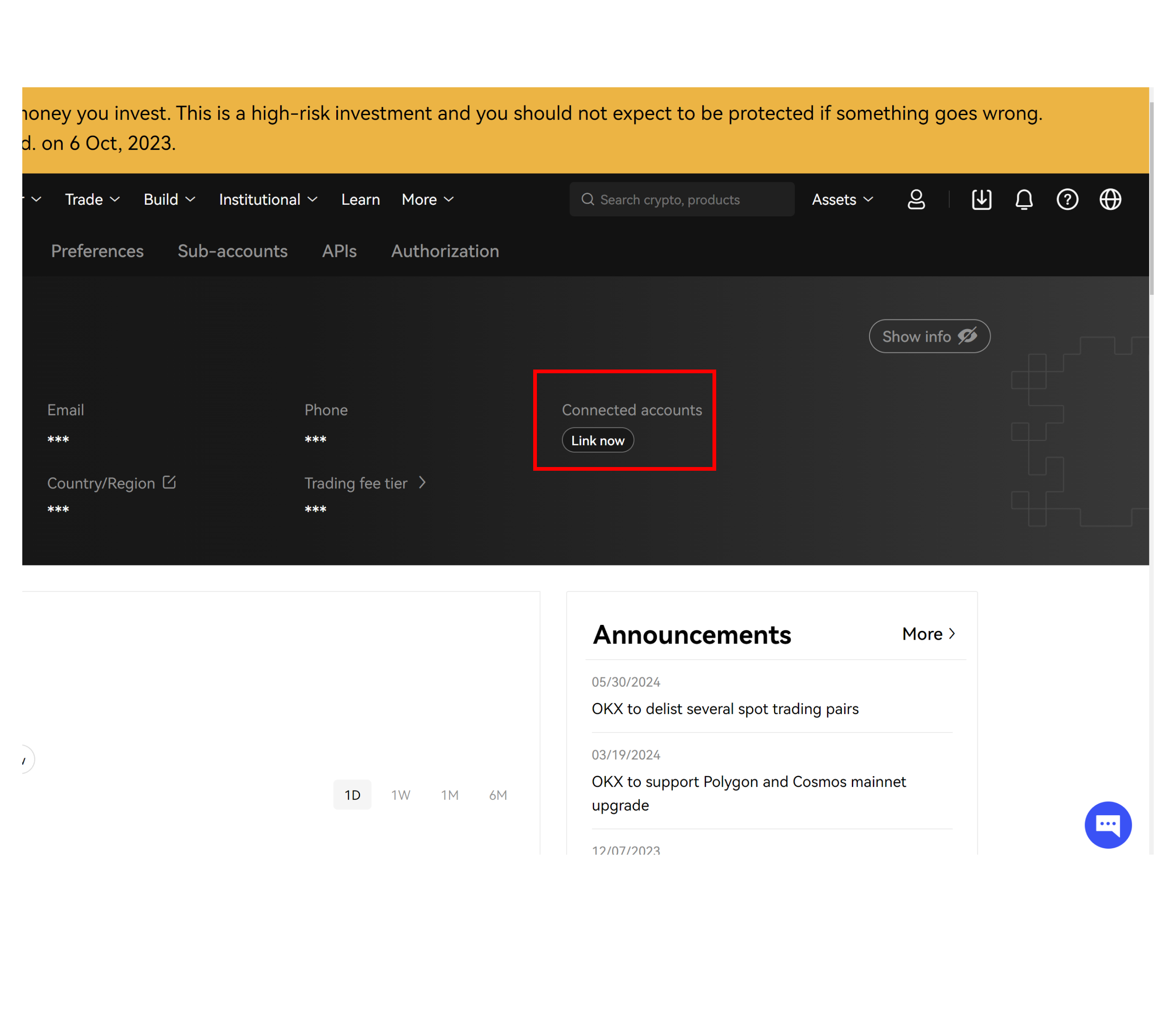

The initial KYC process with OKX is straightforward, involving a quick ID scan on mobile with verification completed within minutes. Afterward, I answered questions about my investor type and potential crypto investments. Logging in offers several security options like 2FA, Passkeys, and biometric security, and linking Google, Apple, OKX wallet, or Telegram accounts is a simple process that requires a 2FA prompt.

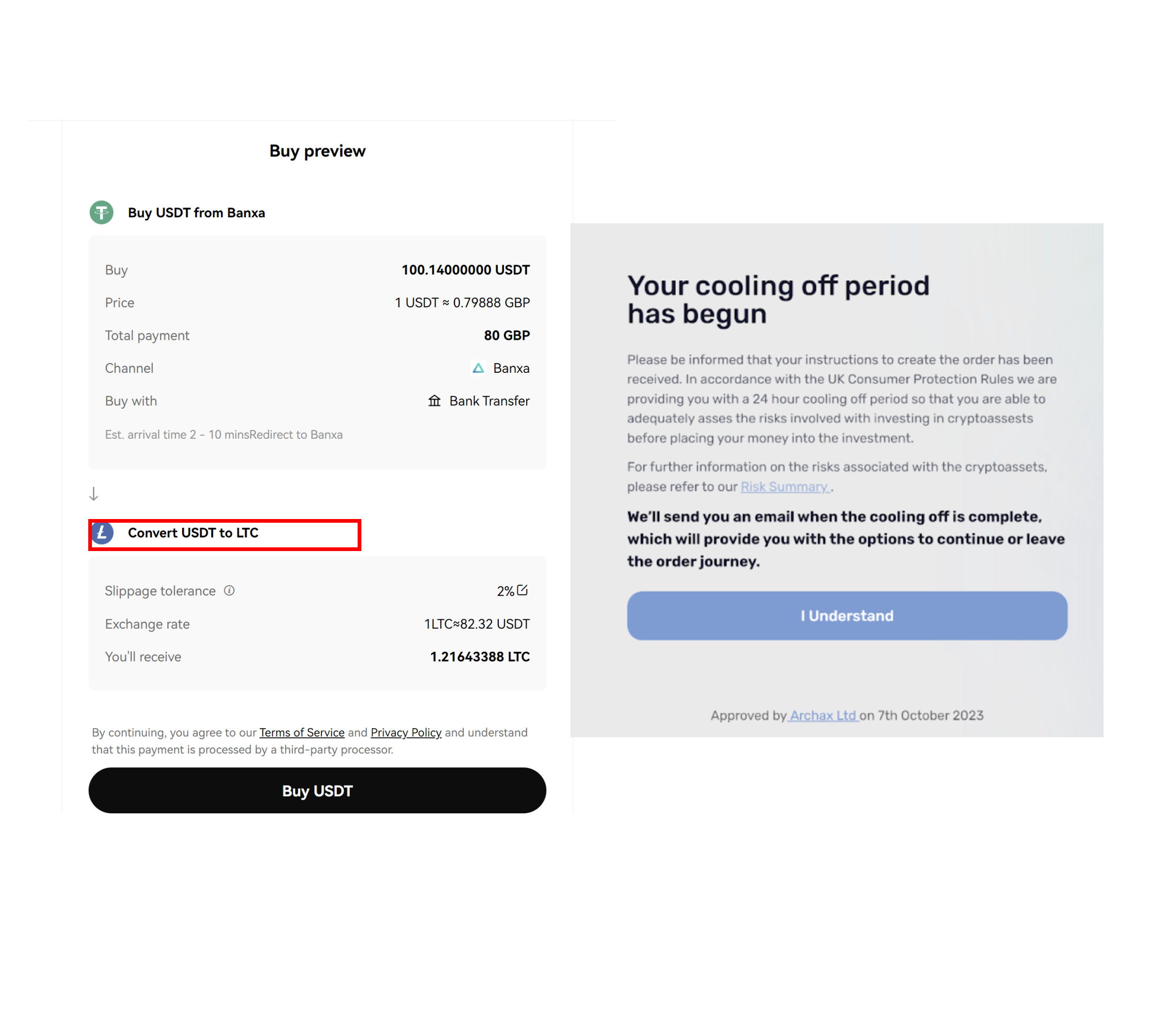

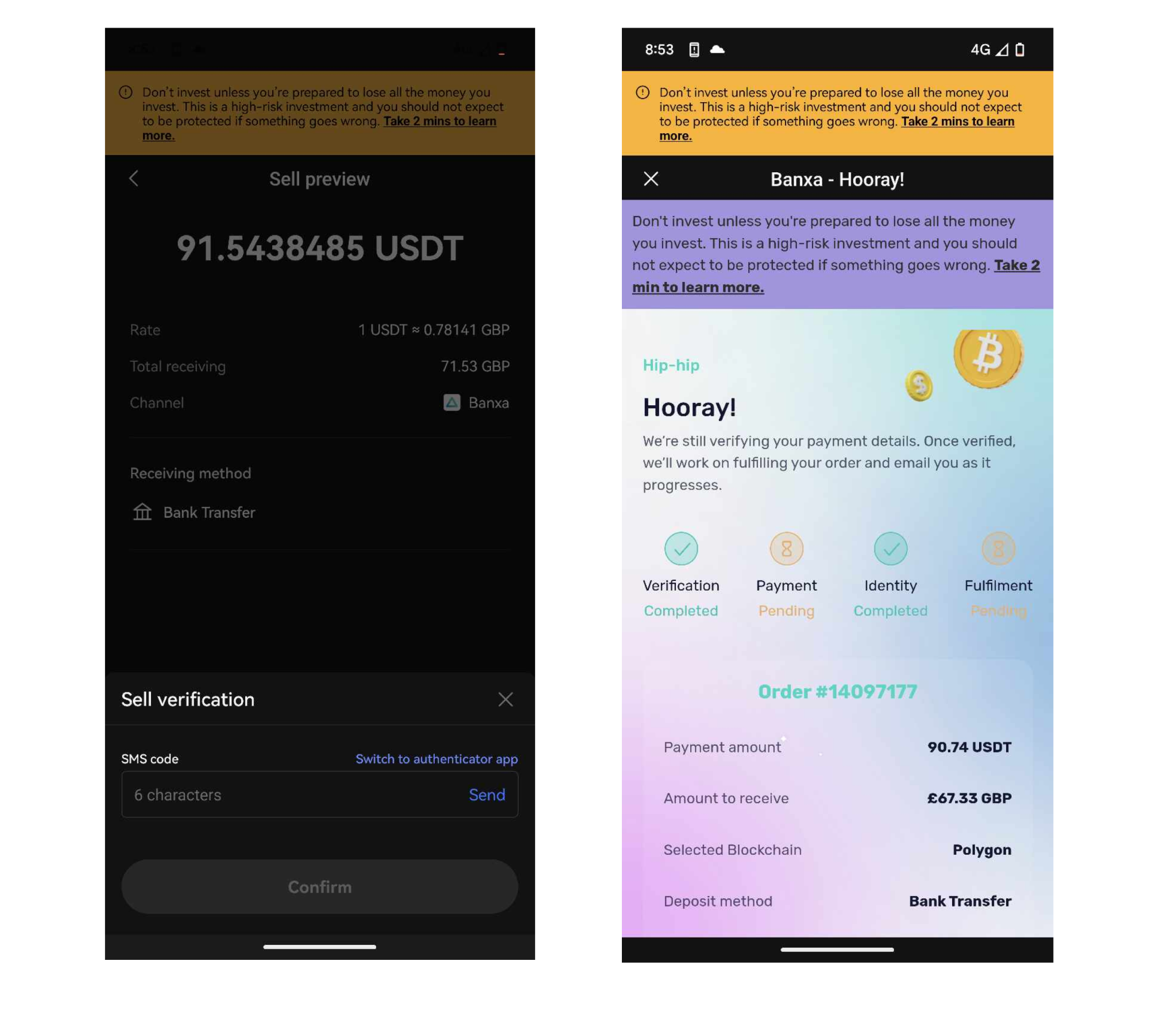

I bought LTC via Banxa, a banking intermediary because direct deposit fiat options are limited. This was frustrating, as it required a second KYC process to buy crypto through OKX’s banking partners. Due to geographical restrictions, I could not choose which token to buy other than Tether (USDT). But on the bright side, OKX provides 0% free for crypto conversions so that won’t cost you anything extra.

Note how the image above implies that it will automatically convert the USDT to LTC. It doesn’t actually do this; you have to do it yourself after the transaction is finished.

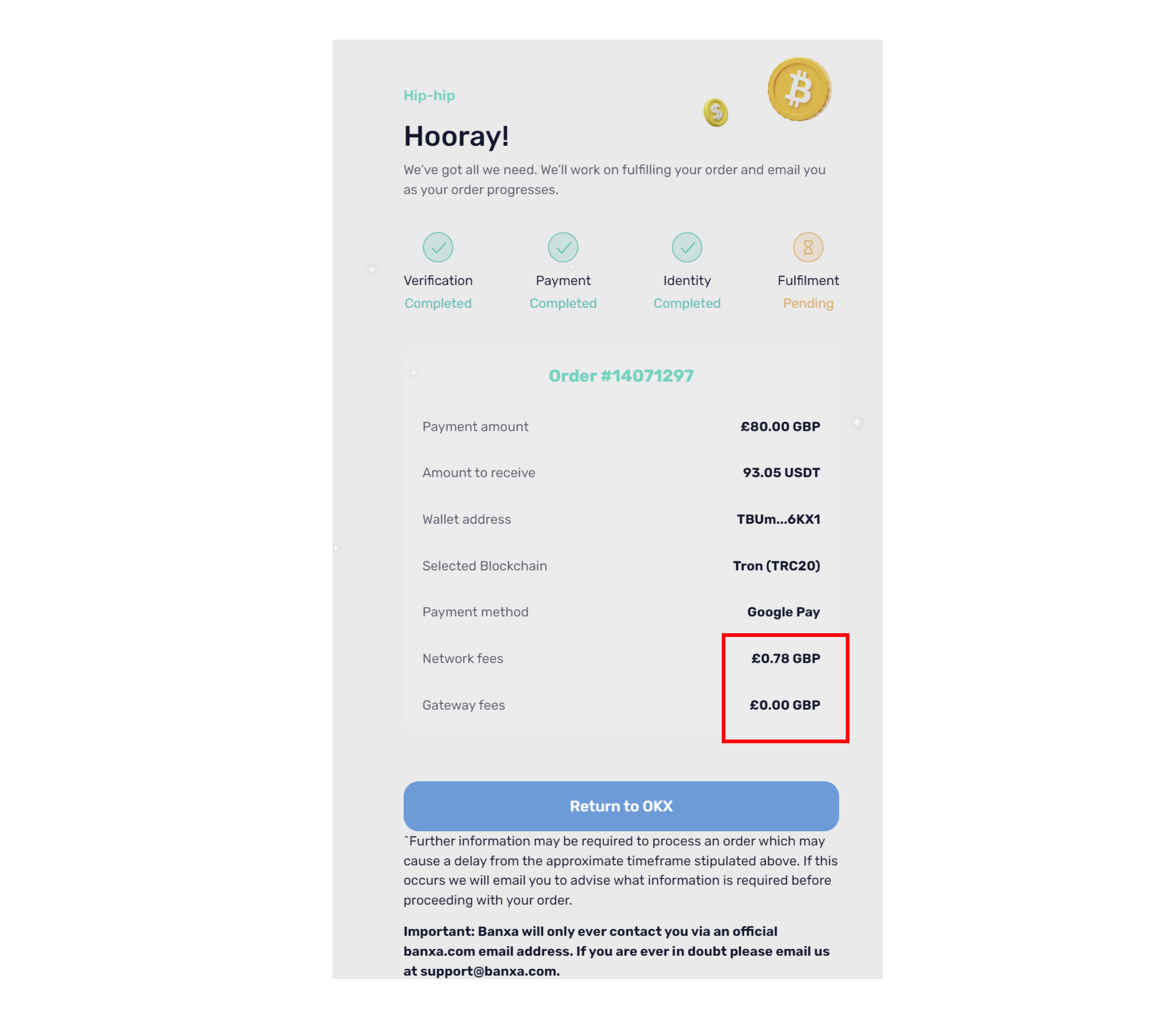

Thankfully, once you’ve completed the KYC for Banxa, you won’t need to do it again to deposit funds into your OKX account. However, if you’re in the UK like me, you’ll have to wait 24 hours before receiving your funds. Due to this cool-off period, I had to restart the buying process, which was a hassle. Once I got through that, I chose the Google Pay option, which had no gateway fees and only a £0.78 network fee.

I successfully received the USDT in my portfolio within around a minute.

Step 2: Trading

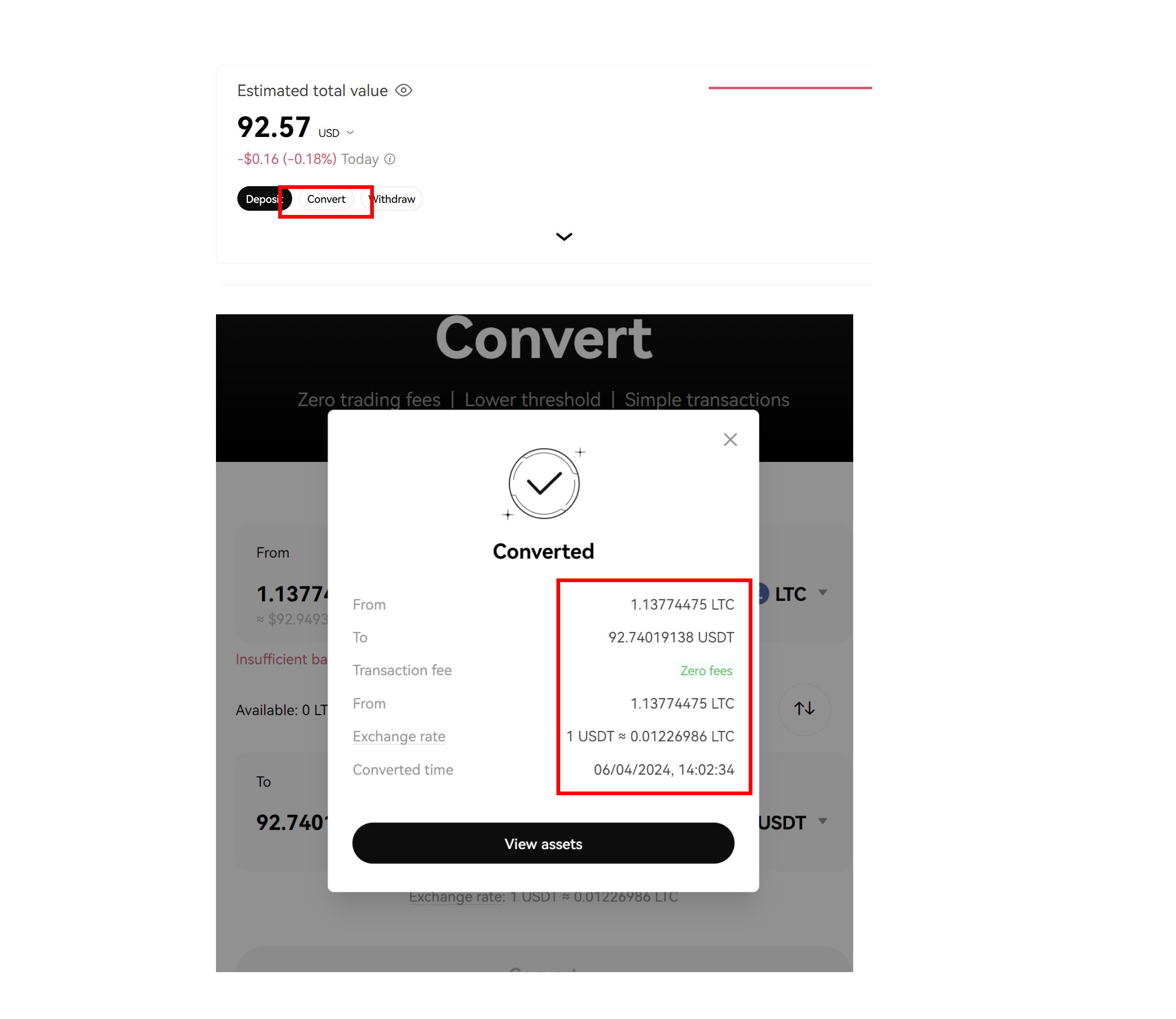

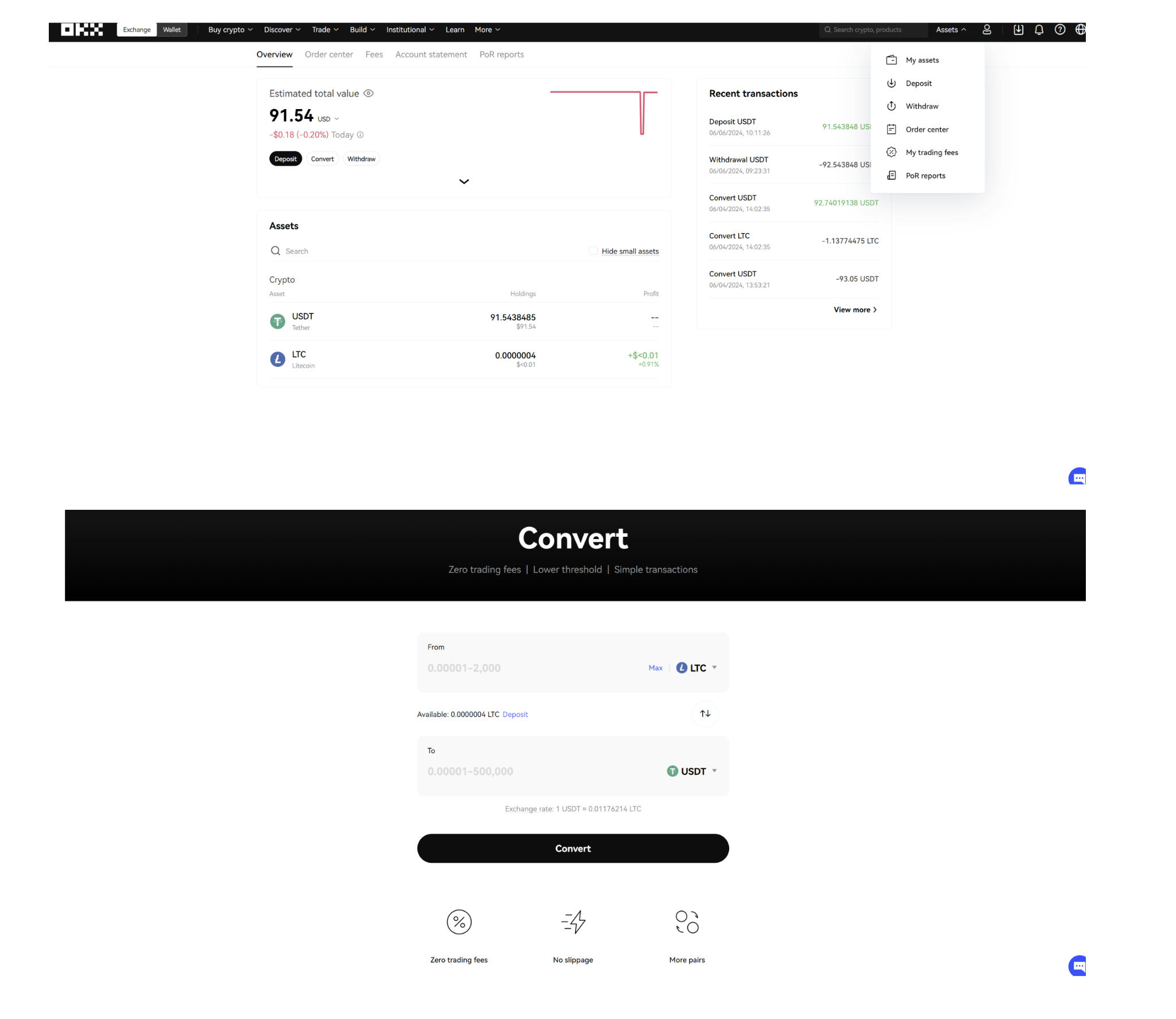

Trading on OKX is intuitive. To prepare for a trade, I converted my LTC back to USDT within the “My assets” section. This process was instantaneous and readily available within my portfolio immediately at no fee.

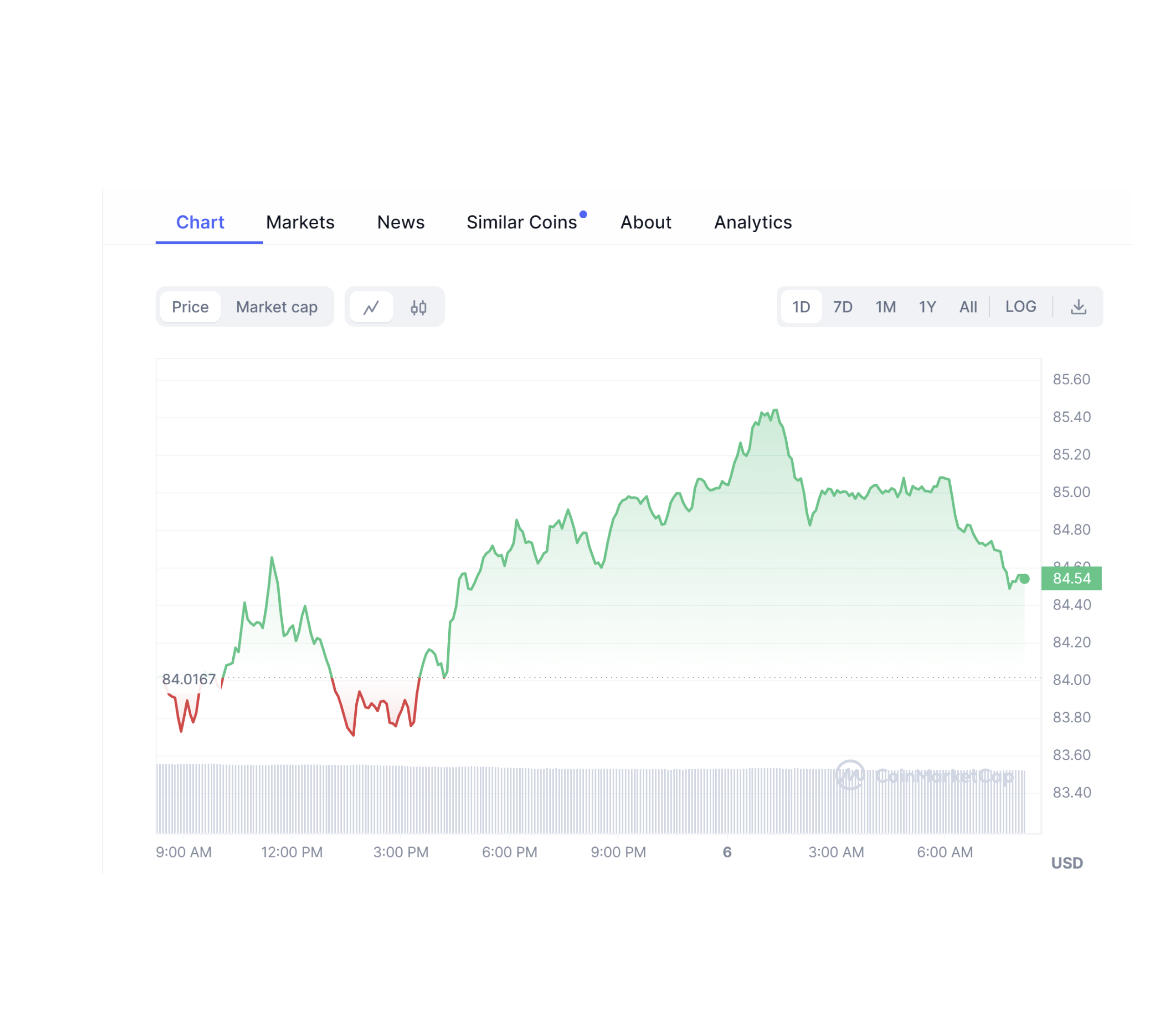

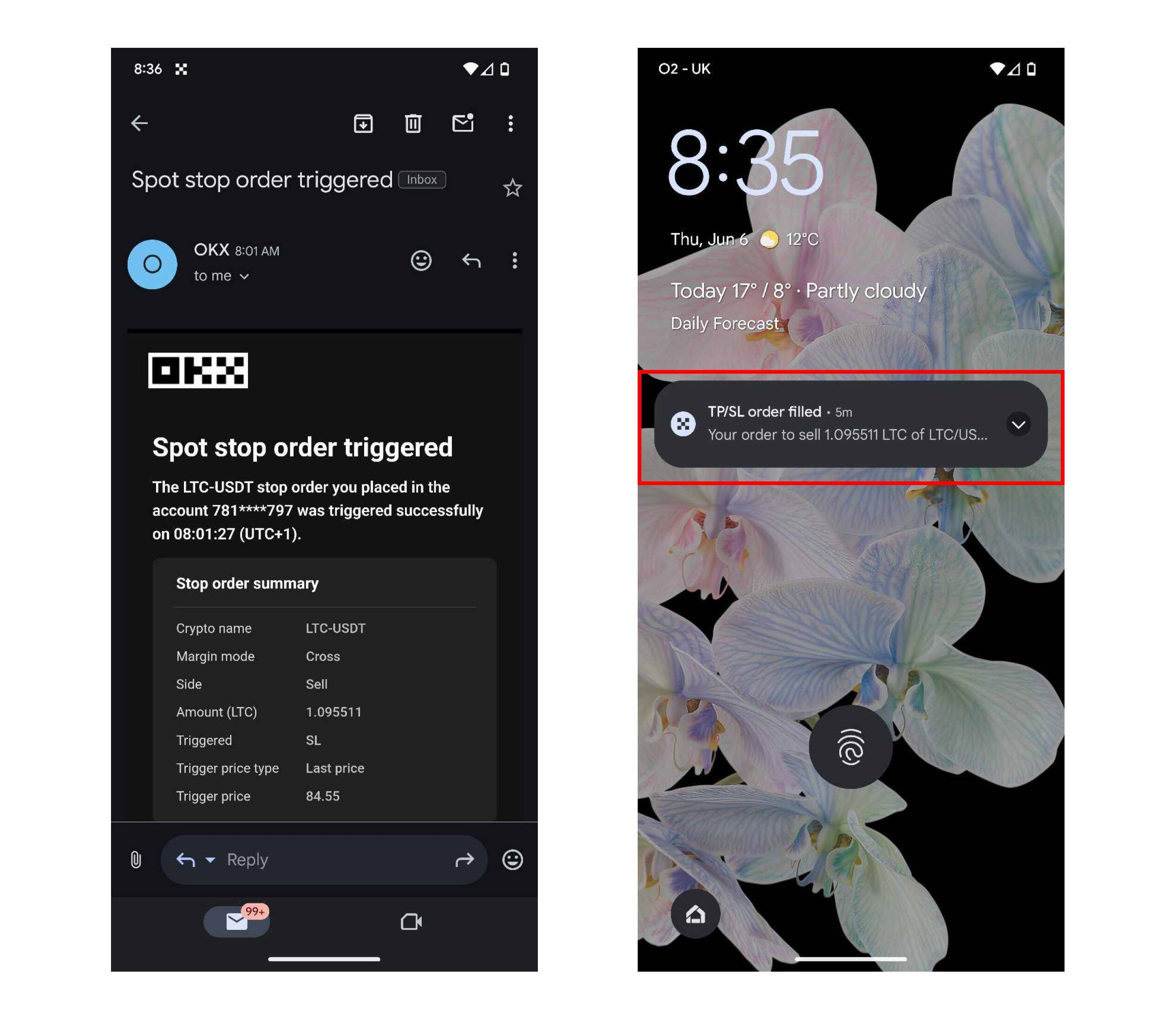

To evaluate OKX’s professional trading capabilities, I sold USDT for LTC instead of using the portfolio’s conversion feature. Anticipating a slight loss due to the market trending higher since my initial LTC to USDT conversion, I proceeded with the trade. The market price was $84.56, with a stop-loss order set at $84.54. Preferring not to delay, the order was executed instantly. I appreciated how the chart displayed both entry and exit points post-trade, providing clear visual feedback. The trade incurred a taker fee of 0.00010966 LTC.

The trade duration was 4 seconds, commencing at 08:01:23 and concluding at 08:01:27.

Step 3: Withdrawal and review

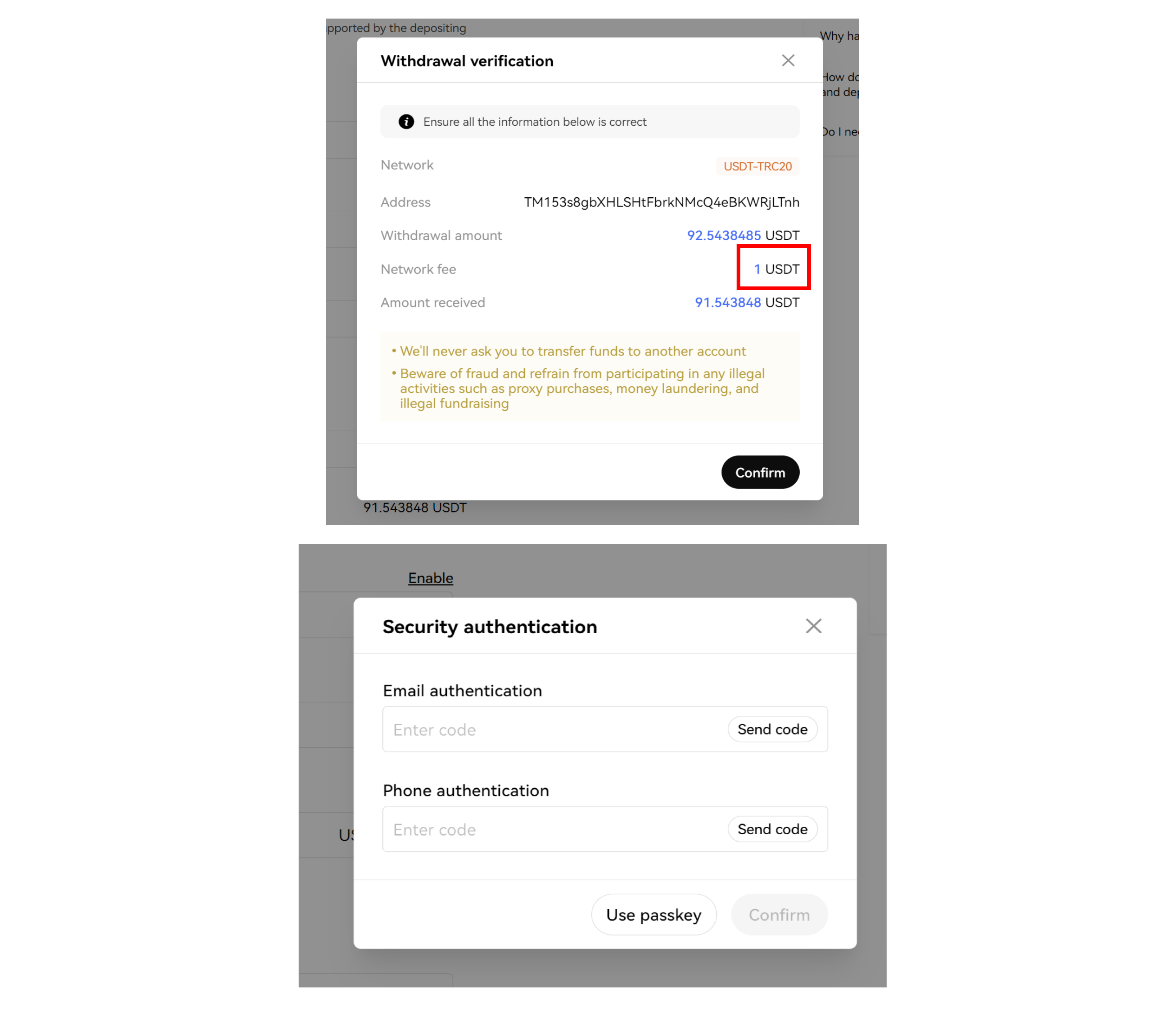

I tested the exchange fees and transaction costs on OKX by sending USDT to my personal wallet via the Tron network:

Transfer Time: Approximately 2 minutes

Network Fee: 1 USDT

Security: Required phone and email codes

Result: USDT arrived in my Trust Wallet within a minute, matching OKX’s prediction of 91.543848 USDT with no extra fees beyond the standard network charge

OKX clearly prompts the user to check if the transaction info is correct before confirmation.

Unfortunately, the next two attempts were unsuccessful; the withdrawals never reached my bank. Eventually, one week later, I received a notification that the option to withdraw fiat had been permanently removed due to geographical restrictions.

Testing a week later found withdrawals in GBP had been permanently disabled, but the options for AUD and EUR withdrawals were still available.

While still attempting to withdraw fiat, I found that OKX was highly responsive in sending automated email updates; however, it made no mention of fiat withdrawals being disabled.

While the dual KYC process can be a bit of a hassle, OKX’s free crypto conversions, low trading fees, and user-friendly interface are great once you’re set up. Withdrawing crypto is unavailable in some regions, which might put off some new users. Despite this, OKX offers a fast and functional trading experience with minimal fees, making it a solid choice for professional traders.

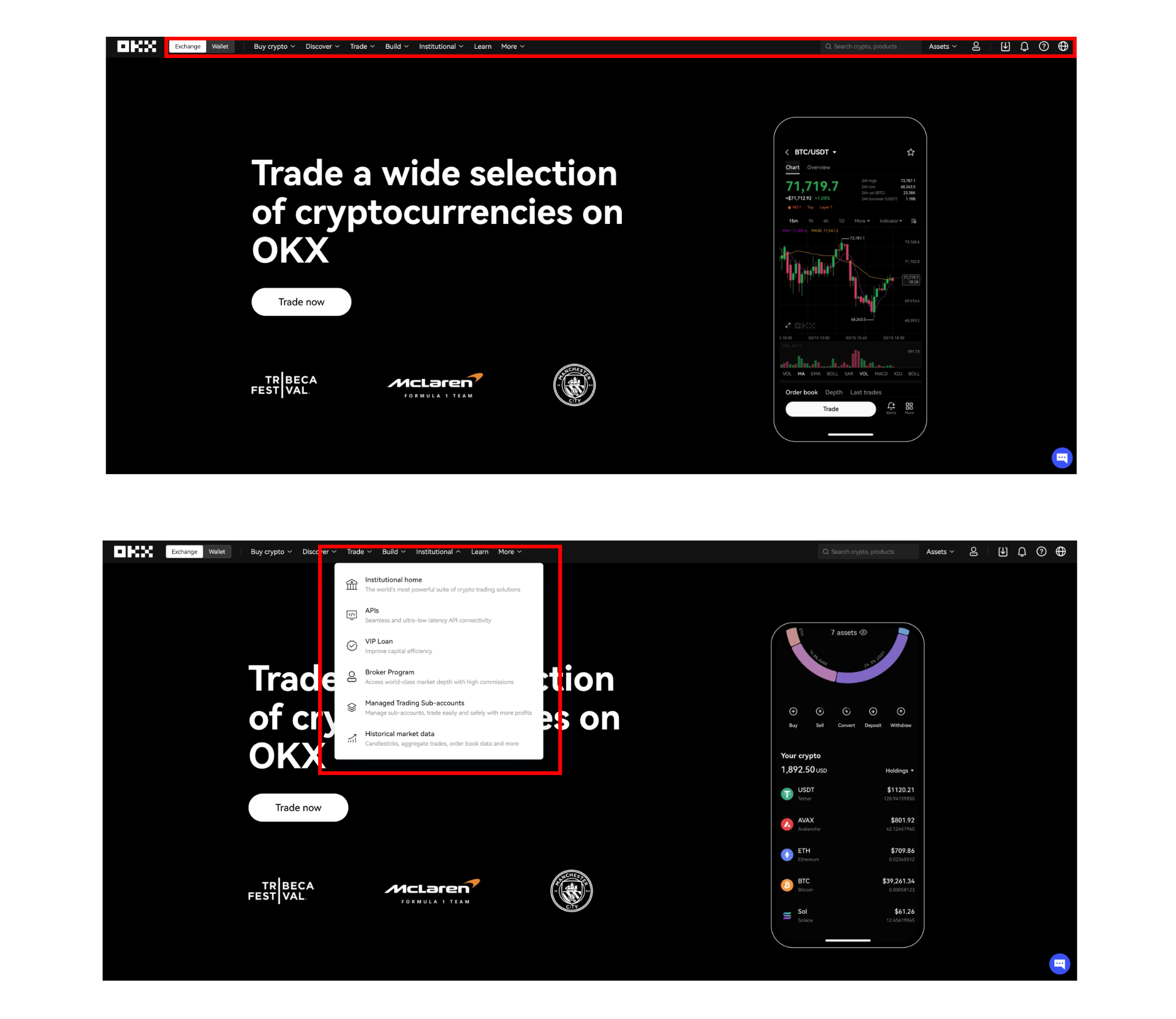

OKX Desktop Version

OKX balances professional asset management and trading features with a user-friendly interface, though primarily geared toward experienced traders. Its true value lies in its array of charting tools, technical indicators, and immersive trading experience that complement a trader’s expertise. The platform includes the following order types:

- Market Order: Traders use market orders to buy or sell an asset at the best available current price.

- Limit Order: Traders use limit orders to buy or sell an asset at a specified price or better, ensuring the order is executed only at the desired price or a more favorable price.

- Stop-Loss Order: Traders use stop-loss orders to automatically buy or sell an asset when its price reaches a predetermined level, helping to mitigate potential losses.

- Take-Profit (TP) Order: A TP order is used to lock in profits by selling an asset once it reaches a specified price, ensuring traders secure gains when the target price is hit.

| Tools for Active Traders | Availability |

| Order book depth | Available |

| Advanced charting | Yes |

| Technical indicators | 104 technical indicators |

| Drawing Tools | Yes |

| Watch list | Yes |

Navigation Ease

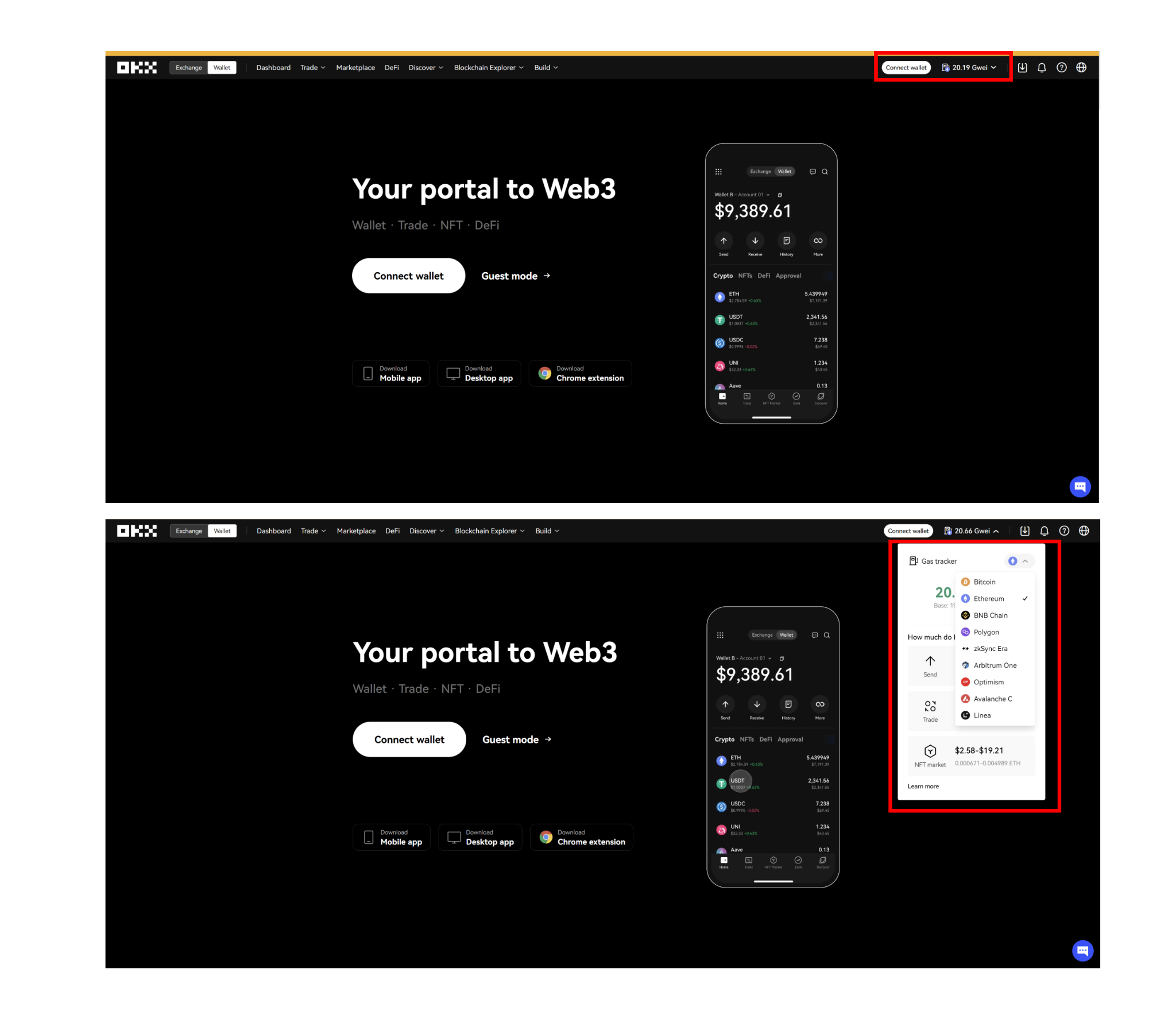

OKX’s navigation is reminiscent of a decentralized exchange like Uniswap. Users can switch quickly between the exchange and their decentralized wallet, connect third-party wallets from the nav bar, and view gas fees for mainstream blockchain networks with a single click.

OKX navigation for the UK version lacks Bot Trading, futures, and leverage trading options.

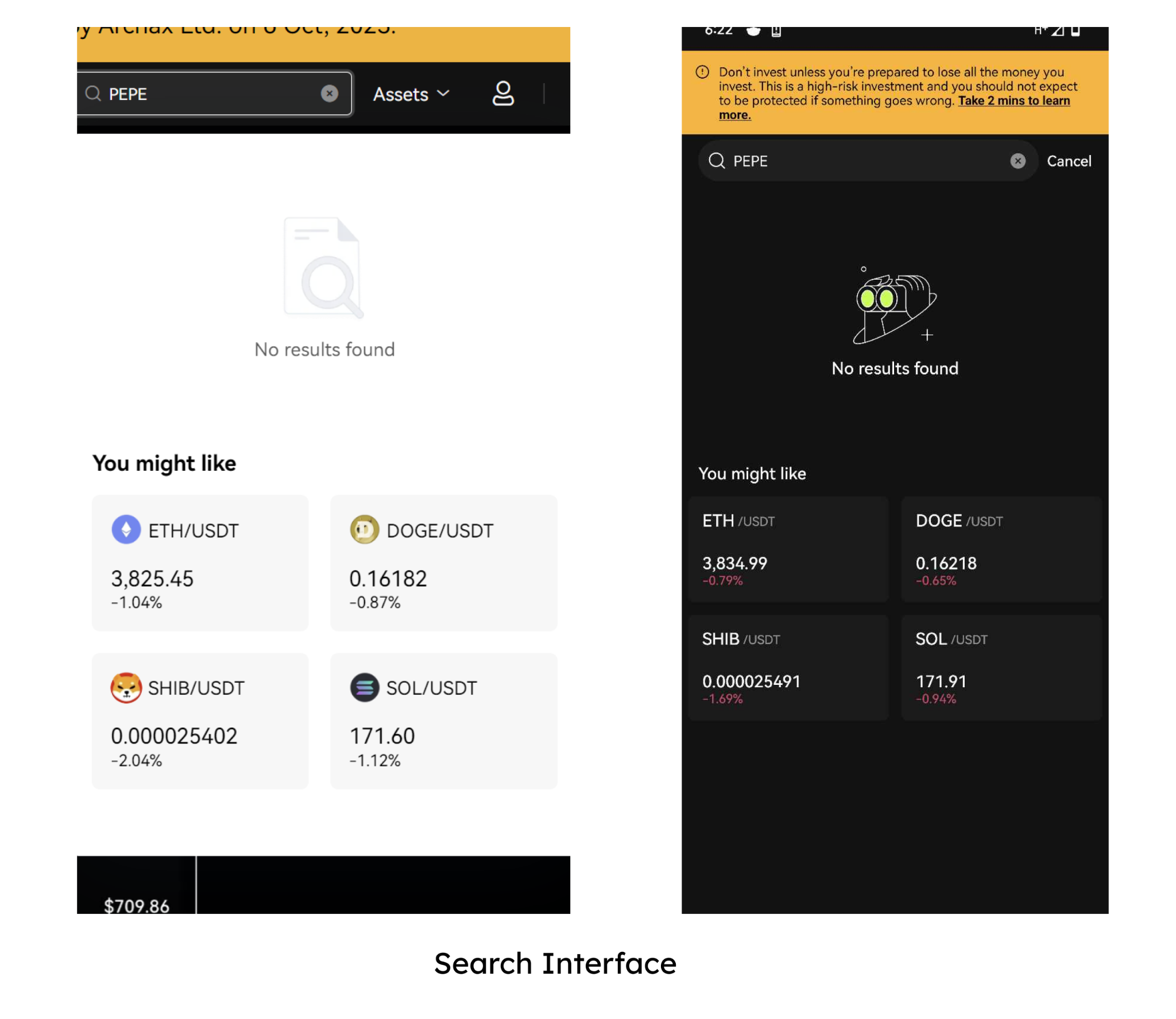

Search Functionality

I found OKX’s search functionality disappointing due to geographical restrictions. With only 40 cryptocurrencies available to UK users, the search tool is limited to those cryptos. In contrast, exchanges like Coinbase provide a superior search tool that allows users to discover unlisted cryptocurrencies that serve as educational resources for the larger crypto market.

Despite supporting over 300 tokens, OKX UK geographical restrictions make the search options fairly lackluster, with just 40 accessible tokens.

Trade Navigation

OKX’s trade navigation is essentially divided into two main parts: a simplified Buy/Sell interface coupled with the asset management page and a trading interface with advanced features.

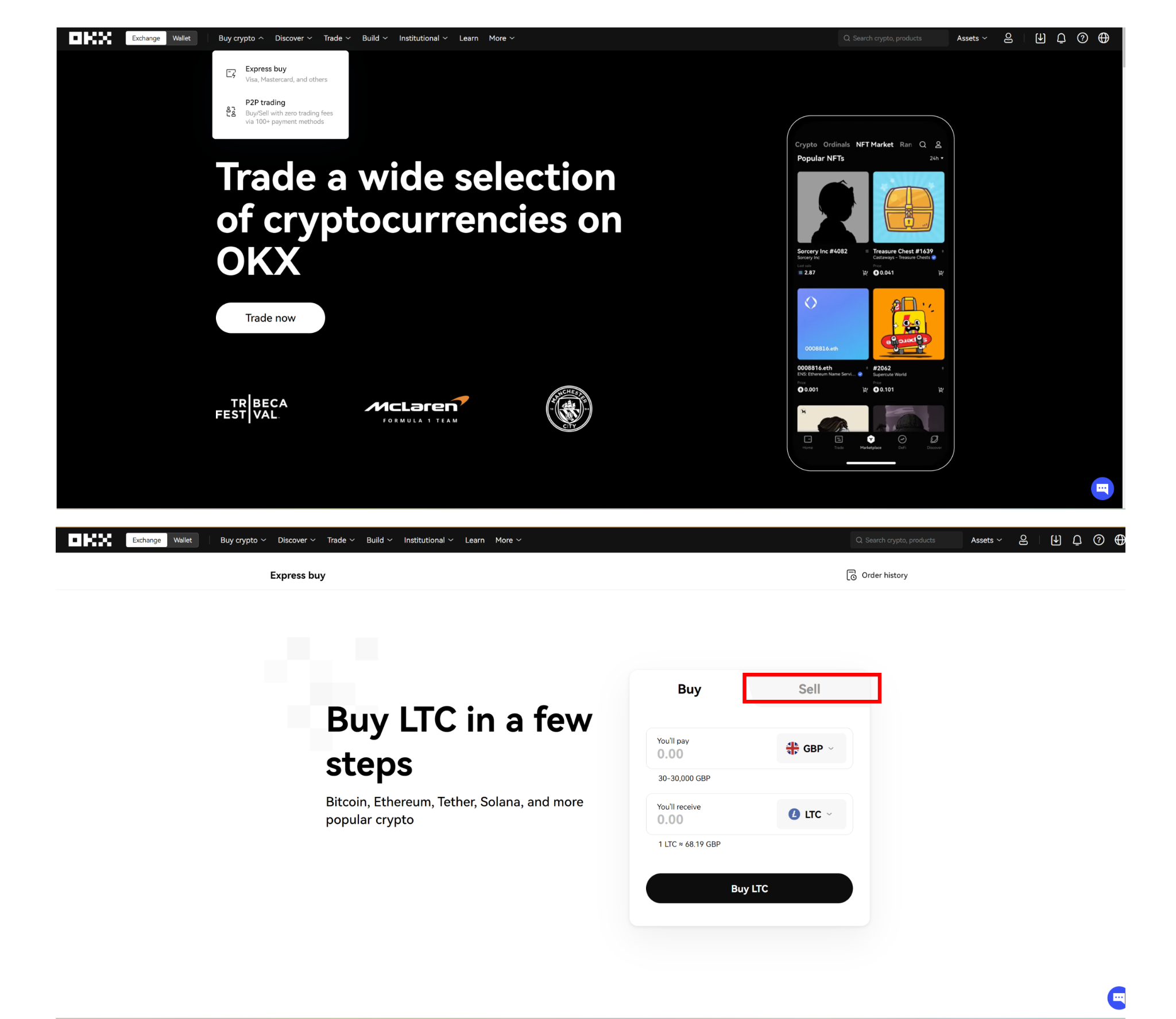

Buying/Selling & Asset Management is mostly suited for beginners. Here, they can buy, sell, stake, and convert crypto at market prices. Selling crypto for fiat can confuse new users because the option to sell crypto is only accessible by clicking the “Buy” option — there’s no direct “Sell” option.

There is no sell option within the main navigation of the OKX interface.

One of the best trading functionalities on OKX is the crypto conversion tool, which is located within the asset management section. Users can convert crypto at market prices completely free, with 0% slippage.

Trading Interface

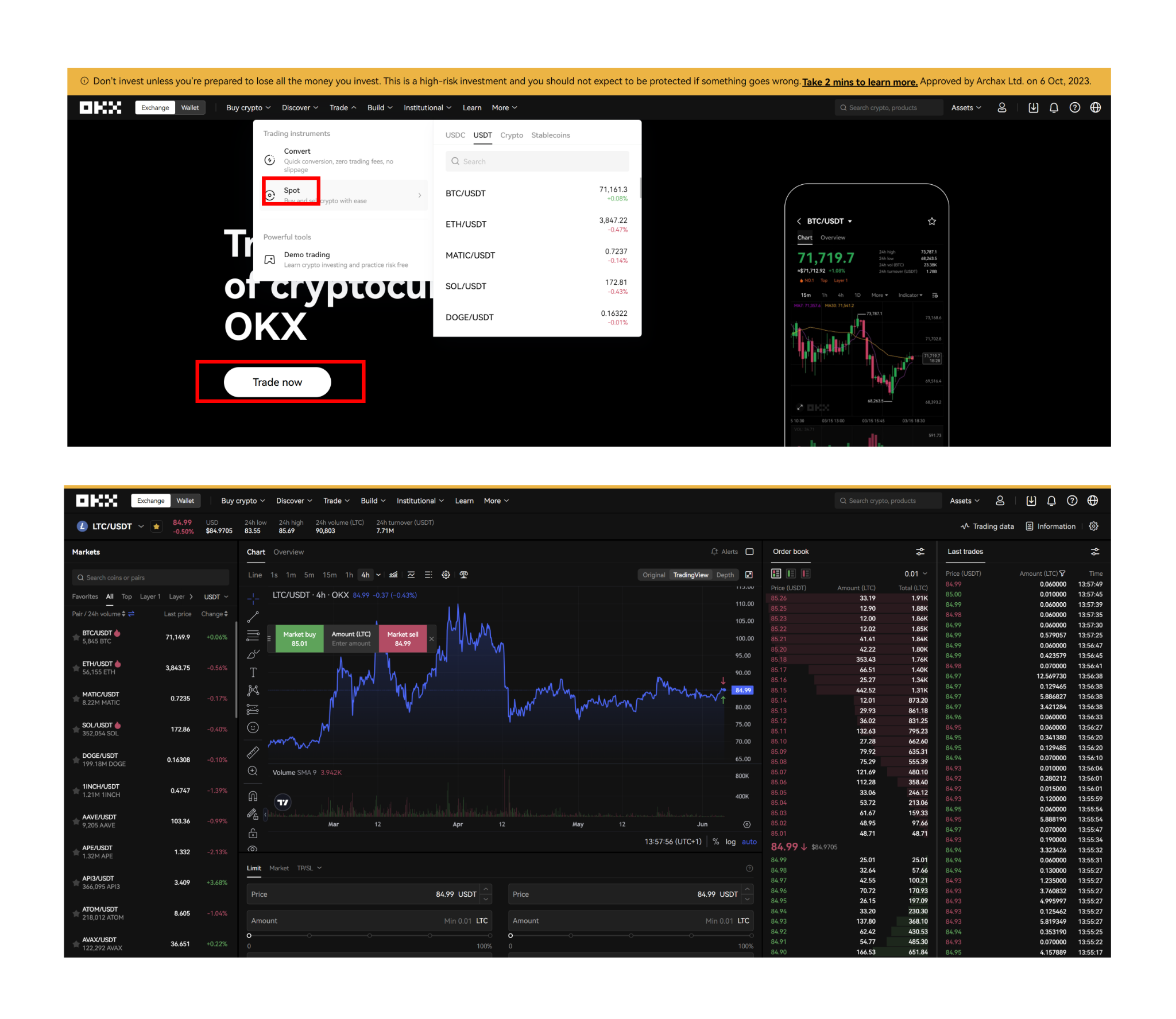

The OKX trading interface is the platform’s main attraction, easily accessible from the site’s main call to action and navigation bar.

- Professional Tools: In-depth order book, technical indicators, various trading pairs, hourly charts, and display options.

- User-Friendly Layout: No hidden features; everything is clearly laid out on the screen.

- Charting Options: Easily switch between OKX’s native charting, depth view, and TradingView.

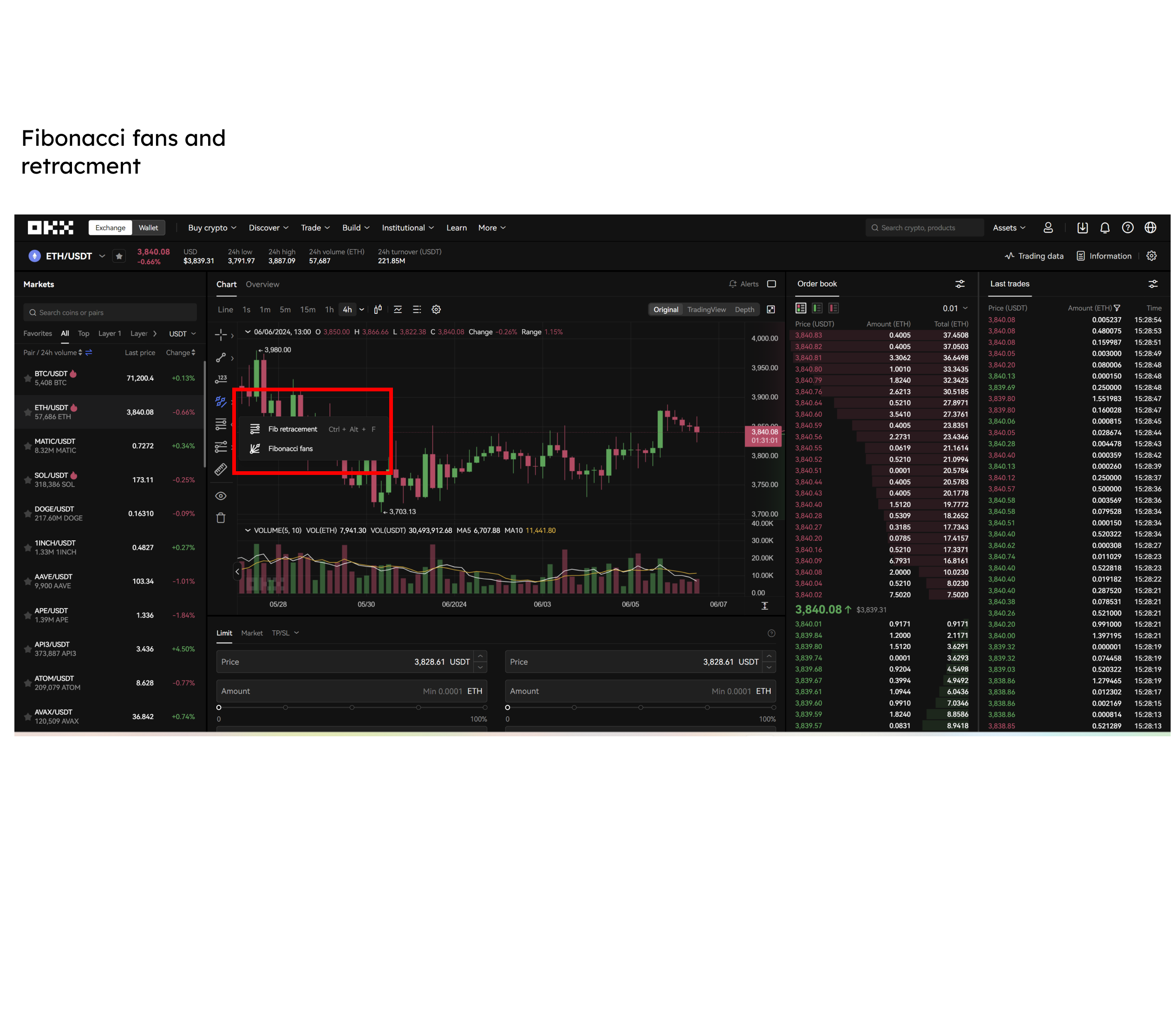

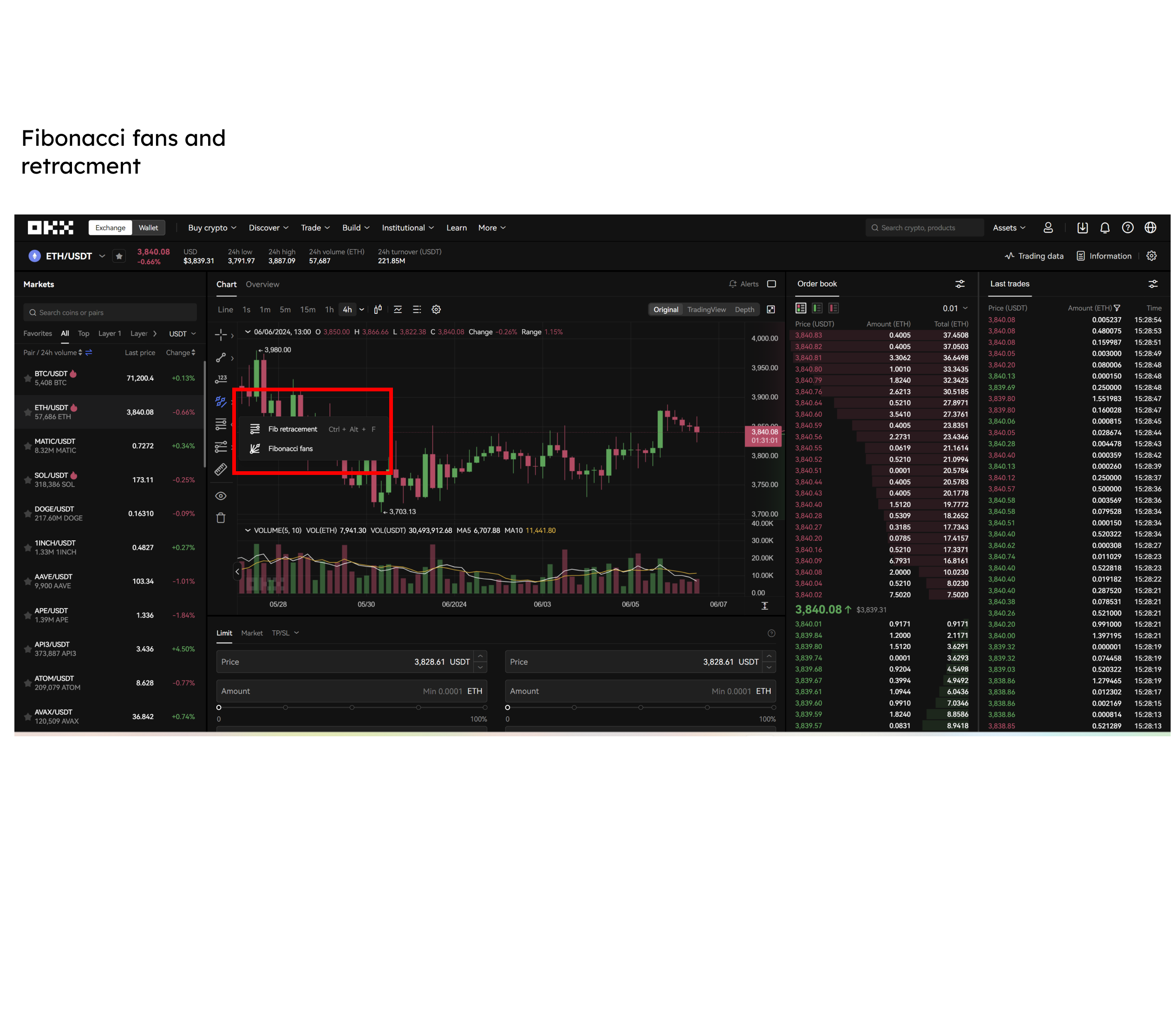

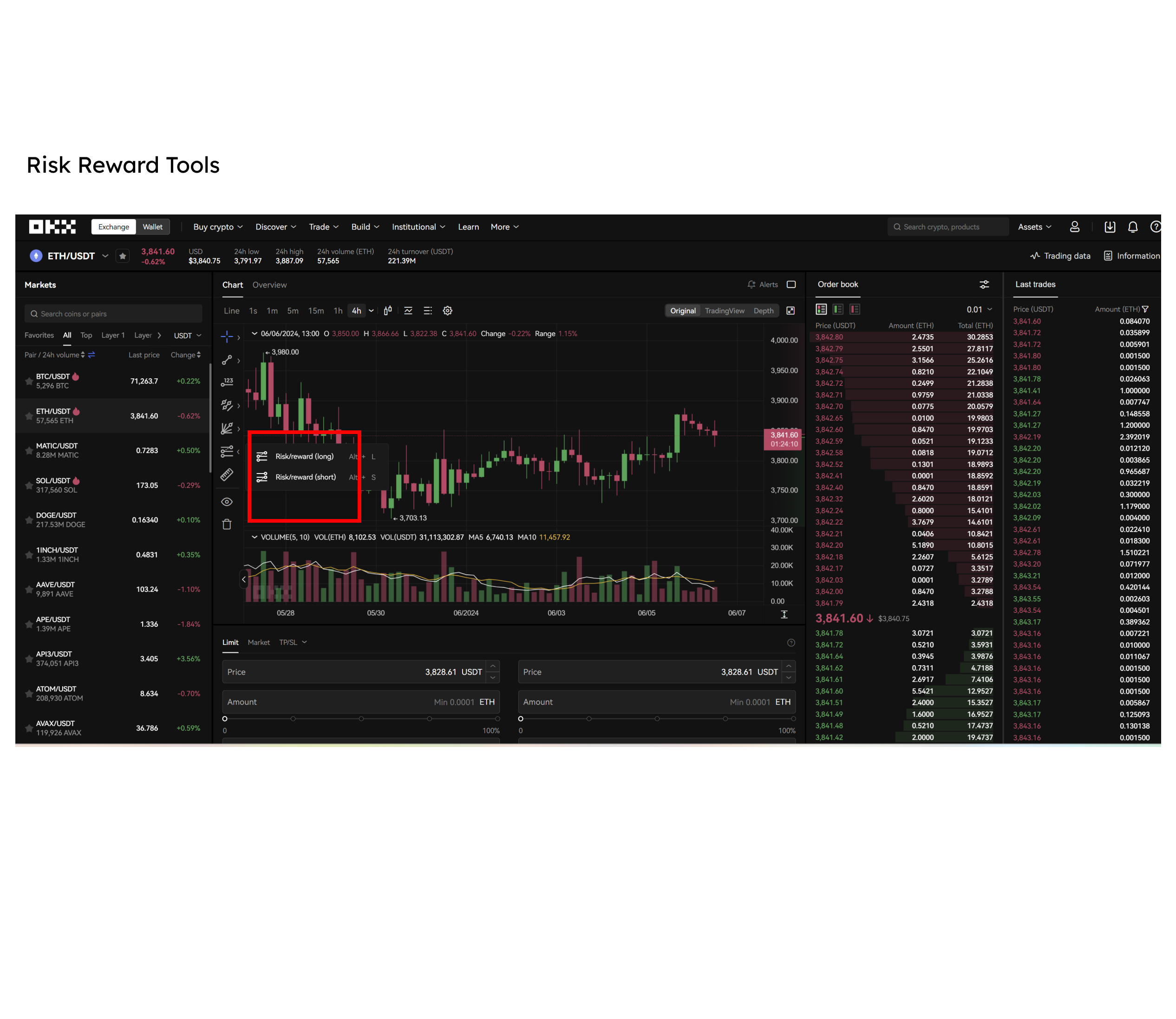

- Advanced Charting: TradingView integration with tools like Fibonacci and risk-reward, plus the ability to star favorite trading pairs.

- Customization: Write and include emojis within the trading screen, catering to live streamers and influencers.

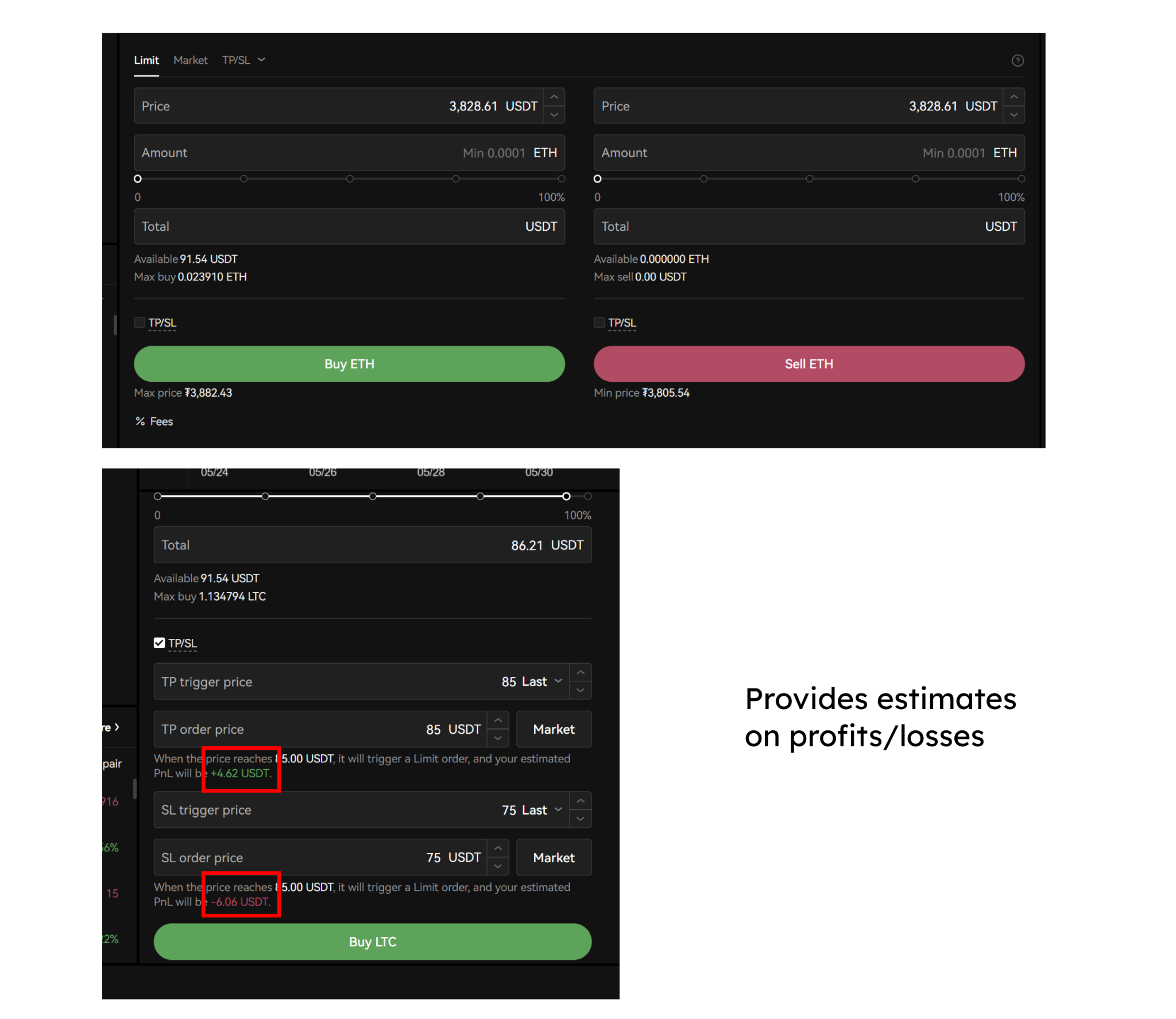

- Intuitive Navigation: A clear split between buy and sell options makes it easy to understand your current position. Dropdown options for take profit and stop loss provide specific estimates of potential profits or losses.

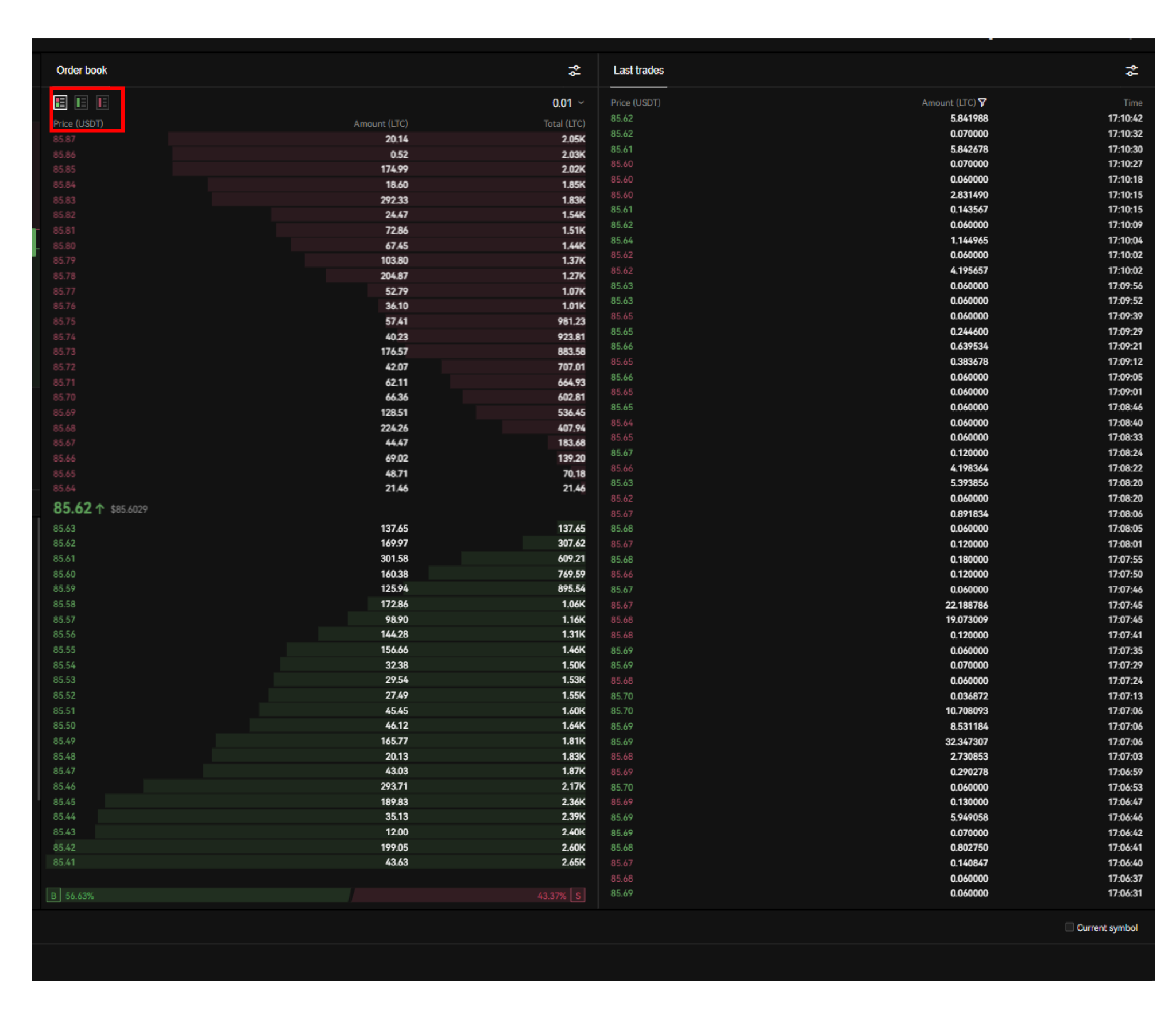

- Order Book & Trade Record: They are conveniently positioned next to each other on the left side. The order book allows users to split their view and focus on buys, sells, or both within each market.

The dual-charting capability, with TradingView and OKX’s native charts, provides a comprehensive and versatile trading experience with the ability to change between them with ease.

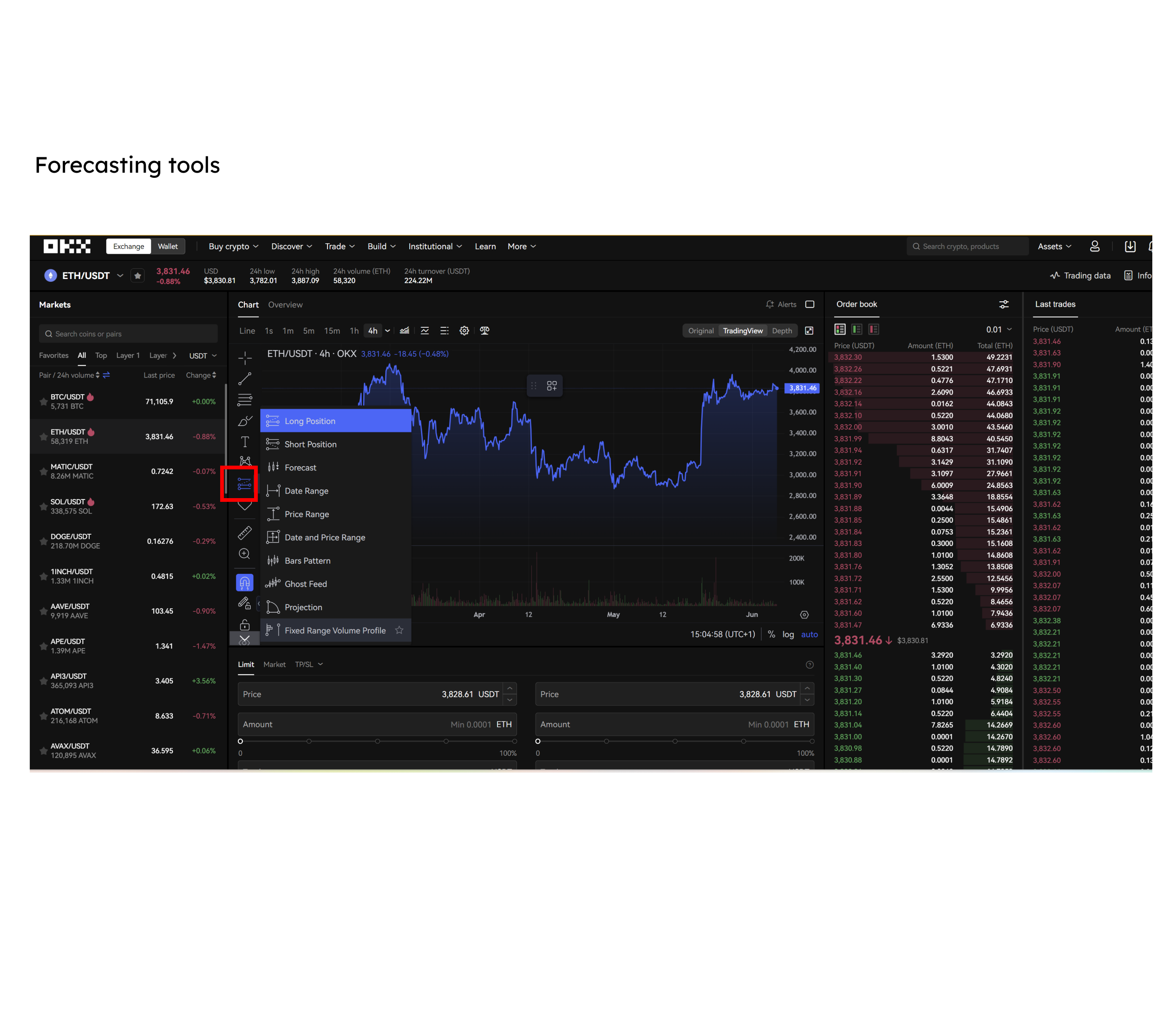

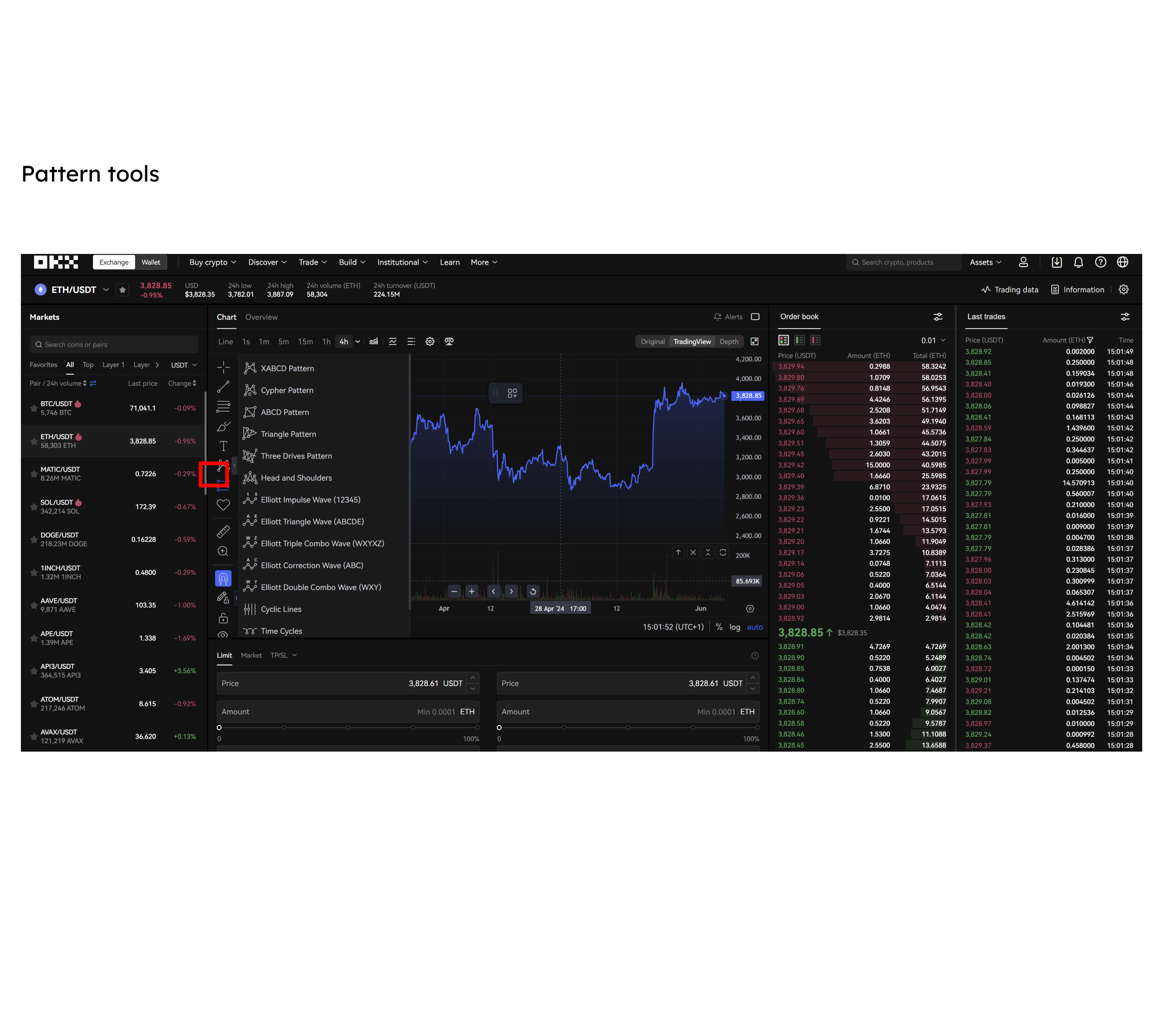

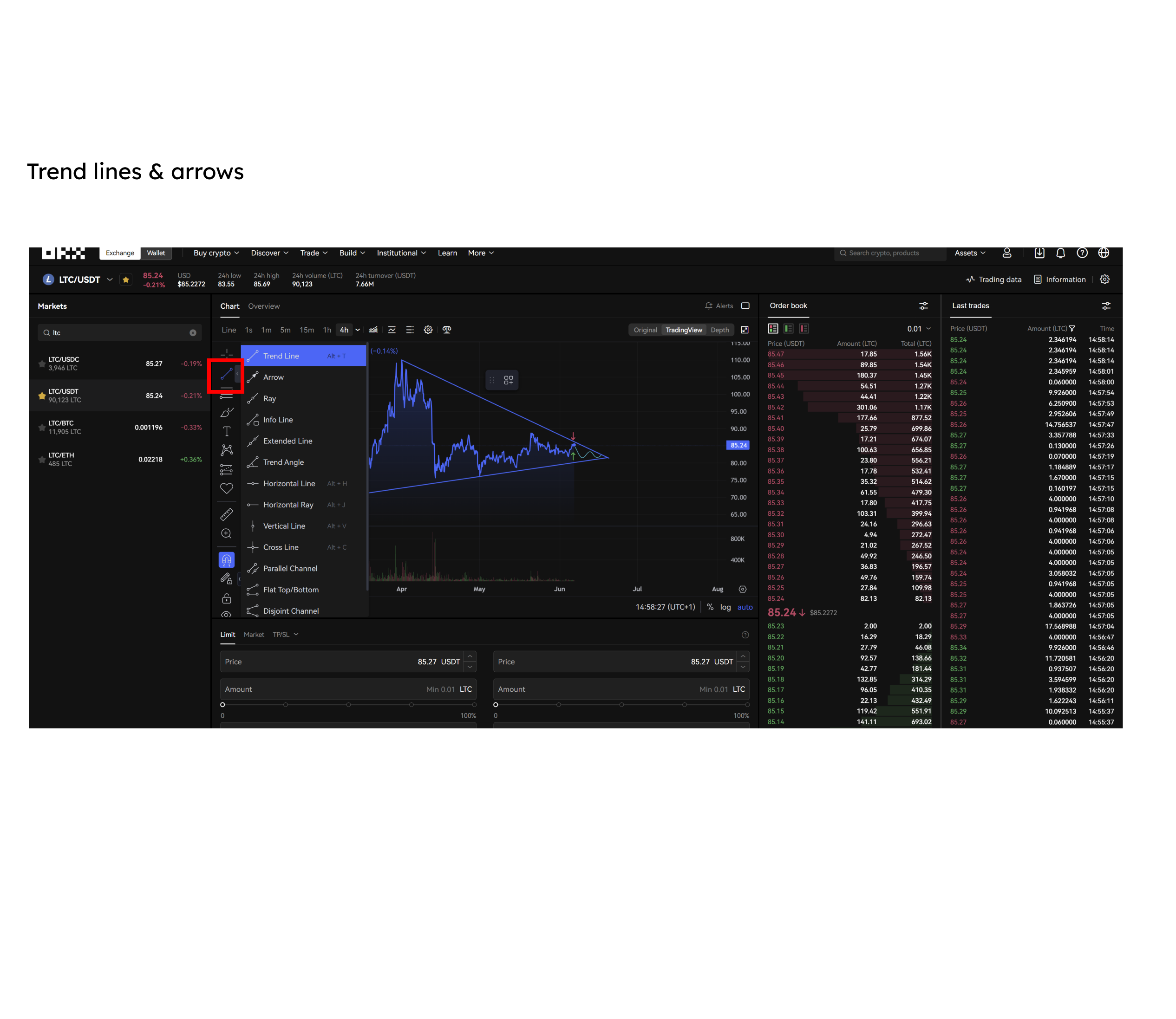

OKX’s TradingView integration really impressed me. As an experienced trader, I thoroughly enjoyed experimenting with various charting options, including trend lines, patterns, and forecasting tools.

OKX’s native advanced trading interface didn’t disappoint either. While the TradingView integration offers a well-rounded product for various traders, OKX’s native interface adds more depth with its robust forecasting tools.

To be honest, I did struggle a bit with the stop loss tools, as they didn’t quickly provide access to more advanced features like the trailing stop loss. However, I appreciated how it guides users to set the correct stop loss by forecasting their profit or loss.

I quickly navigated between buyers and sellers by toggling the OKX’s order book, which is always viable when trading on a desktop.

With various advanced trading options covering futures, margins, and derivatives and various leverage points paired with technical indicators to choose from, OKX is well-suited for making advanced trades. While unavailable to me in the UK, its guides and resources detailing its comprehensive support of API integrations and bot trading options suit those relying on high-frequency automated trades. Overall, OKX offers a great trading experience that is on par with other top exchanges like Binance & Kraken.

My Key Takeaways after Testing OKX Desktop

OKX is a powerful tool for both beginners and professional traders. While trading can be challenging, OKX simplifies the process with in-depth charting, forecasting, and automated tools. Some functionalities are limited by geographical restrictions. Despite limitations, the platform is ideal for traders seeking low fees and robust trading capabilities.

Mobile App

OKX offers a user-friendly mobile app for managing assets and trading on the go. The app is available in Apple’s App Store and Google Play Store. Unlike the desktop, it does not have a pro version. Instead, it provides a simple mode for beginners and an advanced mode for experienced traders. I tested the mobile app over a week using a Google Pixel based in the UK.

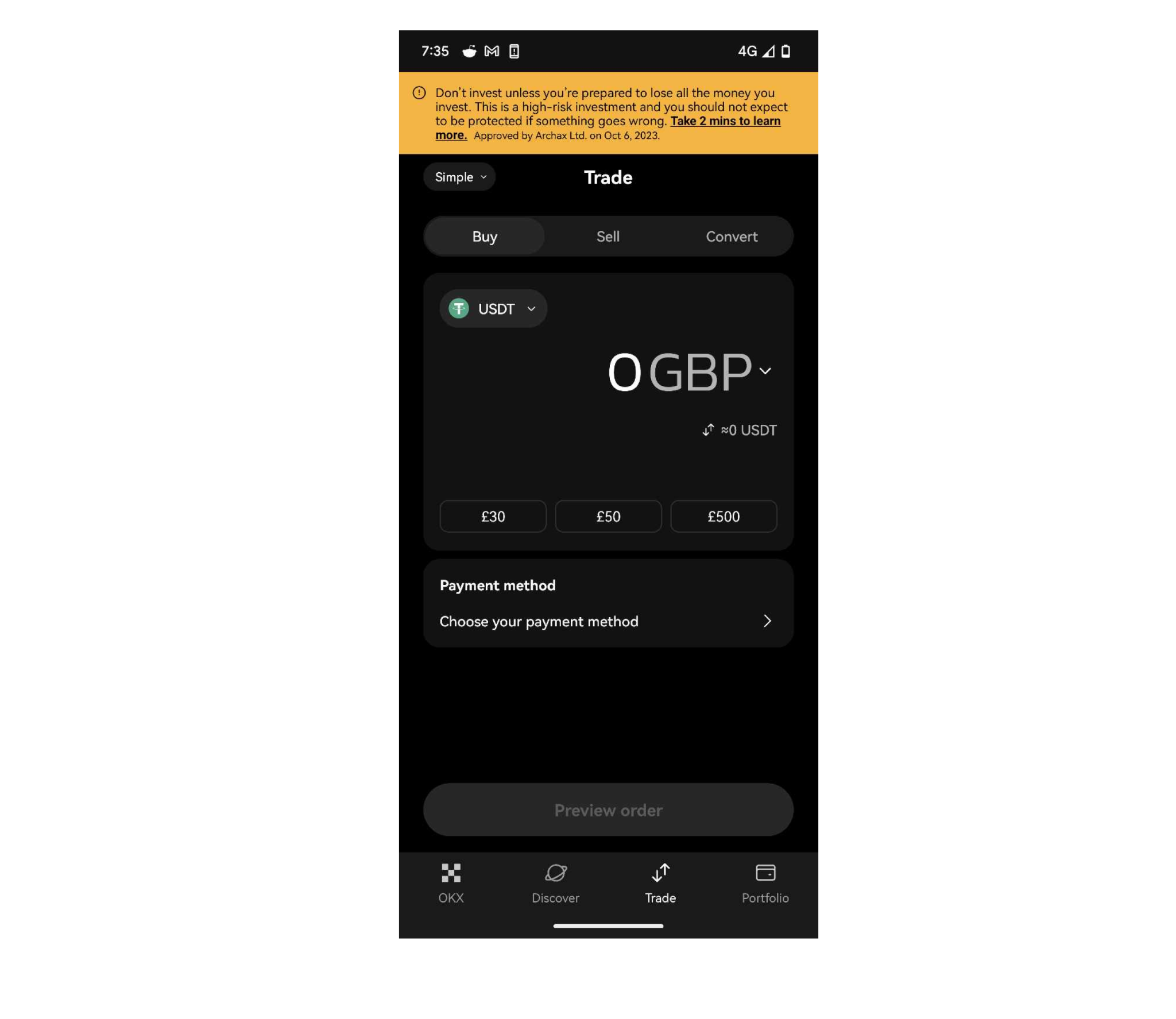

The mobile app’s simple version offers a much better user experience than the desktop version.

Within this version displayed above, users can easily buy and sell crypto using fiat and convert crypto without the hurdles associated with the desktop version; everything is laid out in a minimalist, clearcut way.

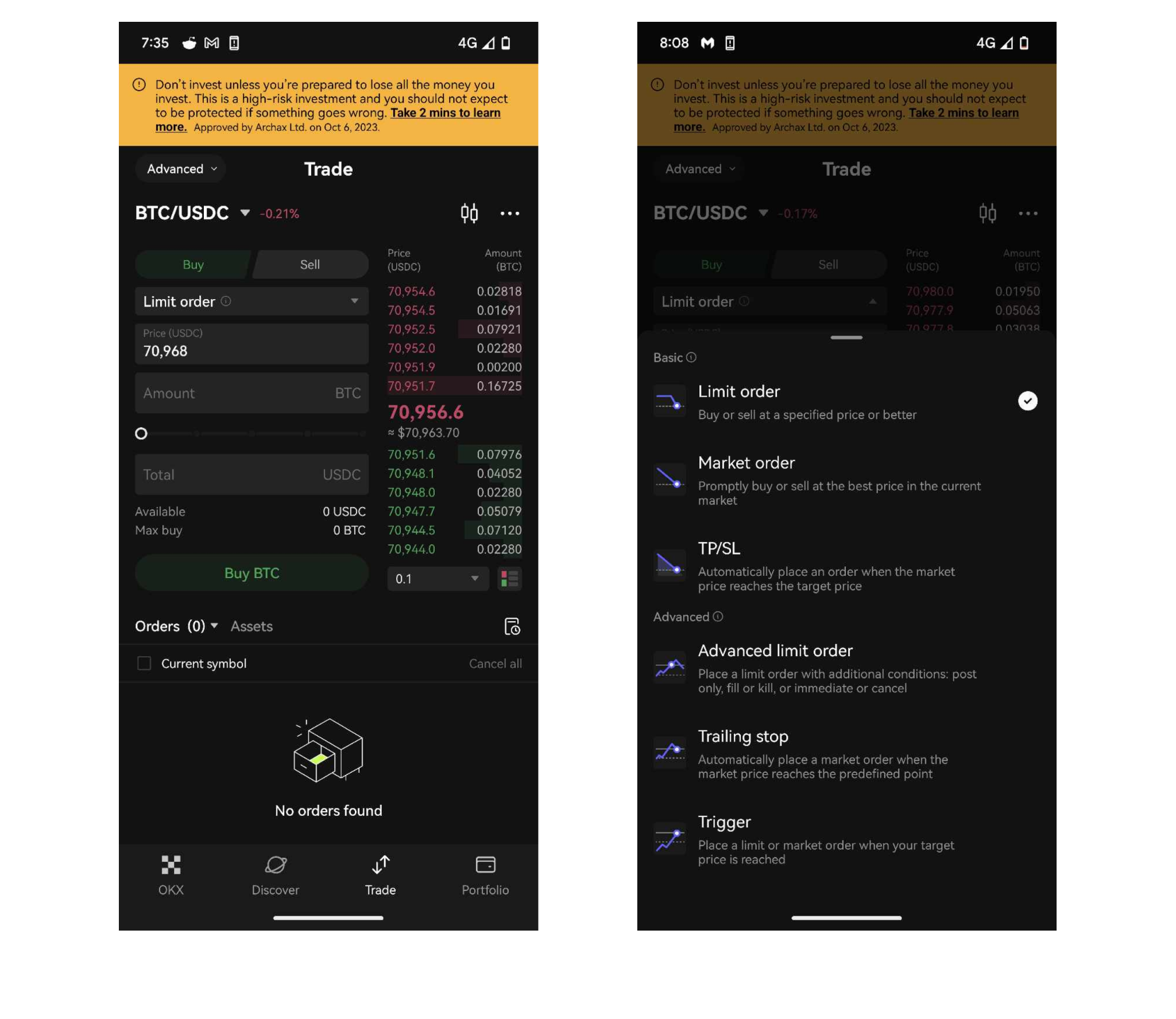

The advanced version of the app is also impressive; users can switch to it with a prompt within the trading interface. It allows users to easily access the live order book and set limits and market orders with TP/SL. Additionally, the app offers advanced orders like limit orders, trailing stops, and trigger orders with just a tap. The bottom of the screen details a history of your orders. I thoroughly enjoyed using this version of the app; the UI is simple and easy to use for a trader on the move.

I found the advanced triggers on the mobile option, such as the advanced limit order and trailing stop much more accessible within the mobile app than the desktop version.

OKX boasts an impressive market discovery feature, but it is limited due to geographical restrictions in the UK. This limitation makes the discovery and search functionalities less robust compared to platforms like Coinbase.

Testing the withdrawal functionality on the Mobile app felt more seamless than the desktop version, the user interface was faster, and the 2FA security felt more intuitive when communicating with the same device it was operating on. I found that the mobile app was much more beginner-friendly than the desktop version.

My Key Takeaways after testing the OKX Mobile App

OKX’s mobile app is an excellent tool for managing assets and trading on the go. After testing it for a week, I found the simple mode to be far superior to the desktop version for beginners, offering a clear and minimalist interface for buying, selling, and converting crypto. The advanced mode impresses with features like live order book access, sophisticated order types, and an intuitive interface. Another great reason to get the app is that it will notify you when your trades are complete and provide market updates.

Despite its high ratings, I must mention issues with fiat withdrawals — I was able to withdraw assets only on my third attempt. However, initiating withdrawals via the app feels faster and smoother, and security features like 2FA work better in the app.

Fees

Throughout my testing, I keenly analyzed fees through personal experience and research into the fee structure. Unfortunately, I have been unable to test fees related to leverage and future fee rates. However, I see that OKX makes the bulk of its fees through its advanced trading interface. My testing confirms that OKX is one of the best crypto exchanges on the market for competitive fees.

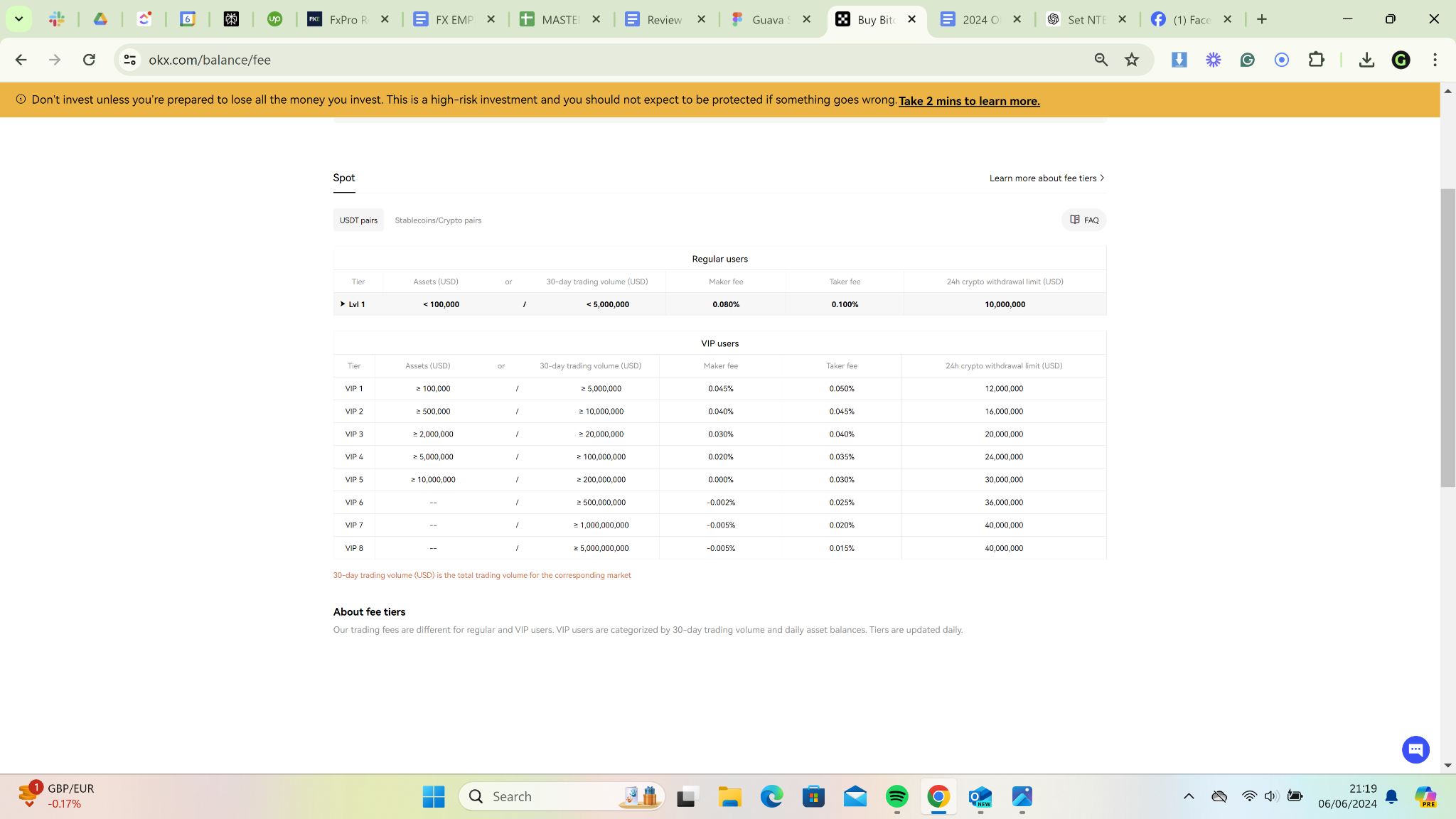

OKX is very transparent regarding fees; the above image shows the public spreadsheet that breaks them down.

- OKX does not charge fees for crypto deposits or withdrawals.

- Some payment methods, like debit and credit cards, may incur a small fee.

- Other payment options like bank transfers or Google Pay transactions do not incur additional fees.

- Users must pay standard network fees for on-chain (crypto) transactions.

- All crypto conversions on the platform are free on the exchange.

OKX stands out as a top-five exchange on Coinmarketcap. This is thanks to its liquidity and trading volume, as well as the competitive fees offered by a vast global user base. While it doesn’t waive fees for fiat deposits, savvy users can navigate around some costs.

My first crypto purchase on OKX was with MasterCard, and I was hit with a hefty £2.54 fee for a £90 transaction, but on my second try, I opted for Google Pay. Although OKX didn’t charge a fee, I did pay a network fee of just £0.78. This was a fantastic deal compared to Coinbase’s standard £2.99 fee for a similar purchase. It’s clear that with a bit of effort, OKX can be very cost-effective.

OKX Spot Maker/Taker Fees

In our review of spot fees, we examine spot fees across three distinct tiers, focusing on the fees for different trading volumes. We focus on the essentials and potential savings through native tokens and various discount schemes. Our unique methodology provides a clear view of fee structures and how they benefit traders of all levels.

The first tier typically represents casual traders, as they don’t usually trade more than $10,000 per month, while the higher tiers often relate to more advanced traders. Using this method, we’re categorizing users not only by their trading style but also by the amount of money they spend on the exchange.

Additionally, we also compare these fees with industry standards to give a thorough perspective on each exchange’s affordability.

| Pricing tier | Maker/Taker Fee | Industry Average |

| Up to $10K | 0.8/0.10% | 0.41% / 0.51% |

| Up to $100K | 0.8/0.10% | 0.33% / 0.37% |

| Up to $500K | 0.8/0.10% | 0.25% / 0.29% |

OKX’s pricing structure is pretty appealing, staying consistent across different trading volumes — whether you’re trading $10k, $100k, or $500k. This model really benefits low-volume traders, offering significant savings compared to exchanges like Coinbase, which charges a 0.40% maker fee and a 0.60% taker fee for a $10,000 trade. OKX attracts pro traders who want to maximize returns through cost-effective trading.

Maker and Taker fees

OKX charges makers 0.08% and takers 0.10%, well below the industry average of 0.40%/0.60%.

Higher trading volumes bring further reductions. Competitive fees are vital for frequent traders, boosting net profits, especially in high-frequency and algorithmic trading.

Deposit fees

OKX deposit fees vary based on your location and your chosen deposit method. For example, users in the EU and UK can buy crypto with 0% fees using credit/debit cards via Google Pay. However, residents in other regions pay standard rates like EUR 1.99%, HKD 2.49%, and USD 2.49%. As a UK-based OKX user, the only deposit options I have available to test are fee-free credit/debit card deposits and ACH bank transfers.

| Payment Method | Deposit Fee | Payment Method Deposit Fee |

| Bank Transfer (ACH) | Free | £0.79 |

| Credit/Debit Card | Free | £2.74 |

| Crypto | Free | Free |

| Google Pay | Free | £0.79 |

| P2P | Free | Variable |

| Apple Pay | Free | £0.75 |

| Wire Transfer | N/A | N/A |

| SEPA Transfer | Free | Variable |

| SWIFT Transfer | N/A | N/A |

| Paypal | N/A | N/A |

The chart above shows the fees for various payment methods for depositing crypto and fiat. This data is based on tests in the UK and may vary by region.

Fiat Withdrawal Fees

OKX could be more transparent about its fiat withdrawal fees. In my testing, I wasn’t charged for my initial fiat withdrawal. OKX frequently states that it only charges for on-chain withdrawals, but without detailing its withdrawal fee structure, it gives the impression of deliberately keeping its fiat withdrawal policy vague. While it seems like there are no exchange fees for fiat withdrawals, be aware that your bank might charge a separate fee depending on the withdrawal method.

| Payment Method | Fee for Withdrawing $10K |

| Bank Transfer (ACH) | 0.% |

| Credit/Debit Card | 0.% |

| Crypto | 0.% |

| Google Pay | 0.% |

| Apple Pay | 0.% |

| Wire Transfer | 0.% |

Leverage Borrowing Fees

OKX’s leverage borrowing fees remain consistent from 1 – 13x. Aside from a few exceptions, such as AXS and others that charge upwards of a 40% annual interest percentage rate, the standard borrowing fees for almost all assets is set at 1% for crypto assets. For stablecoins, the interest rate is 2% for USDT and 8% for USDC. Click here to access the full fee breakdown.

Are OKX’s Fees Competitive?

OKX’s maker-taker fees are highly competitive, with makers paying 0.08% and takers 0.10%, significantly lower than the industry average. However, while OKX is transparent about these trading fees, it lacks clarity regarding fiat withdrawal and deposit fees. Nevertheless, my testing showed no charges for fiat withdrawals. This ambiguity likely stems from the exchange’s operations across over 100 countries, making maintaining a consistent fee structure globally tricky.

Please note that fees may vary, and checking the OKX official website for the latest information is advisable.

In summary, OKX’s fees are competitively priced and variable, making it suitable for freelance and individual traders.

Cryptocurrencies Available on OKX

OKX offers over 350 cryptocurrencies for trade, though only about 40 are available in the UK. It supports various fiat currencies catering to international users, including USD, EUR, AUD, GBP, and INR. The exchange provides diverse cryptocurrency pairs based on location plus a launchpad for new tokens. On CoinMarketCap’s liquidity ranking, OKX ranks 3rd, only behind Binance and Coinbase.

New coins: OKX has a listing application form and regularly announces new token launches. It also facilitates token sales through Initial Exchange Offerings (IEOs), the most recent of which was Blockchain Brawlers two years ago

Launchpad: OKX’s launchpad, Jumpstart, was launched in 2019 and provides access to emerging crypto projects through events like “Mining” and “On Sale,” allowing users to stake crypto for token rewards.

Notable successful projects include DEAPcoin, Element Black, and SUI, which has become the 44th largest cryptocurrency by market cap at over $2.2 billion within the last year. With its successful track record, Jumpstart is regarded as one of the VIP crypto launchpads in the industry.

Deposits and Withdrawals

OKX excels in offering both crypto and fiat deposits and withdrawals, providing a great experience due to low fees, speed, and overall performance compared to other exchanges. However, for users in regions with regulatory restrictions, like myself, the process becomes more complicated.

As a UK-based user, I could only deposit and withdraw using ACH and credit/debit cards, both of which were processed instantly. Crypto-to-crypto withdrawals, tested via the Tron network, were exceptionally fast, executing in less than a minute — quicker than usual.

The dual KYC process with OKX and Banxa was frustrating, as both needed to be completed. While depositing funds is straightforward, the desktop interface made it challenging to find the withdrawal option, though the mobile app is more user-friendly. To withdraw fiat, I had to transfer my crypto to a different exchange and initiate the withdrawal from there.

OKX Deposit Options

I found that OKX supports 67 different fiat currencies for purchasing crypto. While it’s standard not to charge for ACH bank transfers, it’s rare to find a centralized exchange that charges no fees for methods like wire, credit/debit card, and SWIFT transfers. This makes OKX a great choice for traders looking to keep fees low.

| Available Payment Methods | Fee |

| Bank Transfer (ACH) | 0% |

| Wire Transfer | 0% |

| SEPA Transfer | 0% |

| Credit/Debit Card | 0% |

| Pix*, Google & Apply Pay | 0% |

| SWIFT Transfer | 0% |

*Pix is an instant payment platform created and managed by the monetary authority of Brazil

**Note that deposit options can vary significantly from region to region. Always check the exchange’s official site for the most accurate and region-specific deposit information.

OKX Withdrawal Methods

Based on our testing with the UK version of OKX, the only fiat withdrawal option available was via credit/debit card. Internationally, the platform supports ACH, SEPA, Wire, SWIFT, and e-wallet withdrawals using services like Pix, Google, and Apple Pay. However, the availability and fees for these options vary based on location, currency, and withdrawal type.

| Method | Availability | Fees | Processing Time |

| Bank Transfer (ACH) | N/A | N/A | N/A |

| Wire Transfer | Yes | No fee or up to $2 | Instant – 24 hours |

| SEPA Transfer | Yes | No fee | Instant – 24 hours |

| Credit/Debit Card | Yes | No fee | Instant – 24 hours |

| PayPal/E-Wallets | Yes | No fee | N/A |

| SWIFT Transfer | N/A | N/A | N/A |

My withdrawal experiences were mixed. The first withdrawal attempt was free and completed in less than an hour. However, despite trying 4 separate times, subsequent attempts were unsuccessful due to recurring timeout issues. According to the AI chatbot, fiat withdrawals are not supported in the UK, which explains why some withdrawals did not work. Despite these restrictions, our testing found that withdrawals are still possible, though inconsistently.

I could not find documents surrounding specific fiat withdrawal limits as this is not information OKX openly makes available within my region.

Customer Service

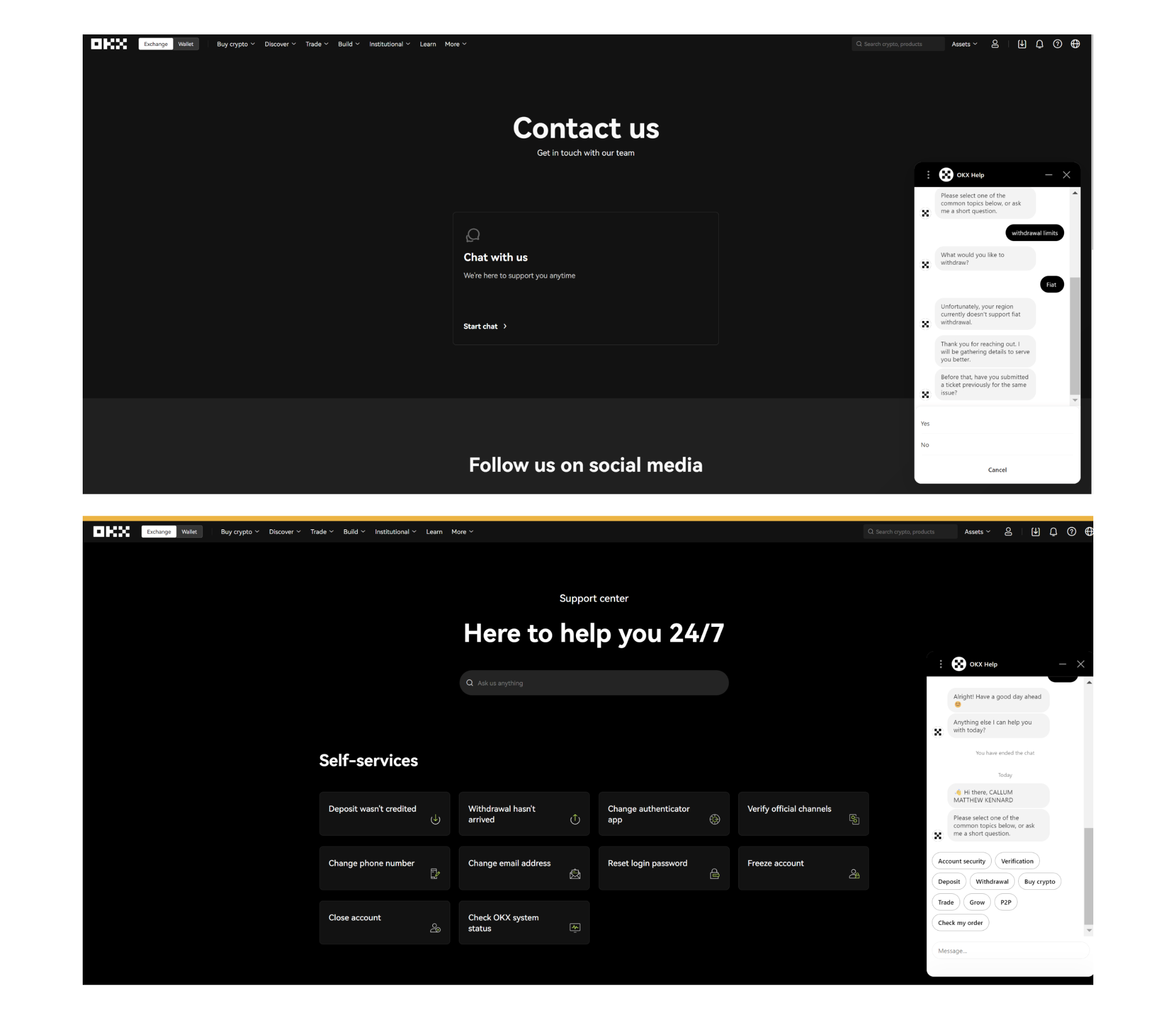

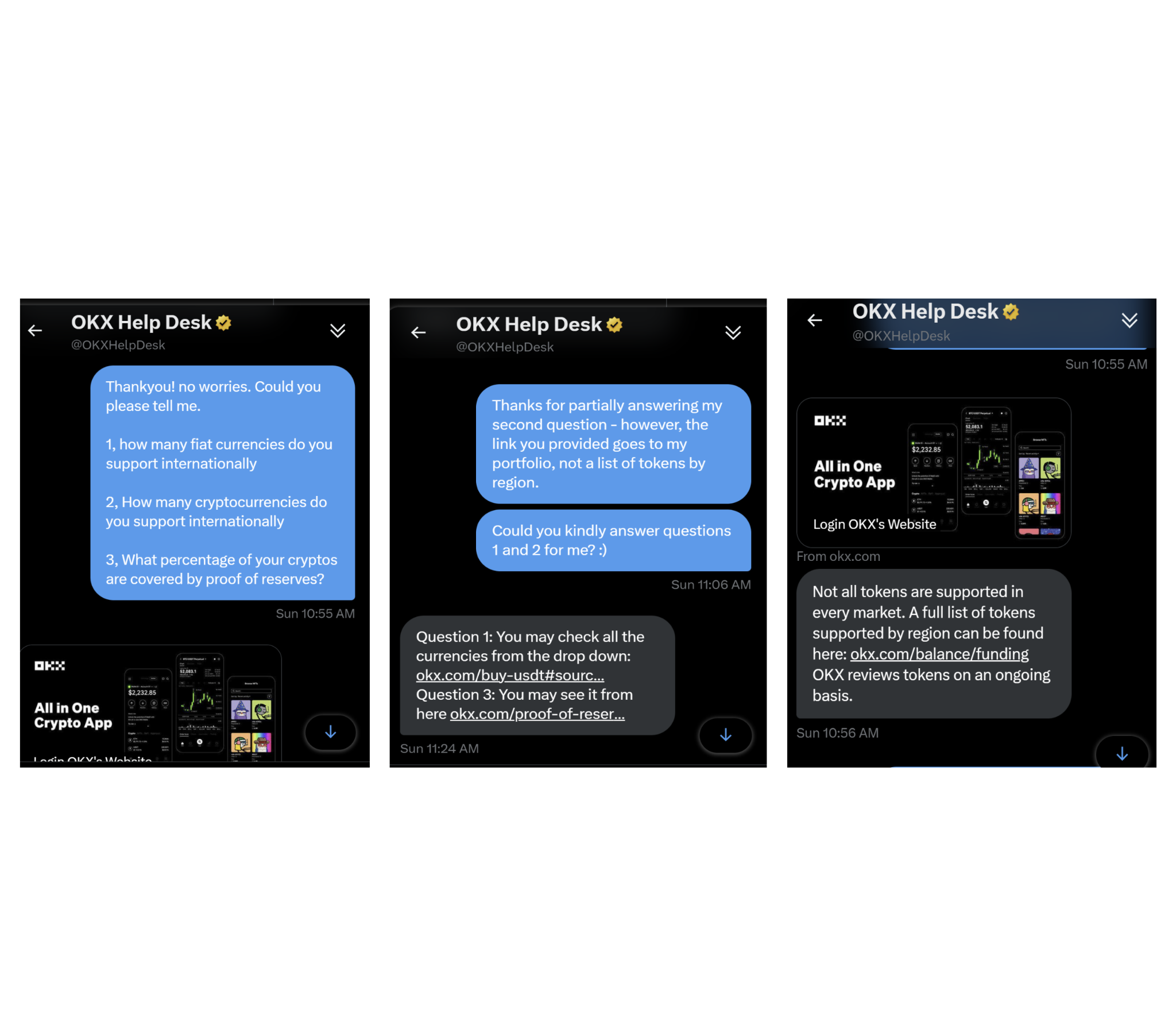

OKX’s customer service leaves much to be desired, as no live support staff is available. Users can only reach out via email or an AI chatbot (available in 13 languages) that redirects to over 292 FAQs. They don’t offer account managers or personalized services for high-volume clients, either.

From our experience, the best way to contact a representative is through their helpdesk on X. The support section on their website doesn’t actually open a ticket; instead, you need to navigate to the “contact” section, which then prompts the chatbot to create a support ticket. Plus, you can’t open multiple support tickets at the same time.

| Live Chat | Phone | Languages | |

| 24/7 | N/A | 24/7 | English, Russian, Turkish, Spanish, Hindi, Portuguese, Indonesian, Vietnamese, Filipino, Japanese |

OKX’s customer service falls short of other leading exchanges. For instance, Coinbase offers phone support and live chat, Kraken provides 24-hour live chat support, and Binance also features 24/7 live chat assistance.

OKX Customer Support Test

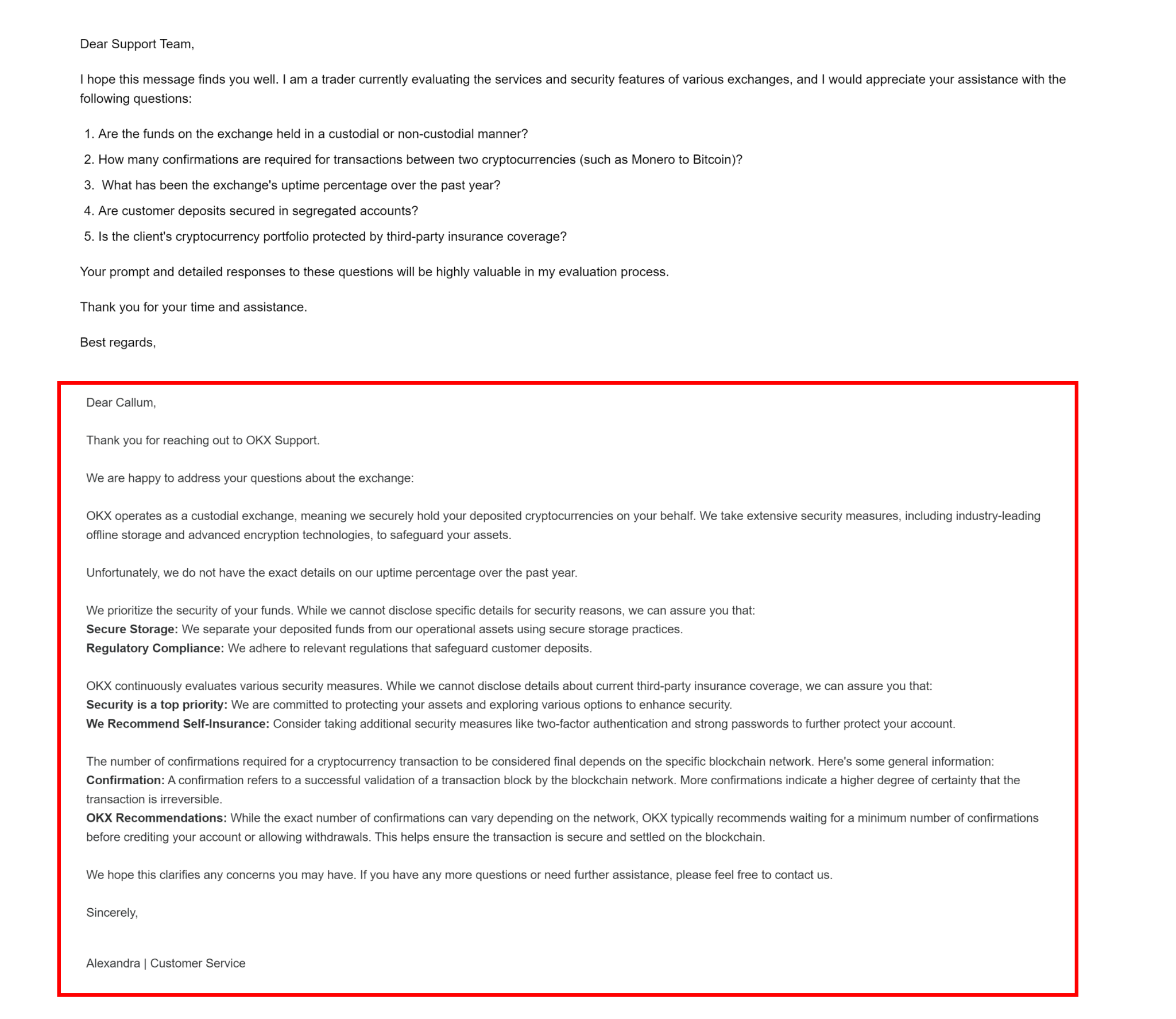

We created a unique trading test to evaluate the quality of customer services for diverse user needs. We personally contact support using all available methods and present hypothetical problems that users might face. Our evaluation concentrates on how quickly they respond, the quality of the help provided, and whether we can talk to a real person rather than a bot. This method effectively measures the capability of customer support to assist both active traders and casual investors.

During my testing, I found that the fastest way to reach a customer service representative was through OKX’s Helpdesk account on Twitter (X). The responses were professional and prompt but often addressed only one or two questions at a time. The answers were underwhelming and frequently included links to pages that were unavailable in my region or provided incomplete information. It would be more effective if the international support team on social media asked for the user’s location to provide more relevant assistance.

OKX’s customer service via email is good, it took just 3 hours to get a response. Within my email, I asked the same set of questions as I had on their X account. The replies were more detailed, but still lacked depth and specifics, particularly regarding uptime and security.

Overall, while the email assistance was responsive and friendly, it could benefit from more comprehensive answers.

OKEXFeatures

- Bitcoin

- Litecoin

- Ethereum

- Australia

- Cameroon

- Chad

- Canada

- Denmark

- France

- Greece

- Haiti

- Iceland

- Libya

- Mexico

- Nepal

- Romania

- Cape Verde

- Belize

- Senegal

- Sri Lanka

- United Kingdom

- Eritrea

- Gambia

- Indonesia

- Lebanon

- Angola

- Malta

- Bahamas

- Benin

- Chile

- Ghana

- Gibraltar

- Grenada

- Serbia

- Guinea-Bissau

- Tonga

- Kenya

- Finland

- Namibia

- Oman

- Jamaica

- Palau

- Solomon Islands

- Kyrgyzstan

- Tunisia

- Montenegro

- Peru

- Sweden

- Trinidad and Tobago

- Yemen

- Bahrain

- Belarus

- Bulgaria

- Colombia

- Cuba

- Cyprus

- Algeria

- Burkina Faso

- Cambodia

- Kuwait

- Russian Federation

- Saint Lucia

- South Sudan

- Tanzania

- Turkey

- Virgin Islands, British

- Japan

- South Korea

- Malawi

- Maldives

- Netherlands

- Botswana

- Qatar

- Saint Kitts and Nevis

- Saint Vincent and the Grenadines

- Slovenia

- Sudan

- Taiwan

- Tuvalu

- Vatican City

- Uruguay

- Malaysia

- Moldova

- Nauru

- Papua New Guinea

- Zambia

- Andorra

- Bolivia

- Afghanistan

- Congo

- Cote d'Ivoire

- Laos

- Dominican Republic

- Mauritania

- Egypt

- Gabon

- Morocco

- Uganda

- Swaziland

- Vietnam

- Nigeria

- Austria

- Barbados

- Bosnia and Herzegovina

- Djibouti

- Equatorial Guinea

- Comoros

- Estonia

- Fiji

- Ethiopia

- Mali

- Hong Kong

- Ireland

- Italy

- Philippines

- Macedonia

- Poland

- Madagascar

- Sierra Leone

- Vanuatu

- Panama

- Portugal

- Samoa

- Saudi Arabia

- Timor-Leste

- Albania

- Burundi

- Guinea

- Iran

- Armenia

- Bangladesh

- Belgium

- Kiribati

- Lithuania

- Bhutan

- Mongolia

- Cayman Islands

- Rwanda

- Myanmar

- Niger

- Sao Tome and Principe

- Slovakia

- Czech Republic

- Thailand

- United Arab Emirates

- Ecuador

- Germany

- India

- Liberia

- Liechtenstein

- Luxembourg

- Marshall Islands

- Mozambique

- New Zealand

- Pakistan

- Togo

- Uzbekistan

- Venezuela

- Zimbabwe

- Antigua and Barbuda

- Croatia

- Argentina

- Guyana

- Kazakhstan

- Lesotho

- Central African Republic

- Norway

- Paraguay

- San Marino

- Spain

- Suriname

- Switzerland

- Tajikistan

- Guatemala

- Honduras

- Iraq

- Mauritius

- Nicaragua

- Singapore

- Somalia

- Azerbaijan

- Brazil

- Brunei

- China

- Costa Rica

- El Salvador

- Georgia

- Israel

- Hungary

- Jordan

- Latvia

- Micronesia

- Seychelles

- South Africa

- Turkmenistan

- Ukraine

- Isle of Man

- Kosovo

Payment Method

| Exchange Details | Info |

|---|---|

| Headquarters Country | Hong Kong |

| Foundation Year | 2017 |

| Type | exchange |

| Trading Allowed | Yes |

Top Wallets

- Your capital is at riskRead Review

- Your capital is at riskRead Review

- Your capital is at riskRead Review