Advertisement

Advertisement

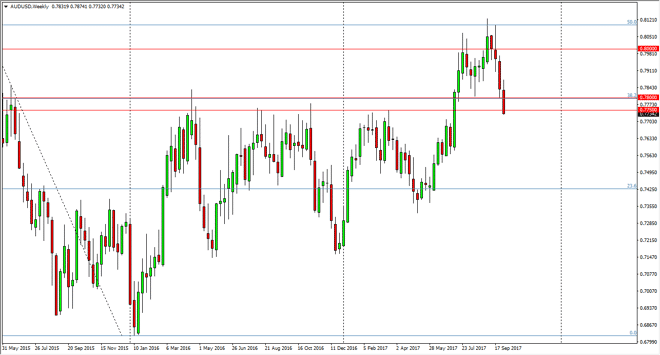

AUD/USD forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:28 GMT+00:00

The Australian dollar initially tried to rally during the week, but rolled over and broke down below the 0.78 level. By the time we got done with the

The Australian dollar initially tried to rally during the week, but rolled over and broke down below the 0.78 level. By the time we got done with the Friday session, the market broke down below the 0.7750 level as well. That is a significant level, and was the scene of a massive breakout. The fact that we are closing towards the bottom of the weekly candle suggests that we are going to continue to drop from here, perhaps reaching down to the 0.75 handle. The gold markets of course have a major influence on the Australian dollar, so pay attention to that market as well. Either way, this is a market that looks a very likely to find a lot of noise in this area now that we have cleared the open space.

Ominous sign

It’s a pretty ominous sign that we have broken down below the 0.7750 level, so I think that the market is most certainly going to continue to find sellers. If we were to break above the 0.78 level, I would rethink my thesis, but right now it’s more than likely going to be a negative market in the next couple of weeks. Ultimately, if we can break above the 0.78 level, the market would probably go looking towards the 0.80 level above, and if we can break above the 0.81 level, the market continues the longer-term uptrend. However, this looks very negative and that should be the overall attitude for the next move. I think that the 0.75 level underneath will be supportive, but if we break down below there, we probably continue to drop rather significantly. I believe that the next couple of weeks will be vital when it comes to the future of the Australian dollar.

AUD/USD Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement