Advertisement

Advertisement

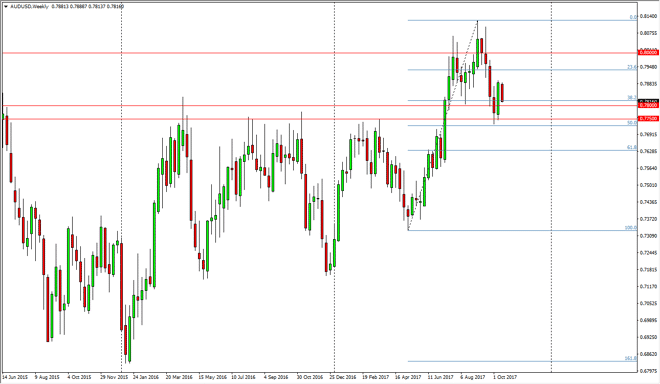

AUD/USD forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:20 GMT+00:00

The Australian dollar fell during the bulk of the week, reaching down towards the 0.78 level. Part of this was due to gold selling off, as it looks as if

The Australian dollar fell during the bulk of the week, reaching down towards the 0.78 level. Part of this was due to gold selling off, as it looks as if Donald Trump may pick a hawkish Federal Reserve Chairman, if that’s the case, it should be good for the US dollar, and therefore gold sold off. Because of this, the market looks likely to test the vital 0.78 level which extends support down to the 0.7750 level. Any type of bounce from that area could be a buying opportunity, but quite frankly it’s going to be short-term traders that see that opportunity going forward, and probably not long-term traders. If we were to break down to a fresh, new low, that could be very negative, and send the Australian dollar even lower. I think that a bounce from here could have the market eventually trying to reach the 0.80 level, but we will have to wait and see if we get the proper support just below. In the meantime, expect a lot of volatility, and pay attention to gold, as it quite often will lead the way for the Australian dollar, but don’t forget Copper markets either.

Another factor for the Australian dollar typically is the Asian stock markets, so they start to rally it could help the Aussie, but right now it looks as if the market is starting to favor the US dollar in general, so we could have a bit of stagnation at best. At worst, we could have some type of breakdown, but I also recognize that the 0.80 level is the beginning of a significant resistance extending about 100 pips, so breaking out above there was always going to take a significant amount of momentum and bullish pressure.

AUD/USD Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement