Advertisement

Advertisement

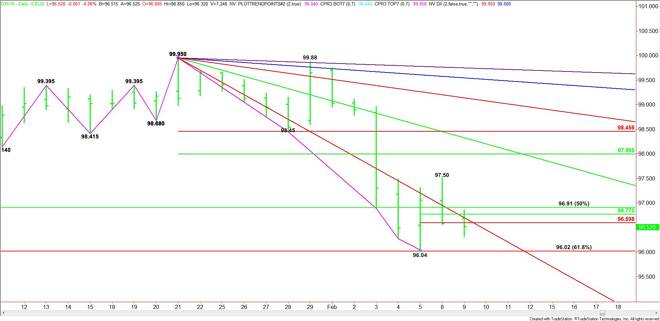

US Dollar Index (DX) Futures Technical Analysis – February 9, 2016 Forecast

By:

March U.S. Dollar Index futures are trading slightly lower after posting some volatile price action on Monday. Friday’s closing price reversal bottom was

March U.S. Dollar Index futures are trading slightly lower after posting some volatile price action on Monday. Friday’s closing price reversal bottom was confirmed, but the rally stalled at 97.50, leading to a short-term technical retracement. The price action suggests that investors are mixed about the near-term direction of the Greenback, leading to the choppy, two-sided trade.

Technically, the main trend is down according to the daily swing chart, but traders are trying to shift the momentum to the upside with the formation of a closing price reversal bottom. Today’s price action suggests some traders remain indifferent to the idea.

The main retracement zone is 96.91 to 96.02. The lower level of this zone stopped the break at 96.04 late last week. This week, the index is straddling the zone, perhaps trying to consolidate or build a support base.

Based on Monday’s close at 96.51, the direction of the market today will likely be determined by trader reaction to the short-term Fibonacci level at 96.77 to 96.60.

A sustained move under 96.60 will indicate the presence of sellers. This could create enough downside momentum to challenge the closing price reversal bottom at 96.04 and the major Fib level at 96.02.

A sustained move over 96.60 will signal the presence of buyers. The first upside objective is a long-term downtrending angle at 96.70. This is followed closely by a major 50% level at 96.91.

The daily chart begins to open up on a sustained move over 96.91 with the next upside target yesterday’s high at 97.50.

If the bottom at 96.04 holds as support then the primary upside target becomes 97.99 to 98.46.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement