Advertisement

Advertisement

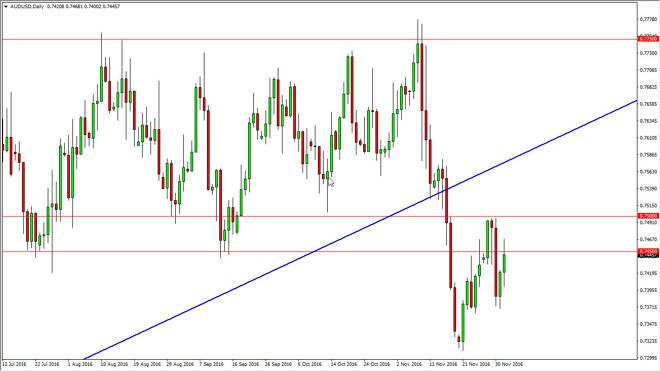

AUD/USD Forecast December 5, 2016, Technical Analysis

Published: Dec 3, 2016, 03:33 GMT+00:00

The AUD/USD pair fell slightly during the session on Friday, but found enough support near the 0.74 level to bounce and test the 0.7450 level again. We

The AUD/USD pair fell slightly during the session on Friday, but found enough support near the 0.74 level to bounce and test the 0.7450 level again. We found resistance there, as we have in the past, so now it looks very choppy to say the least. The weekly candle of course is very neutral, so it appears that the market is going to perhaps pick up more selling pressure. On the other hand, if we can break above the 0.75 level, we could make a move toward 0.76 above. Gold markets of course are very influential when it comes down to the Australian dollar, so you’ll have to pay attention to that marketplace. We have recently broken down below the $1200 level in the gold market, which of course is very bearish in general.

I believe that the gold markets will reach towards the $1100 level given enough time, and this is a direct effect of the US dollar strengthening in general, and of course the interest-rate hike that is looming in December. The question now comes down to whether or not the Federal Reserve can increase interest rates more than just once. If it looks as if they are going to, the US dollar will strengthen, which of course will weigh against the value of gold itself. Because of this, it’s likely that the markets will be volatile but I do think that eventually gold starts to fall as the US dollar is the only game in town currently.

Keep in mind that the Euro is soft, and that almost by a designation makes the US dollar strengthen. With this in mind, gold should fall and of course the knock on effect in the Australian dollar should continue. You also have to keep in mind that the Australian dollar is a bit of a proxy for Asian, which is in exactly strong at the moment. Ultimately, I think that we reach down to the 0.73 level, and then the 0.70 level over the longer term. I have no interest in buying until we break above the aforementioned 0.75 handle.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement