Advertisement

Advertisement

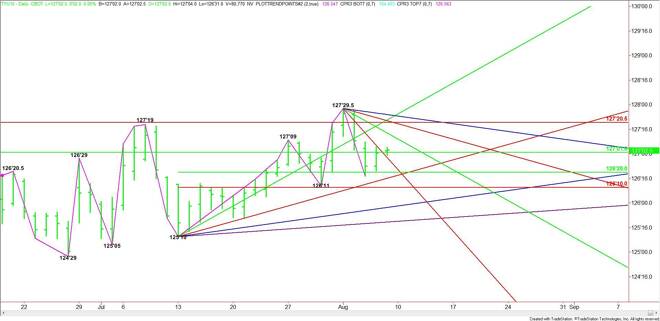

10-Yr U.S. Treasury Notes (TY) Futures Technical Analysis – August 7, 2015 Forecast

By:

September 10-Year U.S. Treasury Notes are trading slightly higher shortly ahead of the U.S. Non-Farm Payrolls report. The report, due out at 8:30 a.m. ET,

September 10-Year U.S. Treasury Notes are trading slightly higher shortly ahead of the U.S. Non-Farm Payrolls report. The report, due out at 8:30 a.m. ET, is expected to show the economy added 222K new jobs in July. A number substantially higher will likely trigger a sell-off. A number substantially lower will likely fuel a resumption of the uptrend.

Technically, the main trend is up according to the daily swing chart. A trade through 126’11 will turn the main trend to down.

During the pre-market session, T-Notes are trading on the strong side of a downtrending angle at 126’29.5 and a major 50% level at 127’01. This is giving the market an early upside bias.

The first potential uptrending angle drops in at 127’13.5. The next target is a potential resistance cluster at 127’20.5 to 127’21.5. The next targets are an uptrending angle at 127’22 and a downtrending angle at 127’25.5. The final potential resistance is the main top at 127’29.5. A trade through this level will trigger a resumption of the uptrend.

A break below the major 50% level at 127’01 will be the first sign of weakness. A sustained move under the downtrending angle at 126’29.5 will signal the presence of sellers.

The first major downside target is a short-term 50% level at 126’20, followed by an uptrending angle at 126’16 then a main bottom at 126’11 and a short-term Fibonacci level at 126’10.

A trade through 126’11 will turn the main trend to down, but don’t expect an acceleration to the downside until 126’10 is taken out. This move could create enough downside momentum to trigger a break into angles at 125’29 and 125’19.5.

Based on the pre-market session, the direction of the market at the time of the report will be determined by trader reaction to the major 50% level at 127’01. A sustained move over this level will be bullish. A sustained move under this level will be bearish. Watch for increased volatility at 8:30 a.m. ET.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement