Advertisement

Advertisement

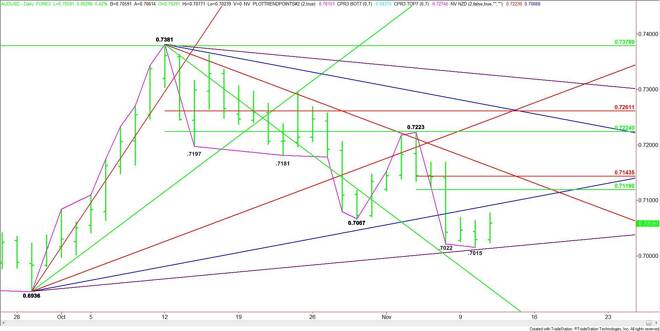

AUD/USD Forex Technical Analysis – November 11, 2015 Forecast

By:

The AUD/USD is trading higher under thin trading conditions. Volume is below average because of the U.S. bank holiday. The earlier rally to .7077 took out

The AUD/USD is trading higher under thin trading conditions. Volume is below average because of the U.S. bank holiday. The earlier rally to .7077 took out yesterday’s high, making .7015 a new minor bottom.

The nearest support is a major uptrending angle at .7014 today. This forms a tight support cluster with the minor bottom at .7015. A break through this area will signal a resumption of the downtrend.

The nearest upside target is an uptrending angle at .7091. This angle is also a potential trigger point for an upside breakout.

The main trend is down according to the daily swing chart. The new range is .7223 to .7015. Taking out the angle at .7091 could trigger an acceleration into its retracement zone at .7119 to .7143. Since the trend is down, sellers are likely to come in on a test of this area.

Based on the short-term rally from .7015 to .7077, a new pivot has formed at .7046. This pivot is likely to control the direction of the market the rest of the session.

Today’s U.S. bank holiday is likely to mean that volume will be light. This could lead to a range bound trade. Watch for a possible two-sided trade on both sides of the pivot at .7046. Be careful buying strength and selling weakness because of low volume.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement