Advertisement

Advertisement

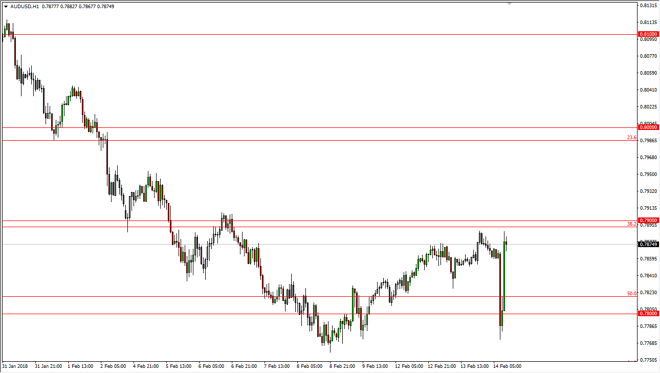

AUD/USD Price Forecast February 15, 2018, Technical Analysis

Updated: Feb 15, 2018, 04:47 GMT+00:00

The Australian dollar had a wild ride during the trading session on Wednesday, dipping below the 0.78 level and then completely wiping out the sudden loss is that we had seen after the CPI announcement in the United States.

The Australian dollar was very noisy, as Tuesday showed signs of bullish pressure, but then broke down below the 0.78 handle at one point, but then turned around to rally towards the 0.79 level again. If we can break above this level, the market could then go to the 0.80 level above, which is a large, round, psychologically significant number, and it of course is the pivot point that I’ve been talking about for some time in this pair going back to the 1980s.

Ultimately, if the market breaks above there we could go to the 0.81 handle, which is the top of the resistance, and I think that if we can break above the level, the market should continue to go much higher, and perhaps into more of a “buy-and-hold” scenario. The longer-term outlook of this market is bullish in my estimation, especially considering how we have seen such a massive turn around during the trading session. I think that this shows that there is an underlying demand for the Australian dollar, and of course gold which I would assume is influencing this market rather drastically as well.

If we were to break down below the 0.78 handle, then we could see a bit of trouble, perhaps a drop to the 0.7750 level next. However, I suspect that there is maybe a 10% chance this happens, as the last couple of hours have shown that there is strong demand, and of course a continuation of bearish pressure on the greenback itself.

AUD/USD Video 15.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement