Advertisement

Advertisement

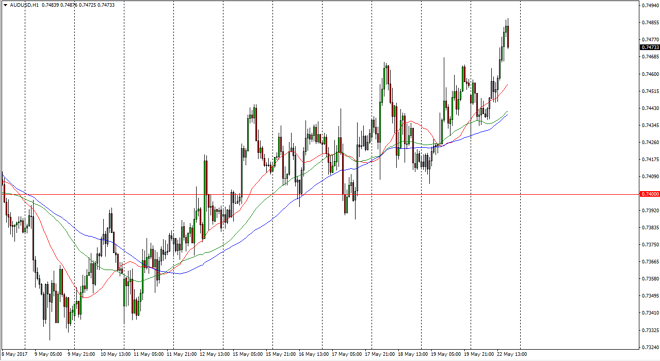

AUD/USD Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:04 GMT+00:00

The Australian dollar had an explosive session on Monday, initially gapping lower, filling the gap, and then continue the down move. However, we turned

The Australian dollar had an explosive session on Monday, initially gapping lower, filling the gap, and then continue the down move. However, we turned around at the 0.7425 level to rocket to the upside. As we approached the 0.75 level, the sellers came back and now it looks as if we may have to pull back to build up enough volume and momentum to break above that level. Remember, the Australian dollar is highly sensitive to the gold markets, and if they rally, so does the Aussie over the longer term. I believe that these pullbacks should continue to offer value that you can take advantage of, especially near the 0.7450 level. That’s an area that has been resistive in the past, and should now be support. Once we break above the 0.75 handle, I think that the market will eventually go looking for the 0.80 level above there, but it may take quite a bit of time.

Gold

If gold markets breakdown, then I would expect this pair to go looking for the 0.74 level underneath, and breaking below there would probably go looking for the 0.7350 level after that. The Australian dollar is highly sensitive to risk appetite as well, so pay attention to that, as if the riskier assets around the world gain, typically the Aussie will as well. I believe that there will be quite a bit of volatility, but it certainly looks as if traders are starting to run from the US dollar, at least in the intermediate time frames, and that should continue to put a bit of bullish pressure in this market as we continue to see choppiness. The weekly chart formed a hammer a couple of weeks ago, which looks as if it is trying to act as a bottom.

AUD/USD Video 23.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement