Advertisement

Advertisement

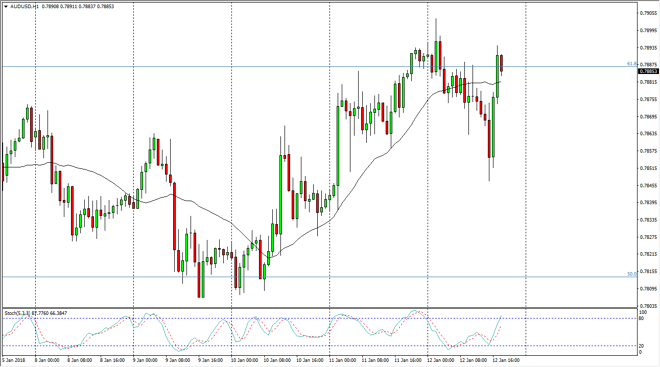

AUD/USD Price Forecast January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 02:53 GMT+00:00

The Australian dollar has drifted lower during most of the week, but bounce significantly as the Americans came to work. With this being the case, looks as if we are starting to see even more support for the Aussie dollar, with the US dollar taking a beating overall on Friday.

The Australian dollar initially fell during the trading session on Friday, but found enough support near the 0.7850 level underneath, showing signs of resiliency. I believe that the US dollar falling against most currencies will continue to help the Australian dollar as well, not to mention that the US dollar falling typically lifts the gold markets as well, a major driver of the Australian dollar. I think that if we can break above the 0.79 level, the market is likely to go to the 0.80 level above, which has been a major area of contention for longer-term traders.

Dips continue to offer value, and I think that using them to pick up value is probably the way to go. Although I recognize that the area between the 0.79 level and the 0.80 level above is going to be difficult to break above, certainly I don’t have any interest in shorting, mainly because that means buying the US dollar. In other words, this is a one-way market by default, because of the inherent weakness in the greenback. I believe that the market breaking above the 0.80 level should send this market much higher, as it is a major barrier going back at least 20 years that I am aware of. At that point, it becomes more of a “buy-and-hold” type of situation. That should correspond with an obvious break out in the gold market, and therefore it will become an obvious trade.

AUD/USD Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement