Advertisement

Advertisement

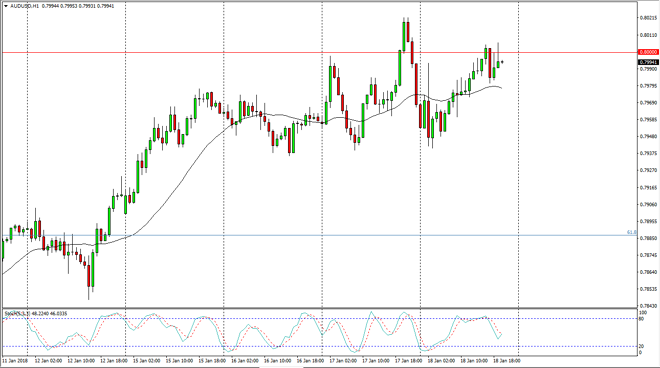

AUD/USD Price Forecast January 19, 2018, Technical Analysis

Updated: Jan 19, 2018, 05:45 GMT+00:00

The Australian dollar has rallied a bit during the trading session on Thursday, reaching towards the 0.80 level. That area is starting to offer resistance again, and quite frankly that’s not a huge surprise as we have seen massive amounts of importance placed upon this market going back decades at this area.

The Australian dollar rallied during the Thursday trading session, reaching towards the 0.80 level. That’s an area that is massive resistance, going back to the 1980s. We have broken above there recently though, but then broke back down below there. I believe that this is essentially the “fulcrum” price, and therefore markets will continue to go back and forth around this area. Eventually, we will get some type of directionality and clarity when it comes to the Australian dollar, and I believe that this will coincide quite nicely with the gold markets who look as if they are trying to decide what to do next.

A break above the 0.81 level should send this market much higher. If we clear that area, the market should become more of a “buy-and-hold” situation, perhaps reaching towards the 0.85 level. Alternately, if we break down below the 0.79 level, the market will probably collapse completely in go down to the 0.7750 level. Either way, I’m expecting a lot of volatility, and I believe that the market will reflect that. The risk appetite of traders around the world will influence where the Australian dollar goes next. As things go better, the Aussie benefits. The gold markets breaking above the $1350 level will unleash a massive uptrend in this market as well. Ultimately, if we break down, it’s likely that the gold markets will follow as well. Currently, I believe that buying short-term pullbacks will probably make the most sense, as we are trying to build up enough momentum to finally break out.

AUD/USD Video 19.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement