Advertisement

Advertisement

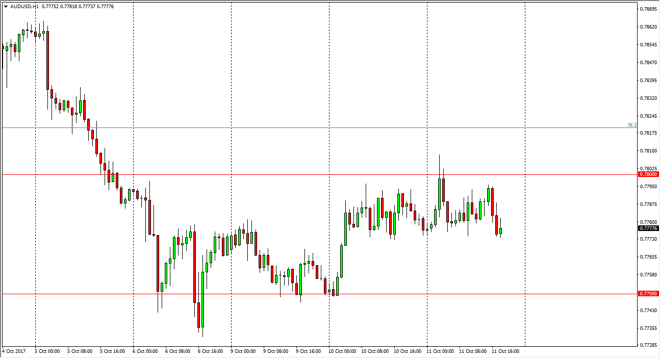

AUD/USD Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:51 GMT+00:00

The Australian dollar went sideways during the session on Wednesday, as we continue to see commodity currencies go flat. The 0.78 level above is

The Australian dollar went sideways during the session on Wednesday, as we continue to see commodity currencies go flat. The 0.78 level above is resistance, and I think it’s a sign of the market trying to build up enough momentum to continue going higher. If we can clear the 0.78 level, it’s likely that we won’t start looking towards the 0.80 level above, which is important on the AUD/USD chart going back decades. Ultimately, I think that if we can break above that area, and clear the resistance that extends to the 0.81 level, the market becomes more of a “buy-and-hold” market for several handles. I believe that we would start aiming for the 0.90 level above, and then possibly parity given enough time. Keep in mind that gold has a major influence on the Australian dollar, so it’s likely that we will follow that marketplace.

The FOMC Meeting Minutes come out later Wednesday, and that could give us an idea as to how hawkish or dovish the Federal Reserve is. Ultimately, I believe that if we break down below the 0.7750 level and possibly even the 0.77 level, it’s likely that the Australian dollar will start to unravel a bit. Having said that, I believe that it is more likely that we will continue to see strength after a retest of the major area that had been so resistive. By doing so, I think we are trying to build up enough momentum to go higher, and in the meantime, I think it’s much more likely to attempt to break out to the upside and continue the longer-term move. Having said that, you never know what happens next, so it’s nice to have clear areas such as the 0.78 level and the 0.77 level to guide your next trade.

AUD/USD Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement