Advertisement

Advertisement

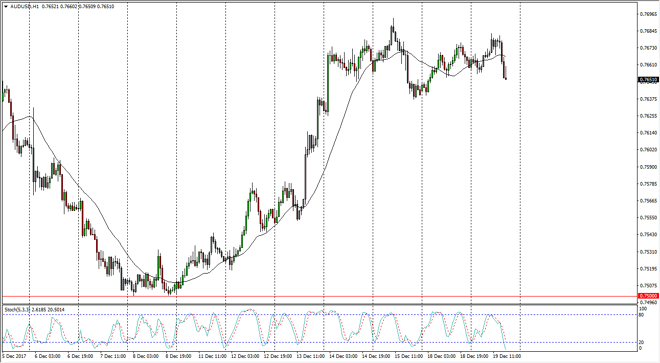

AUD/USD Price Forecast December 20, 2017, Technical Analysis

Updated: Dec 20, 2017, 05:52 GMT+00:00

The Australian dollar initially tried to rally on Tuesday but rolled over and now seems to be threatening a break to the downside.

The Australian dollar had a noisy session on Tuesday, initially going higher, but then rolled over to show signs of weakness. If we can break down below the 0.7625 level, I think that the market could drop down to the 0.75 handle again, which was the scene of the most recent bottom in this pair. Gold markets will have their influence as well, so if gold markets roll over, I suspect that will put a lot of bearish pressure on the Aussie as per usual. Alternately, if gold rally significantly, that could cause a bit of a reversal in the Aussie dollar. However, it appears that a lot of money is jumping into the US stock markets, as tax breaks seem to be coming.

I believe that the volatility of course will be an issue, but quite frankly that tends to work against the Aussie anyway, as it is considered to be a “risk asset.” With this in mind, I think that the downside is probably favored. There are several major resistance areas above that will be difficult to break above, so it’s not until we clear the 0.80 level that I am comfortable going long for a significant amount of time, as I think that there are a lot of potential headwinds. I believe that the market continues to be choppy, so keep your position size relatively small, unless you are very confident, which I think is difficult to do this time a year. The lack of liquidity will cause significant moves, so I think that the market is likely to be a bit dangerous. At this point though, it looks like the sellers are starting to step up their pressure.

AUD/USD Video 20.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement