Advertisement

Advertisement

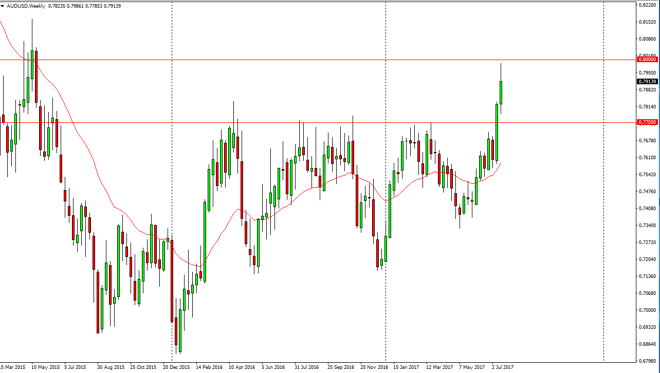

AUD/USD forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:39 GMT+00:00

The Australian dollar had an explosive week during the past several sessions, slamming into the 0.80 level. However, that area continues to be resistive,

The Australian dollar had an explosive week during the past several sessions, slamming into the 0.80 level. However, that area continues to be resistive, so having said that I think that it is a potential turnaround area. I don’t think that were to break down for any significant amount of time though, I think that a pullback is simply going to offer value that people will take advantage of as we try to build up enough momentum to go higher. Because of this, I believe that a pullback that offers a supportive candle is a nice buying opportunity but I also recognize that we the weekly close above the 0.0 level, at that point you would have to think that the Australian dollar will continue to go much higher.

Gold

Gold markets are likely to have an influence on this market as well, as the Australian dollar is used as a proxy for that market. So pay attention to that market, as it goes higher, so does the Aussie dollar. However, I think that the 0.7750 level underneath will be significantly supportive, so it’s not until we break down below there that I would consider selling. I believe that there will be plenty of buyers looking to take advantage of value on the pullback, so being patient for that move might be the best way to trade. Either way, I am presently bullish overall, and therefore don’t have any interest in selling, unless of course we break down below that important level, even though I see there is a significant amount of support under there as well. Either way, I think we’re going to be very choppy but it does appear that the Australian dollar is trying to make the break out finally, and perhaps reaching towards much higher levels.

AUD/USD Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement