Advertisement

Advertisement

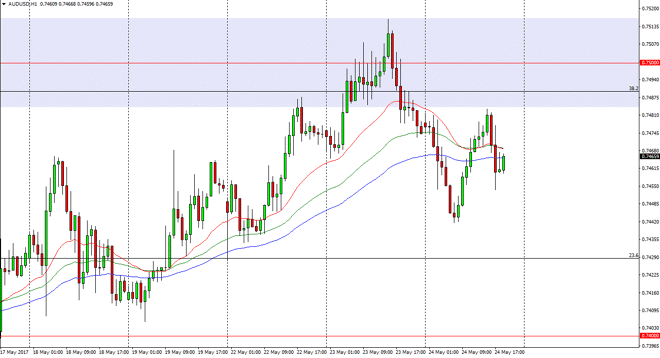

AUD/USD Forecast May 25, 2017, Technical analysis

Updated: May 25, 2017, 03:47 GMT+00:00

The Australian dollar was volatile during the session on Wednesday, initially dipping as low as the 0.7440 level, only to turn around and show signs of

The Australian dollar was volatile during the session on Wednesday, initially dipping as low as the 0.7440 level, only to turn around and show signs of strength again to the 0.7485 level. We then fell again, as we continue to see massive amounts of choppiness. Keep in mind that the Australian dollar tends to be beholden to what’s going on in China and the gold markets, and of course that is starting to throw the pair around in chaos. For example, the Chinese numbers softening and of course the credit rating getting lowered will continue to weigh upon the Australian dollar. At the same time, if we get some type of bullish move in the gold market, then the Australian dollar becomes a proxy for that market for currency traders.

The 0.75 level

The 0.75 level above should continue to be resistive, and I would be the first to point out that the daily candle for the previous session was a shooting star at the 38.2% Fibonacci retracement level. Because of this, I think there is probably more of a downward bias than an upward bias currently. Ultimately, I think you will have to pay attention to what goes on in the gold markets and of course the Chinese stock markets, and pay a little less attention to the Australian economy itself. I think that there will be short-term selling pressure, but if we can make a fresh, new high and above the highs from the session on Tuesday will more than likely offer a buying opportunity. All things being equal though, I would anticipate more softness going forward as any type of uncertainty tends to weigh upon the Australian dollar rather quickly, and of course the US dollar tends to be a bit of a safety currency.

AUD/USD Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement