Advertisement

Advertisement

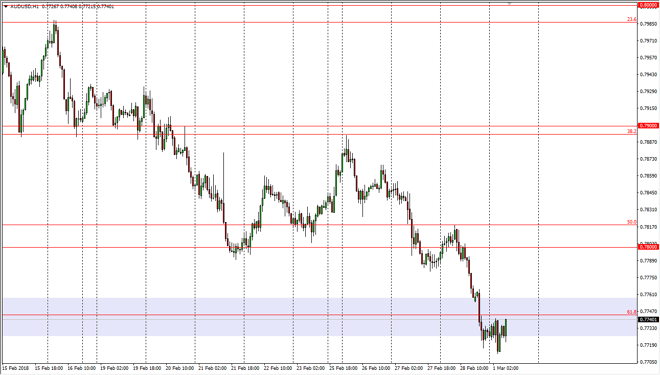

AUD/USD Price Forecast March 2, 2018, Technical Analysis

Updated: Mar 2, 2018, 05:32 GMT+00:00

The Australian dollar has gone back and forth during the trading session on Thursday, bouncing around the 61.8% Fibonacci retracement level, an area that I said must hold for the uptrend to survive. At this point, it looks very likely that we are about to make a significant decision.

The Australian dollar has formed a bit of a base during early trading in America on Thursday, as it looks like we are going to break above the 0.7750 level, the market could go to the 0.78 level rather quickly. A break above there could send this market much higher, as it would have shown that the 61.8% level has held, keeping the uptrend intact. If we continue to rally from here, we could go much higher, but obviously is going to be very noisy. I recognize that the gold markets of course will have the usual influence, but it looks as if gold is trying to rally, so that should put upward pressure on the Aussie as well.

If we break down below the 0.77 level underneath, that could send this market lower, perhaps reaching towards the 0.76 level underneath, perhaps even down to the 0.75 level after that. I believe that the Aussie is going to rally though, because the longer-term outlook for the US dollar seems to be very susceptible to selling pressure, and if the US Dollar Index roles over, then it’s likely that goal will rally as a result. That is reason enough to start buying, and I think at this point we are trying to build up the necessary momentum and perhaps trying to continue the longer-term uptrend. I think that the 0.79 level will offer resistance beyond the current area, and I think that the 0.80 level will eventually act as a magnet for price yet again.

AUD/USD Video 02.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement