Advertisement

Advertisement

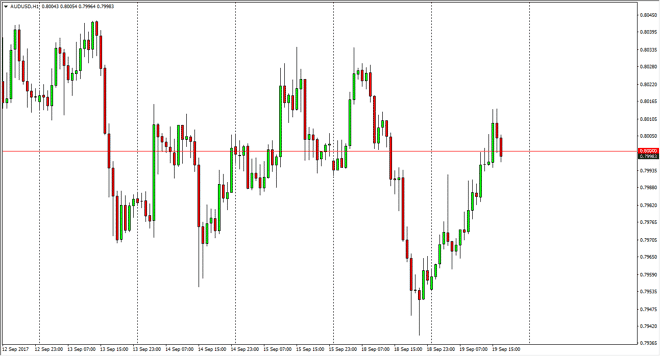

AUD/USD Forecast September 20, 2017, Technical Analysis

Updated: Sep 20, 2017, 04:45 GMT+00:00

The Australian dollar exploded to the upside during the day on Tuesday, breaking above the 0.80 level at one point. We turned around though, and I think

The Australian dollar exploded to the upside during the day on Tuesday, breaking above the 0.80 level at one point. We turned around though, and I think that this level will continue to offer a significant amount of resistance until we get clarity out of the Federal Reserve. There are a lot of conflicting ideas as to what the central bank will be willing to do, especially after the hurricane damage in the southeastern part of the United States. My suspicion is that the Federal Reserve will be reluctant to raise interest rates in what could be a difficult time for the US economy, as the damage assessment is still being looked at. Beyond that, there is yet another hurricane coming, which is at the very least going to affect the US Virgin Islands and Puerto Rico. With that in mind, I believe that the federal reserve will become dovish, or at least stand still.

Gold

Pay attention to the gold markets, they give us an idea as to where the Aussie can go going forward. I’m looking for supportive candles and the short-term bounces to take advantage of what I believe will eventually be a longer-term move. Keep in mind that the 0.0 level is a major level on charts going back decades, so expect a lot of noise in this area, but I think once we clear the 0.8150 level, the market is free to go much higher, and a longer-term “buy-and-hold” type of move. This will be one of the more interesting currency pairs to trade, as I believe we are on the precipice of something rather large. Through experience, I can tell you that typically these types of moves take a lot of effort, so therefore a lot of volatility ensues.

AUD/USD Video 20.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement