Advertisement

Advertisement

AUD/USD Price Forecast February 21, 2018, Technical Analysis

Updated: Feb 21, 2018, 05:05 GMT+00:00

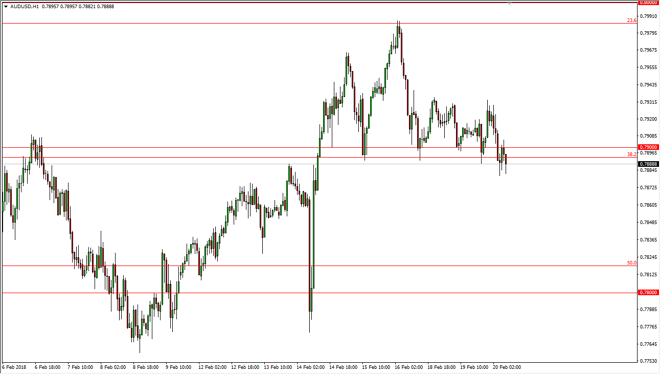

The Australian dollar broke down a bit during the day on Tuesday, slicing through the 0.79 level to show signs of weakness. Ultimately, I do think that there is some support in this area, so it should give you an idea as to where we should go next. I think that if we can break above the 0.79 level again, it’s likely that we will make a move higher again.

The Australian dollar has broken down a little bit during the trading session on Tuesday, but we are starting to find support as I record this. If we can break above the 0.79 level substantially, I think it will be another attempt to reach the 0.80 level above, which has been very important over the longer-term charts. I think that it will take a lot of momentum to finally break above there again, but I do believe it happens.

Pay attention to gold markets, they tend to move the Australian dollar as well, so I think that the astute trader will be paying attention to both markets. I think that ultimately, both go higher as the US dollar has had its issues lately, not the least of which involve the bond markets selling off. That is not a good sign, and I believe that we will continue to see a lot of momentum.

Even if we break down from here, I believe that the 0.7850 level will be supportive, and then below there the 0.78 handle. Ultimately, I think that the market will eventually rally, so I don’t have any interest in shorting, and I look at breakdowns as potential opportunities to pick up value. I have a longer-term upward bias, not only based upon this chart, but the fact that gold is trying to break out over major levels.

AUD/USD Video 21.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement