Advertisement

Advertisement

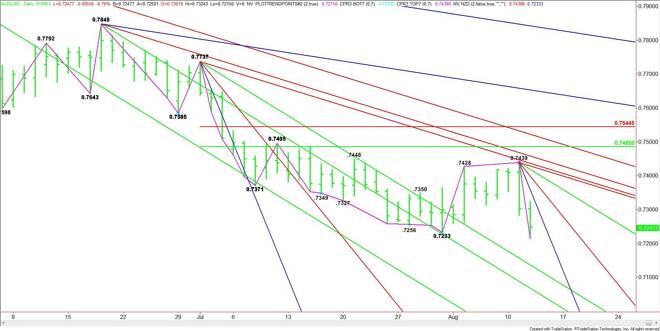

AUD/USD Forex Technical Analysis – August 12, 2015 Forecast

By:

China triggered another sell-off by the AUD/USD earlier in the session when it cut the value of the Yuan against the U.S. Dollar for a second consecutive

China triggered another sell-off by the AUD/USD earlier in the session when it cut the value of the Yuan against the U.S. Dollar for a second consecutive day, trimming the reference rate by 1.62 percent. The People’s Bank of China downplayed expectations it would continue to depreciate the currency, however, the reaction by the market suggests there is a bias for further depreciation.

The sell-off earlier in the session drove the market through the late July main bottom at .7233, stopping at .7215 before regaining the previous bottom. This suggests that the move through the bottom may have been related to sell stops rather than fresh shorting. Based on the current price at .7250, anyone that sold weakness through .7233 is trapped. This could lead to further short-covering until a stopper comes in to refresh their short positions.

The first likely target of a rebound rally today is a steep downtrending angle at .7359. This is followed by a pair of angles at .7399 and .7419.

For longer-term traders, the best resistance and the angles that have been guiding the market lower since June come in at .7429, .7437 and .7458.

If the selling is strong enough later in the session to continue the break then look for a possible acceleration through .7215. The next potential downside target is a downtrending angle at .7137. Crossing to the weak side of this angle will put the AUD/USD in an extremely bearish position with the next target coming in at .7068.

Investors are worried that the People’s Bank of China is not finished with its devaluation moves so they are expected to be a little tentative about playing the long side. There may be a few intraday counter-trend rallies, but conditions are likely to remain bearish unless a closing price reversal bottom forms.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement