Advertisement

Advertisement

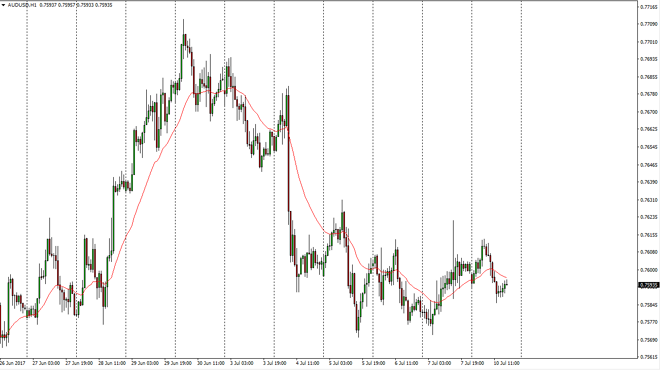

AUD/USD Forecast July 11, 2017, Technical Analysis

Updated: Jul 11, 2017, 05:43 GMT+00:00

The Australian dollar initially tried to rally on Monday, but turned around at the 0.76 level to fall to the 0.7580 level. We hardly gone anywhere during

The Australian dollar initially tried to rally on Monday, but turned around at the 0.76 level to fall to the 0.7580 level. We hardly gone anywhere during the day though, and I believe the Australian dollar is mirroring what we are seeing in the New Zealand dollar, simple ambivalence. Ultimately, I think that the 0.7550 level underneath will continue to be supportive, and if we can bounce from there I think that it’s likely that the market will try to rally again. However, gold markets seem to be stabilizing, and that could cause this market to be very quiet. This is a marketplace that should continue to be choppy and tight, so I would not put a lot of money in the pair because of the lack of volatility.

Follow the gold markets

I believe that the gold markets will be the way to tell what’s going on to the Australian dollar. The market looks very likely to be choppy and the short-term, but given enough time we could get some type of catalyst coming from the yellow metal to push the market higher. Alternately, if the gold markets breakdown below the $1200 level, that should send the Australian dollar much lower. We already know that the Federal Reserve is likely to raise interest rates and the short-term, and that could continue to put a bit of a weight around the neck of gold, and by extension the Australian dollar. If we did break above the 0.7625 handle, I think at that point we would probably go looking towards the 0.7675 level over the next several sessions. Ultimately, this is a market that needs something to jump in and start pushing in one direction or another. In the meantime, I am ambivalent.

AUD/USD Video 11.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement