Advertisement

Advertisement

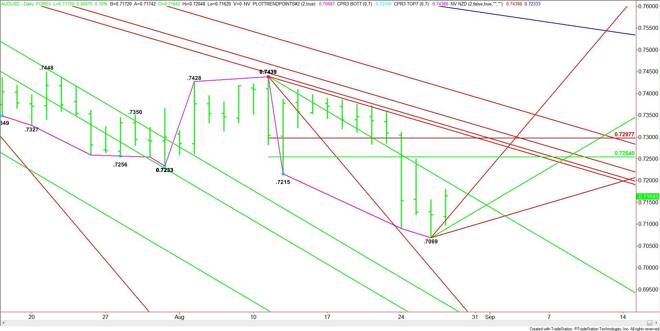

AUD/USD Forex Technical Analysis – August 28, 2015 Forecast

By:

Another strong rally in the global equity markets created a risk-on scenario which spread to the higher-yielding foreign currency markets, giving the

Another strong rally in the global equity markets created a risk-on scenario which spread to the higher-yielding foreign currency markets, giving the AUD/USD a boost on Thursday. Dovish comments earlier in the week from a Fed official also helped underpin the Forex pair because it weakened the case for raising interest rates in September. The strong recovery in the equity indices also diminished talk of another rate cut by the Reserve Bank of Australia as early as November. This led to position-squaring which also helped support higher prices.

Technically, the main trend is down according to the swing chart. Yesterday’s higher-high created a new minor bottom at .7069.

On Thursday, the market found support on an uptrending angle from the .7069 bottom. This angle comes in at .7149 today. Additional angles come in at .7109 and .7089. Since a new bottom may be developing, any of these angles may be tested as buyers try to develop a support base.

On the upside, the first target is a downtrending angle at .7179. The daily chart opens up to the upside over this angle, giving the market plenty of room to rally.

A sustained move over .7179 could create enough upside momentum to challenge a 50% level at .7254. This is another potential trigger point for an upside breakout with the next likely target a Fibonacci level at .7298. This is followed closely by a downtrending angle at .7309.

Based on the strong close, there could be a continuation of the rally into the angle .7109 early in the session. Since the main trend is down, sellers may come in on the initial test of this angle. If the buying is strong enough to take it out then look for a possible acceleration to the upside on strong short-covering and aggressive counter-trend buying.

If the selling is too strong on the test of .7109 then look for a break back into the support angles.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement