Advertisement

Advertisement

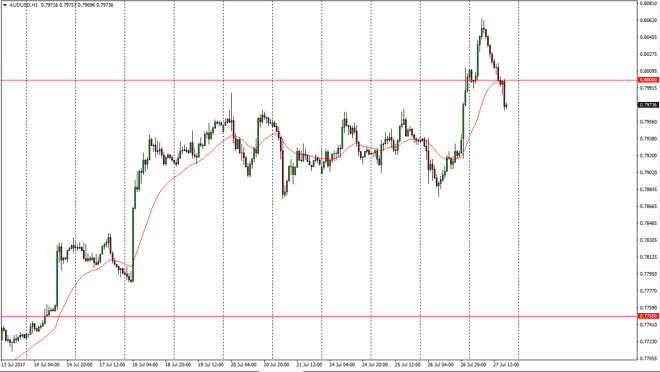

AUD/USD Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:55 GMT+00:00

The Australian dollar initially spiked higher during the day on Thursday, but found enough resistance at the 0.8050 level to turn around and fall below

The Australian dollar initially spiked higher during the day on Thursday, but found enough resistance at the 0.8050 level to turn around and fall below the 0.80 level. I think that we are now testing support at the 0.7975 handle, which was the previous resistance. I think that this pullback is a buying opportunity though, because it was so resistive in the past. That’s not to say that is can be easy for this market to go higher, but I think that given enough time we should continue to grind out to the upside as the US dollar will continue to be somewhat soft. I think that gold markets of course will have the usual influence on the Australian dollar, so if they start to rally, so will the Aussie. If we can break out above the 0.8065 handle, the market should then go looking for the 0.81 level above, and then eventually the 0.82 handle.

Volatility, but bullish overall

I believe in the volatility showing opportunities to go long of the Aussie as it should continue to be a strong currency due to gold and of course the shrinking US dollar longer term. Given enough time, I believe that the Australian dollar will find plenty of buyers, and that we will go looking towards much higher levels. In the short term, we may bounce around the 0.80 handle, but the longer-term direction of this market certainly seems to be to the upside as we continue to see plenty of interest and not only gold, but the Aussie itself. The US dollar looks to be softening over the longer term but we may have a bit of a “relief rally” in the US dollar causing bits of noise in the market. I believe the buyers are returning.

AUD/USD Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement