Advertisement

Advertisement

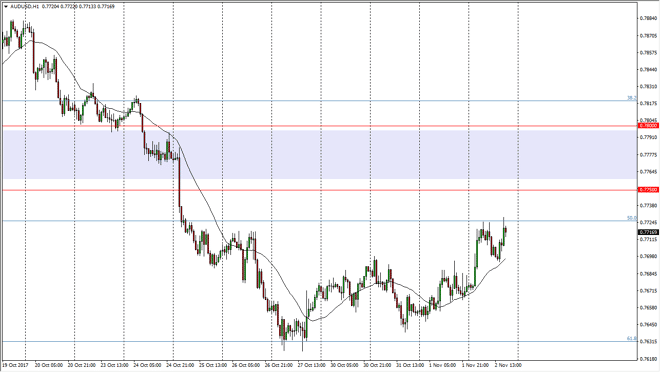

AUD/USD Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:14 GMT+00:00

The Australian dollar rallied during the trading session on Thursday, as we reached towards the 0.7725 level. However, I see a massive amount of

The Australian dollar rallied during the trading session on Thursday, as we reached towards the 0.7725 level. However, I see a massive amount of resistance just above, starting at the 0.7750 level, and extending to the 0.78 level. This is an area that had previously been massive resistance, so when we broke above there should’ve been massive support. I got broken through, so I suspect that the sellers are probably still waiting in that same general direction. If we can see a bit of a selloff in the gold markets, that should help this market fall as well, as it should be a sign of the US dollar strengthening. Any signs of weakness in the above area should be and I selling opportunity, as we would roll over and more than likely go towards the 0.76 handle, if not the 0.75 level.

The alternate scenario of course is a breakout above the 0.78 handle, and that should have the Australian dollar going towards the 0.80 level after that. This market has struggled in that area, and I think it would take a significant amount of momentum to break out. I don’t think we get that today, but we could get some answers to whether the resistance above can hold. Because of this, I will stay on the sidelines and wait to see how the day closes, and follow accordingly. If we break above the purple area on the chart with a daily close, the market should continue to go higher, perhaps offering a buying opportunity Monday morning. Alternately, if we get some type of exhaustive candle on the daily close, then I would be a seller at the Monday open. Ultimately, this is a market that needs to make a significant move soon.

AUD/USD Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement