Advertisement

Advertisement

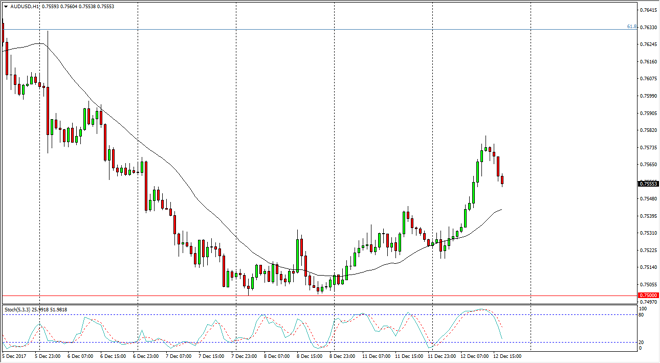

AUD/USD Price Forecast December 13, 2017, Technical Analysis

Updated: Dec 13, 2017, 06:10 GMT+00:00

The Australian dollar was volatile during the trading session on Tuesday, reaching as high as the 0.7580 level, but rolled over later in the day at CPI figures came out stronger than anticipated in the United States. With today’s Federal Reserve announcement, it’s likely that we will get more clarity.

The Australian dollar has rallied initially during the trading session on Tuesday, but has a negative look to it later in the day as the CPI figures came out stronger than anticipated, and a favorite of course money flowing into the United States. If we can break down from here, I think we will go looking towards the 0.75 support level which should be massively supportive. The market should continue to be very volatile, but I think that given enough time we will break down. A breakdown below the 0.75 level should send this market down to the 0.7350 level, an area that has been supportive in the past.

Ultimately, we could rally from here, but I think that will have a lot to do with the Federal Reserve, and what its attitude is as far as interest rate hikes are concerned going forward. If we are more hawkish than anticipated, that could be the death knell for the Australian dollar and the short-term, but having said that I think that the Federal Reserve being dovish could send this market to the upside. However, the 0.7650 level above is massive resistance, so I think that the upside will be somewhat limited and less of course the Federal Reserve shocks the market and flat-out states they will not be raising interest rates. In general, I think that this rally will end up being and I selling opportunity, as gold is not helping either.

AUD/USD Video 13.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement