Advertisement

Advertisement

AUD/USD Price Forecast March 9, 2018, Technical Analysis

Updated: Mar 9, 2018, 06:28 GMT+00:00

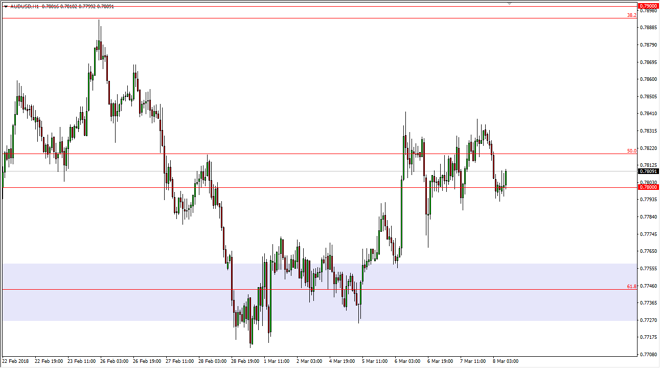

The Australian dollar has been very noisy during trading on Thursday, dropping down towards the 0.78 level before finding buyers again. Ultimately, the market looks as if it is trying to form some type of ascending triangle on the hourly chart, and then reach to the upside.

The Australian dollar has rallied a bit after initially falling during the trading session on Thursday. The 0.78 level underneath is going to continue to be an area of interest, as it is a large, round, psychologically significant number. When you look at the hourly chart, that doesn’t take much imagination to form an ascending triangle. If we can break above the 0.7850 level, the market then goes looking towards the 0.79 level after that. I do recognize that this pair will probably be noisy, because the Australian dollar does tend to be a bit noisy at times, but keep in mind that there is the correlation with gold that you should be paying attention to as well.

I believe that the market will continue to find buyers on dips, and at this point I most certainly have an upward bias. However, I recognize that if we break down below the 0.77 handle, that could be very negative and send this market down to the 0.75 handle. Ultimately, I believe that the market will go looking towards the 0.80 level above, which has been a fulcrum for price on longer-term charts going back to the late 1980s. It’s going to take a lot of effort to break above that level, so don’t be surprised to see this market continue to slam around in both directions. By keeping a small position, or more importantly – low leverage, you can ride out the noise that is almost certainly going to be part of this currency pair over the next several weeks.

AUD/USD Video 09.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement