Advertisement

Advertisement

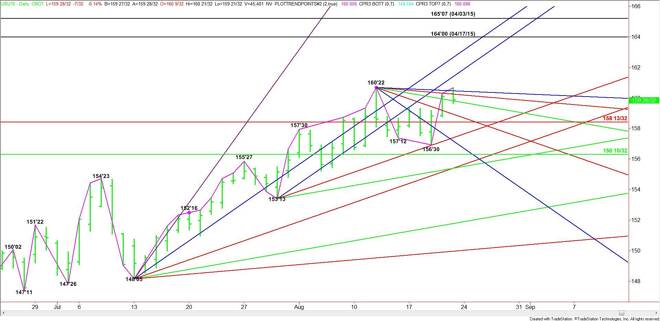

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – August 21, 2015 Forecast

By:

September 30-Year U.S. Treasury Bonds are trading slightly lower after failing to take out the main top at 160’22 earlier in the session. The market is

September 30-Year U.S. Treasury Bonds are trading slightly lower after failing to take out the main top at 160’22 earlier in the session. The market is getting its guidance from the stock market so use this as an indicator today. If stocks break then look for T-Bonds to firm. If stocks rally then look for T-Bonds to weaken.

On the upside, the first two objectives are downtrending angles at 160’08 and 160’15. The main top is 160’22. A trade through this top will signal a resumption of the uptrend with the next likely targets a pair of steep uptrending angles at 161’13 and 162’21.

A break under 159’26 will signal the presence of sellers. This could drive the market into the next downtrending angle at 158’30 and the major Fibonacci level at 158’13. The main support is an uptrending angle at 157’13. This is the angle that provided support earlier in the week.

Based on the current price at 159’29, it looks like the direction of the market the rest of the session will be determined by trader reaction to the angle at 159’26. Watch the price action and read the order flow at this price to determine whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement