Advertisement

Advertisement

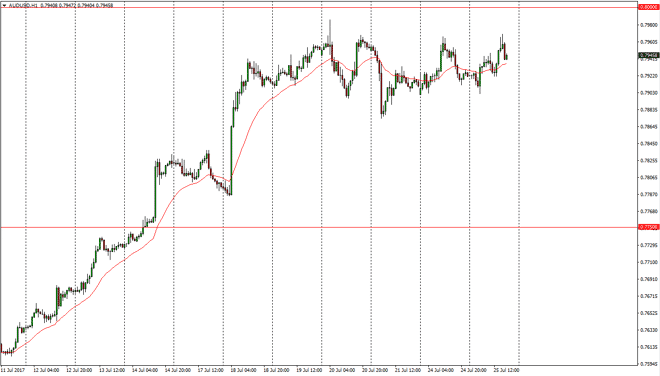

AUD/USD Forecast July 26, 2017, Technical Analysis

Updated: Jul 26, 2017, 04:39 GMT+00:00

The Australian dollar rose during the session on Tuesday, as we continue to consolidate overall. I believe that the market is waiting for the FOMC

The Australian dollar rose during the session on Tuesday, as we continue to consolidate overall. I believe that the market is waiting for the FOMC Statement coming out today, as the Australian dollar is so highly leveraged to gold. If the statement is dovish, is very likely that we will finally break above the 0.80 level, which would be a very bullish sign. This is a level that means a lot on charts going back decades, so a break above the 0.80 level census market to the upside for the longer term. Alternately, if we break down below the 0.75 zero level, I feel that the uptrend is probably over, and we start to break down. I recognize that the market is certainly “leaning” to the upside, but it probably won’t be until we get the statement and some type of dovish tone to that statement that the market will because than enough to break out.

Watch Gold

If gold starts to rally, this pair will follow. Of course, the opposite is true as well, so by watching the gold markets, you can get a read on where the Australian dollar should go next. Ultimately, this is a market that I think is trying to break out to the upside, but doing so between now and the announcement would be a simple gambling, and I believe that most traders around the world are aware of this. Because of this, I believe that it be very difficult to trade this market between now and 2 o’clock Eastern Standard Time in New York, so I will be on the sidelines in general. However, as soon as we get the break out I would be willing to put money to work if it’s after the announcement.

AUD/USD Video 26.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement