Advertisement

Advertisement

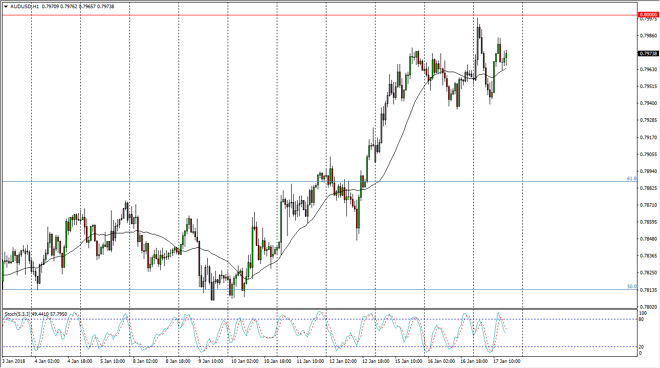

AUD/USD Price Forecast January 18, 2018, Technical Analysis

Updated: Jan 18, 2018, 05:21 GMT+00:00

The Australian dollar initially tried to rally during the trading session on Wednesday, reaching towards the 0.80 level. That’s an area that is crucial on the longer-term charts, and looks as if it is very vulnerable.

The US dollar initially tried to rally towards the 0.80 level, an area that has been important for quite some time. A break above that level is a significant move, but it’s not until we break above the 0.80 level that the market is more of a “buy-and-hold” market. I think in the meantime, short-term pullbacks will continue to offer value the people are willing to take advantage of, and that will be especially true if the gold markets rally. Ultimately, I think pullbacks find plenty of support at the 0.7950 level, and most certainly at the 0.79 level.

With the volatility that we have seen during the day, I think that the market is trying to build up enough momentum to finally break out to the upside, and that pullbacks will probably offer value the people are willing to take advantage of. Gold markets a course have their influence on the Australian dollars well, as we have seen gold rally significantly, while simultaneously seeing the US dollar didn’t beat down. I believe that longer-term, the market will finally break out to the upside, and then reach towards the 0.85 handle. Adding on dips could probably continue to be the way going forward, so I think that we should continue to have plenty of reasons to go long. So be especially true if the “risk on” attitude of overall global markets continue. The market looks likely to be noisy, but ultimately it is a market that should continue to see value hunters come into the market on dips.

AUD/USD Video 18.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement