Advertisement

Advertisement

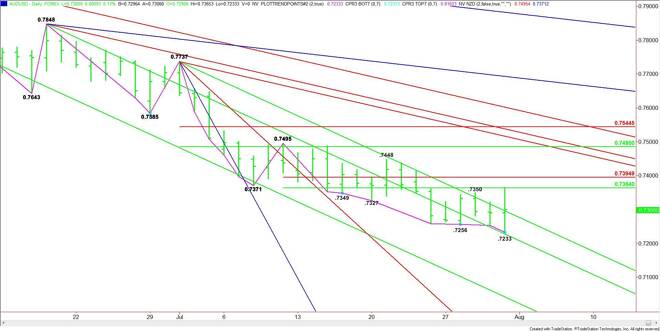

AUD/USD Forex Technical Analysis – August 3, 2015 Forecast

By:

After reaching a new low for the year, the AUD/USD rebounded on Friday to produce a potentially bullish closing price reversal bottom. Right now, we are

After reaching a new low for the year, the AUD/USD rebounded on Friday to produce a potentially bullish closing price reversal bottom. Right now, we are treating this as a rally in a bear market since the main trend is down on the daily chart. In addition, it may not even be a trend changing event, just merely position-squaring ahead of Tuesday’s Reserve Bank of Australia monetary policy statement.

The short-term range is .7495 to .7233. Its retracement zone is .7364 to .7395. The lower or 50% level of this zone was tested successfully on Friday when the rally stopped at .7365.

A trade through .7365 will confirm the closing price reversal bottom. This could trigger a rally into the Fibonacci level at .7395. The daily chart opens up to the upside on a sustained move over this level.

The main range is .7737 to .7233. If there is a sustained move over .7395 then its retracement zone at .7485 to .7544 becomes the primary upside target.

Friday’s close was .7300. The nearest downtrending Gann angle comes in at .7277. A sustained move under this angle will signal the presence of sellers. The next downside targets under this angle are .7233 and .7208. Crossing .7233 will negate the closing price reversal bottom. Crossing to the bearish side of the angle at .7208 will put the market in an extremely weak position.

The direction of the market today will be determined by trader reaction to the downtrending angle at .7277.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement