Advertisement

Advertisement

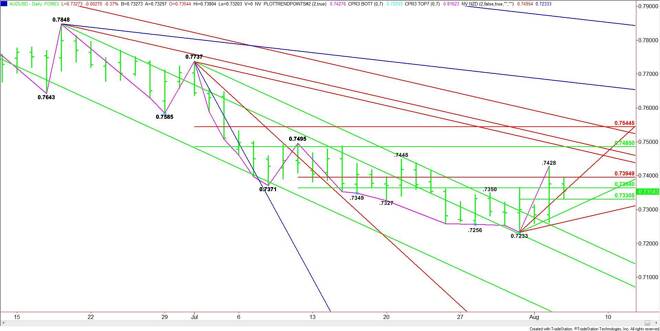

AUD/USD Forex Technical Analysis – August 6, 2015 Forecast

By:

The AUD/USD posted an inside move, lower close on Wednesday. The inability to follow-through to the upside verifies that the strong surge on Tuesday was

The AUD/USD posted an inside move, lower close on Wednesday. The inability to follow-through to the upside verifies that the strong surge on Tuesday was triggered by short-covering, rather than aggressive buying.

Technically, the main trend is down according to the daily swing chart. The new short-term range is .7233 to .7428. Its 50% level or pivot is .7330. This price was tested successfully on Wednesday. Trader reaction to this price should set the tone for the day and perhaps over the near-term. Sellers are going to try to drive the market through it. Buyers are going to try to establish a potentially bullish secondary higher bottom.

A sustained move through .7330 is likely to trigger a break into the next uptrending angle at .7313. The next angle comes in at .7273. This is the last major uptrending angle before the .7233 main bottom.

A sustained move over .7330 will signal the presence of buyers. The first target is the main 50% level at .7364. A steep uptrending angle at .7393 and the Fibonacci level at .7395 form the next upside target and potential resistance cluster.

The resistance cluster at .7393 to .7395 is also a potential trigger point for an upside breakout with the next target a minor high at .7428. The major upside target is another resistance cluster at .7477 to .7485. This is followed by another downtrending angle at .7498.

Watch and read the price action and order flow at .7330 today. This will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement