Advertisement

Advertisement

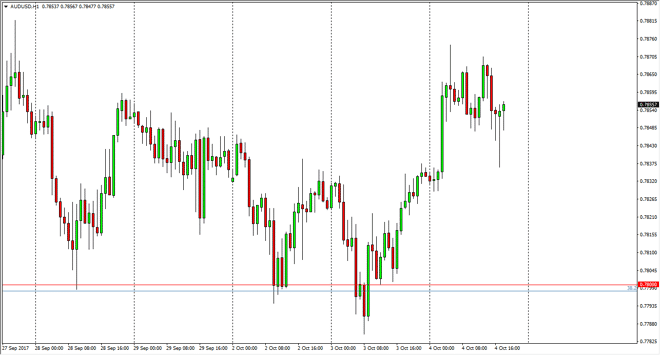

AUD/USD Forecast October 5, 2017, Technical Analysis

Updated: Oct 5, 2017, 05:26 GMT+00:00

The Australian dollar has gone higher during the session on Wednesday, as we reached towards the 0.7870 level, and then pulled back. However, we have seen

The Australian dollar has gone higher during the session on Wednesday, as we reached towards the 0.7870 level, and then pulled back. However, we have seen a lot of support just below, so I think that the market will eventually start to rally, as the 0.7850 level looks likely to bring in buyers. I also recognize that the 0.78 level underneath is supportive, and therefore I don’t have any interest in shorting. If the gold markets can continue to rally, it will send this market higher as well as the gold and Australian dollar tend to move in the same direction. On a move above the 0.79 handle, the market should then go looking towards the 0.80 level above.

AUD/USD Video 05.10.17

I like pullbacks

I think that the Australian dollar will continue to find a lot of support at the 0.78 level underneath, so therefore I like pullbacks as opportunity to pick up value. Remember, the pair broke out above this level recently, and has now come back to retest this area. Now that it has, the market should continue to find plenty of interest on dips as the 0.80 level above has offered a major amount of resistance. If we can break above the 0.81 level, the market should go much higher, perhaps reaching towards the 0.90 level longer term. I think it’ll take a while to get there obviously, but it becomes more of a “buy-and-hold” situation once we do break above the 0.81 handle.

Alternately, if we break down below the 0.7750 level, the market should roll over rather drastically. I don’t see that happening, but it is also a possibility that we should pay attention to. If we do break down below there, I think the market could fall to the 0.75 level rather rapidly.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement