Advertisement

Advertisement

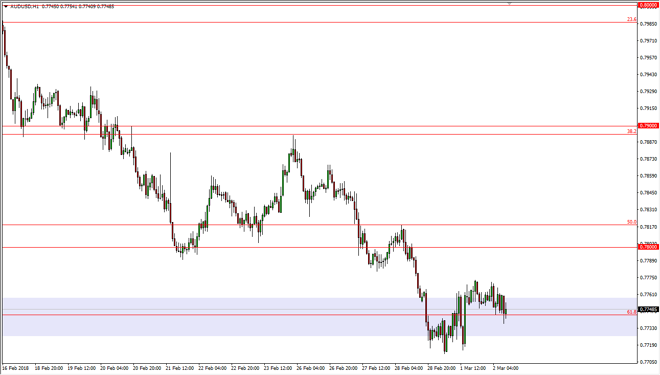

AUD/USD Price Forecast March 5, 2018, Technical Analysis

Updated: Mar 3, 2018, 05:18 GMT+00:00

The Australian dollar has drifted a bit lower during the trading session on Friday, as we continue to bounce around the 61.8% Fibonacci retracement level. I believe that the next couple of sessions will be very important to the next move.

The Australian dollar has drifted a bit lower during the trading session on Friday, and a surprisingly quiet session. Because of this, I think that we may be trying to find a bit of support in this area which of course makes sense as it was the 61.8% Fibonacci retracement level from the most recent move higher. If we break down to a fresh, new low, I think that the market will then break down towards the 0.75 level over the longer term. We do have an uptrend line between here and there, so we could get a bit of a reprieve near the 0.76 handle, continuing the overall uptrend. However, experience has told me that typically once we break below the 61.8% Fibonacci retracement level, more often than not we continue to wipe out the entire move higher.

I think there is a lot of concern out there right now, and perhaps gold could get a bit of a bid. If that’s the case, the Aussie might be an outlier when it comes to trading against the US dollar, as gold will help lift this market. If that’s the move that we see, the market will probably reach towards the 0.78 handle above, which is massively supportive in the past, and should be resistive now. If we can break above there, then the market would feel free to go to the 0.79 level after that. I think the one thing you can count on is a lot of volatility but right now I think we are simply trying to consolidate and figure out where to go next. Expect choppy conditions.

AUD/USD Video 05.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement