Advertisement

Advertisement

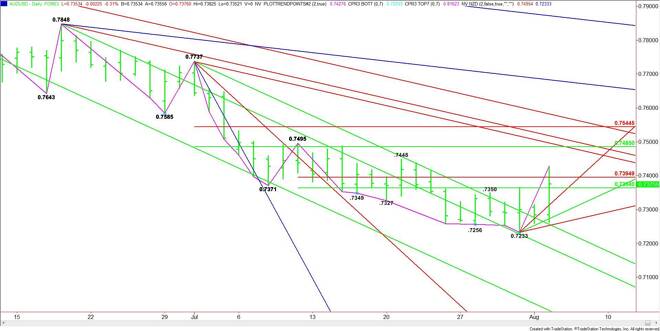

AUD/USD Forex Technical Analysis – August 5, 2015 Forecast

By:

The AUD/USD surged on Tuesday after the Reserve Bank of Australia refrained from an interest rate hike while issuing a monetary policy statement which

The AUD/USD surged on Tuesday after the Reserve Bank of Australia refrained from an interest rate hike while issuing a monetary policy statement which suggested it seems to be happy with the current level of the currency. The news triggered a price spike on short-covering, profit-taking and position-squaring.

The main trend is down according to the daily swing chart. The short term range is .7495 to .7233. Its retracement zone is .7364 to .7395. The market briefly pierced this zone, but eventually settled inside it. Since the main trend is down, sellers are likely defending the trend on a test of this zone. The direction of the market today will be determined by trader reaction to this zone.

A sustained move over the upper or Fibonacci level at .7395 will signal the presence of buyers. The daily chart indicates there is plenty of room to the upside with the next potential targets a 50% level at .7485, and a pair of downtrending angles at .7487 and .7498. A test of .7485 will complete a 50% retracement of the .7737 to .7233 range.

A sustained move under the 50% level at .7364 will signal the presence of sellers. The first downside target is a steep uptrending angle at .7353. Additional angles comes in at .7293 and .7203. The latter is the last angle before the .7233 main bottom.

Monday’s price action was impressive, but it was only a shift in momentum. If the market is forming a bottom then it should break for a couple of days in a test of the .7233 bottom. Before moving higher it will be important to build a secondary higher bottom.

Timing is an issue too. Because of the important U.S. Non-Farm Payrolls report on Friday and its impact on the Fed’s interest rate decision, the AUD/USD could trade sideways into August 7.

Look for an upside bias to develop on a sustained move over .7395 and a downside bias on a sustained move under .7364.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement