Advertisement

Advertisement

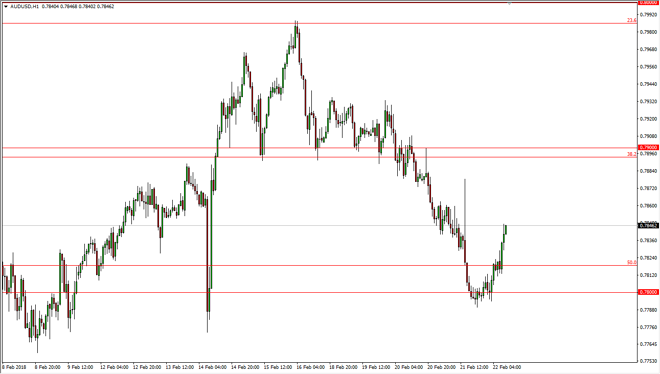

AUD/USD Price Forecast February 23, 2018, Technical Analysis

Updated: Feb 23, 2018, 04:50 GMT+00:00

The Australian dollar has rallied rather significantly during the trading session on Thursday, breaking above the 0.7850 level. Ultimately, I think the 0.78 level will be looked at as a nice buying opportunity.

The Australian dollar has rallied significantly during the trading session on Thursday, using the 0.78 level as support. It looks as if the buyers are coming back with a vengeance, and that we will probably go looking towards the 0.79 level. Pay attention to gold, because of it rallies that should help this market as well, in a general anti-US dollar move. I think that a break above the 0.79 level should send this market to the 0.80 level, an area that has been important on longer-term charts, and has been a magnet for price.

Overall, I believe that this market continues to offer opportunities on dips, and I do think that eventually we break out to the upside and enter more of a “buy-and-hold” scenario, especially if the US dollar tanks against almost everything else, something that’s very possible. I think that the Australian dollar will be a perfect vehicle as it is so highly correlated the gold, which I anticipate will do quite well.

The alternate scenario is that we break down below the 0.78 level underneath, reaching down to the 0.7750 level after that. Ultimately, I think that the market will continue to be noisy and will base its next move upon the value of the greenback in general as I think there are a lot of questions with the bond markets right now, and of course the potential for some type of melt down in the greenback, which I think could be coming. The US Dollar Index is testing very significant support levels, which could lead to several years of weakness. If that’s the case, the Aussie should come out quite well.

AUD/USD Video 23.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement