Advertisement

Advertisement

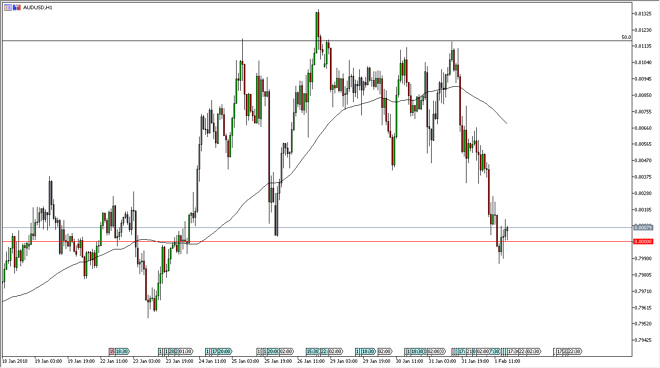

AUD/USD Price Forecast February 2, 2018, Technical Analysis

Updated: Feb 2, 2018, 04:46 GMT+00:00

The Australian dollar has fallen a bit during the trading session, reaching towards the 0.80 level, an area that has been important in the past. Because we have bounced a bit, I think we could get an opportunity to go long in the short term, and then eventually the long-term if we can break above the 0.81 handle and become more of a “buy-and-hold” situation.

The Australian dollar has fallen a bit during the trading session on Thursday, reaching down towards the vital 0.80 level, perhaps sending this market to the 0.8050 level, and then the 0.81 handle. If we can break above there, the market should continue to send this market to the upside, perhaps reaching towards the 0.85 level. The longer-term uptrend should continue going forward, and if the gold markets also rally, it will only put more pressure on this market to the upside.

The US dollar course has been falling for some time, and if that continues, it’s likely that the AUD pair will continue to go higher, as gold will not only press the pair higher, but also have more people flooding into Australia to purchase that goal. In other words, it’s a bit of a “double whammy.” Ultimately, I think that this market does go to the 0.85 handle, and eventually goes a sign 0.90, or perhaps even parity over the next several months, if not years. If we broke down below the 0.79 level, then that would change some things, but right now it doesn’t look very likely to happen. Ultimately, I believe in the Australian dollar, especially if the Asian economies continue to strengthen, as the Australian dollar is a major supplier of commodities to that region, so Asian expansion, especially construction, is very good for this currency.

AUD/USD Video 02.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement