Advertisement

Advertisement

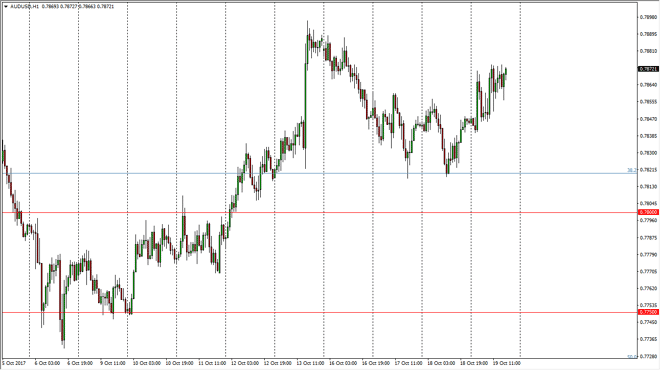

AUD/USD Forecast October 20, 2017, Technical Analysis

Updated: Oct 20, 2017, 05:53 GMT+00:00

The Australian dollar was very choppy and volatile during the session on Thursday, but with an upward proclivity. You can see on the chart that we are

The Australian dollar was very choppy and volatile during the session on Thursday, but with an upward proclivity. You can see on the chart that we are looking to reach towards the 0.79 level, and if we can break above there it’s likely that the market will then go to the 0.80 level above, which has been important to traders for decades. That begins a significant resistance barrier that extends to the 0.81 handle, and a break above there sends this into a “buy-and-hold” situation for the longer-term traders. I think at this point, it’s likely that the markets will find plenty of reason to go higher once we get above that level, and gold could be helpful. Remember that the Australian dollar is highly sensitive to risk appetite, and if markets continue to rally, it’s likely that the pair will rally right along with it.

Once we break above the 0.80 region, then I think the 0.90 level is probably the next target. After that, and then becomes parity. The Australian dollar is highly sensitive to Asia and risk as well, so pay attention to Asian stock markets. If they start to rally, a lot of currency traders will use the Australian dollar is a proxy for China as well. I have no interest in shorting this market, because of the massive amount of support below that starts at the 0.78 handle. With that being the case, I think that we continue to bang around sideways overall, but with an upward tilt. Eventually though, the buyers will prevail and we will go much higher. In the meantime, build your position on short-term dips is probably the best strategy that I can think of, because it allows you to be in a large position once we break out.

AUD/USD Video 20.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement