Advertisement

Advertisement

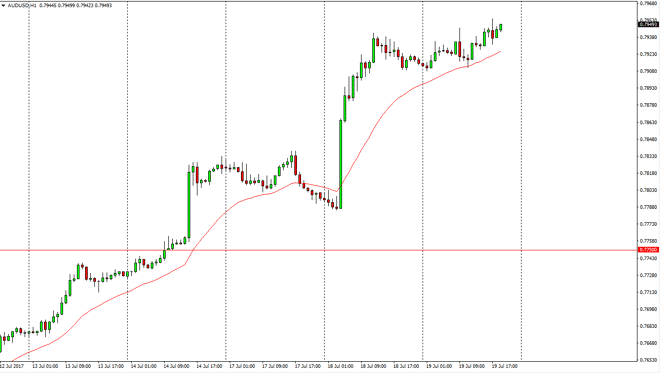

AUD/USD Forecast July 20, 2017, Technical Analysis

Updated: Jul 20, 2017, 06:20 GMT+00:00

The Australian dollar rose slightly during the day on Wednesday, continuing the bullish pressure that we had seen over the last couple of sessions.

The Australian dollar rose slightly during the day on Wednesday, continuing the bullish pressure that we had seen over the last couple of sessions. Because of this, looks as if the market is ready to continue to reach towards the psychologically important figure of 0.80. I believe that the market will continue to follow the gold markets as per usual, which look very healthy. The US dollar is in a lot of trouble, and I think that the Australian dollar is an excellent way to play US dollar weakness. As gold rises, that puts bullish pressure in this market, and of course vice versa. You can see that the 24-hour exponential moving average has offered support as of late, and I think it should continue to do so. Longer-term, the 0.80 level above will cause quite a bit of resistance, but I think it is far too attractive of a target for traders to ignore.

Short-term trading only

I believe that the markets will continue to trade short-term, with the buyers looking to get involved on pullbacks based upon value. Once we break above the 0.80 level, the market then becomes more of a “buy-and-hold” situation. Massively the buying dips will be the best way to go going forward, as we should continue to see bullish pressure above the 0.0 level. I believe that the 0.7750 level underneath should continue to be a bit of a “floor” in the market. The market continues to show upward proclivity, so I don’t necessarily have much in the way of any interest in shorting.

AUD/USD Video 20.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement