Advertisement

Advertisement

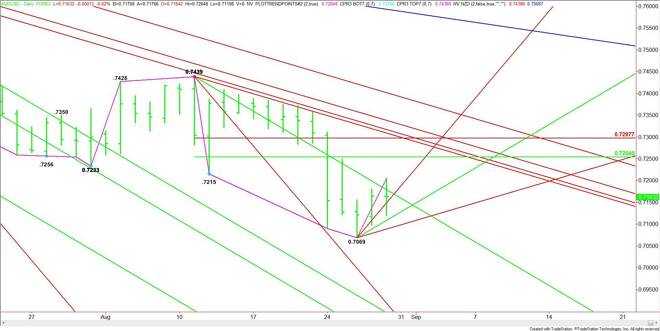

AUD/USD Forex Technical Analysis – August 31, 2015 Forecast

By:

The AUD/USD finished higher on Friday as it attempts to form a support base, following a sell-off into a new multi-year low early last week. This week

The AUD/USD finished higher on Friday as it attempts to form a support base, following a sell-off into a new multi-year low early last week. This week should feature more volatility because of the Reserve Bank of Australia monetary policy meeting on Tuesday and the release of the U.S. Non-Farm Payrolls report on Friday.

There was news over the week-end. Speaking at the central bank symposium at Jackson Hole, Wyoming, Federal Reserve Vice Chair Stanley Fischer stirred the volatility pot when he said on Saturday that he saw “good reason” to expect that inflation would rebound to a healthier pace as the American economy continued to grow. His remarks basically reinforced other recent indication that the Fed remained on course to raise interest rates this year.

On Friday, Mr. Fischer told CNBC that the Fed’s policy-making committee would consider acting when it meets in September. While he did acknowledge the recent volatility in the global financial markets, he downplayed the notion that it would affect the Fed’s decision to raise rates in 2015. He also added that the FOMC is primarily focused on the U.S. labor and inflation trends.

On Tuesday, the RBA is expected to leave interest rates unchanged. However, there is still speculation it may issue a dovish statement, setting up the possibility of another interest rate cut within the next 12 months. Traders have priced in a 31 percent chance of this occurring.

On Friday, the U.S. will report its latest data on U.S. employment. The report is expected to show the economy added 223K new jobs in August.

We could be looking at renewed selling pressure this week if traders decide to focus on the interest rate differential since the Fed could hike and the RBA could offer dovish guidance. A surprise rate cut by the RBA will be bearish. The hawkish speech from Mr. Fischer over the week-end combined with a strong jobs number on Friday could push a rate hike forward. This would also set a bearish scenario.

Technically, the main trend is down according to the daily swing chart.

Based on the close at .7163, the key area to watch on Monday is .7159 to .7189. Falling below the downtrending angle at .7159 will indicate the presence of sellers. This could drive the market in a pair of uptrending angles at .7129 and .7099. The latter is the last potential support angle before the .7069 main bottom.

Overcoming the steep uptrending angle at .7189 will signal the presence of buyers. The daily chart indicates there is plenty of room to the upside. If the AUD/USD starts to gain traction over .7189 then the next target is a 50% level at .7254.

Holding between .7129 and .7189 will indicate investor indecision.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement