Advertisement

Advertisement

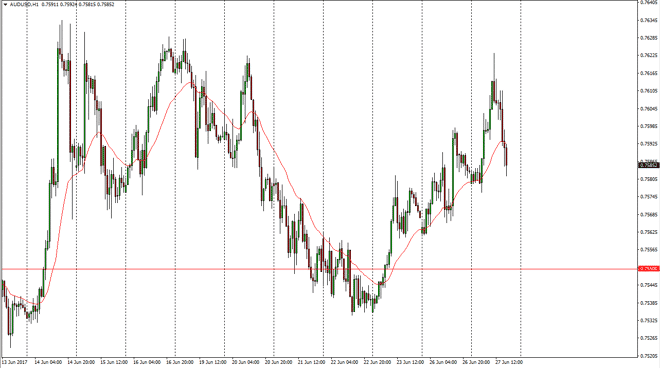

AUD/USD Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:45 GMT+00:00

The Australian dollar initially rally during the day on Tuesday but then found enough resistance near the 0.7625 handle to turn around and drop

The Australian dollar initially rally during the day on Tuesday but then found enough resistance near the 0.7625 handle to turn around and drop significantly. However, as I record this market for the Wednesday session, I can see that the buyers are starting to jump into the market near the 0.7590 level. I think as long as we can stay above the 0.7580 level underneath, the market didn’t continue to go higher. The 24-hour exponential moving average of course is offering dynamic support and resistance, and therefore I think that the traders will be interested. Volatility will continue, but the Australian dollar tends to thrive on the gold market, which I think is trying to make a little bit of the stand.

Asian proxy

Also, keep in mind that as Asian stock indices go, the Australian dollar tends to go. I also believe that if we see good news coming out of Asia economically, that helps the Australian dollar as the market looks at the Aussie dollar as a proxy for copper, gold, and several other commodities that the Aussie supply to contractors in Asia. I believe that the 0.7550 level underneath will be the “floor” in the market, so as long as we can stay above there I think that the market then reaches us to the upside. Ultimately, this is a market that continues to offer buying opportunities on dips, and that should continue to be the way this works out. The market breaking above the 0.7650 level is a very bullish sign, and then should send the market to the 0.7750 level above which is massively resistive on a longer-term chart. I believe that we continue to see this back and forth action, so short-term traders will continue to love the AUD/USD pair.

AUD/USD Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement