Advertisement

Advertisement

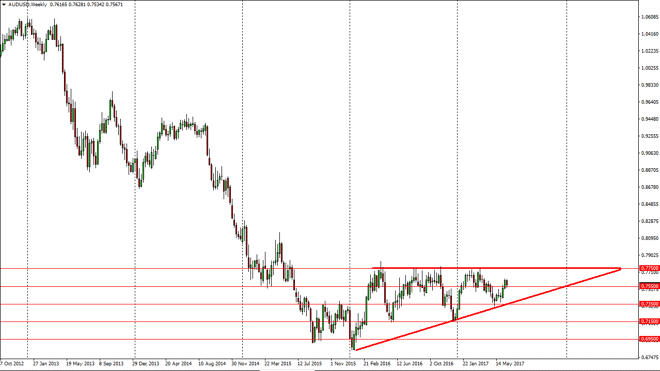

AUD/USD forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:13 GMT+00:00

The Australian dollar initially fell during the week, but found enough support at the 0.7550 level to bounce. More importantly, Gold markets look very

The Australian dollar initially fell during the week, but found enough support at the 0.7550 level to bounce. More importantly, Gold markets look very likely to continue to bounce, and that being the case it should continue to reach towards the 0.7750 level. I think a break above there is a very bullish sign, as it would be a break of major resistance. At that point, I anticipate the market looking to the 0.80 level after that. That is an area that’s been very important for the Australian dollar of the longer-term, speaking in terms of decades. Ultimately, I think that short-term pullbacks are buying opportunities, as long as we can stay within the triangle that I have drawn on this chart.

Buying dips

I believe in buying dips, and building up a large position for the longer-term move that is almost undoubtedly going to try to happen. A break above the 0.80 level census market looking for the 0.88 handle. Marketplace volatility will probably continue to be the case, but it looks as if the commodity markets may help this market. Ultimately, I believe that the Australian GDP strengthening also puts a floor underneath this market. Ultimately, the Federal Reserve is likely to raise rates but we already know this, so it’s not much of a surprise and it is probably already baked into the market. With this, I think that the buyers continue to jump into this market, and that being the case I like the idea in adding to the position to the upside.

AUD/USD Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement