Advertisement

Advertisement

AUD/USD Price Forecast February 16, 2018, Technical Analysis

Updated: Feb 16, 2018, 05:21 GMT+00:00

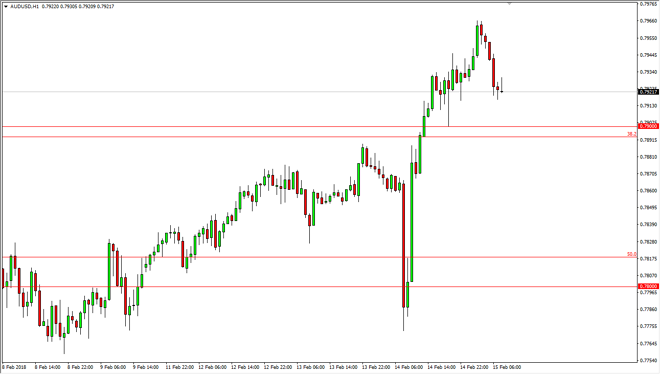

The Australian dollar has rallied initially during the trading session on Thursday but found enough resistance near the 0.7950 level to roll over. However, as I record this video it looks as if the buyers are starting to come back and defend the 0.79 level.

The Australian dollar has rallied initially during the day on Thursday, reaching towards the 0.7950 level before finding sellers again to roll over and test the 0.79 level. This is an area that was resistive, and it makes sense that it would be support now. I believe that the US dollar weakness continues, as the bond market certainly point in that direction. If that’s the case, gold market should rally as well, and that should put upward pressure on the Aussie dollar.

The market should continue to grind its way towards the 0.80 level above, which is a fulcrum for price going back decades, all the way back to the late 80s. This is an area that is vital for the long-term trend, and if we can break above the 0.81 handle, the Australian dollar will find itself in a “buy-and-hold” phase. I would also add on short-term dips, as this would show a significant selling off of the US dollar longer-term, which I believe we are about to see.

If that’s the case though, anticipate a lot of volatility, as the markets are starting to readjust their expectations. I believe that the uptrend is very much intact in this pair if we can stay above the 0.78 handle, which looks very likely to happen. If we were to break down below there, then I think the market goes down to the 0.75 handle over the longer term. Expect noise, keep your position size small, but I would certainly be looking for bullish trades.

AUD/USD Video 16.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement