Advertisement

Advertisement

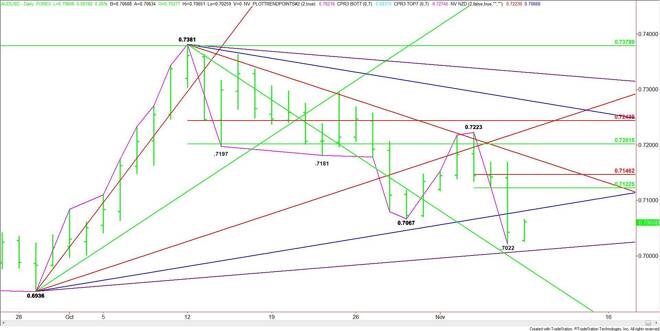

AUD/USD Forex Technical Analysis – November 9, 2015 Forecast

By:

The AUD/USD opened lower on Monday. The price action was driven by the downside momentum created by Friday’s strong U.S. Non-Farm Payrolls report and the

The AUD/USD opened lower on Monday. The price action was driven by the downside momentum created by Friday’s strong U.S. Non-Farm Payrolls report and the release of weak Chinese trade data on Sunday. Short-term oversold conditions and the lack of fresh economic news today, however, may have given traders an excuse to book profits as the Forex pair neared last week’s low at .7022. This could lead to further short-covering later today.

Longer-term indicators are pointing lower because of the divergence between the monetary policies of the Reserve Bank and the U.S. Federal Reserve. Basically, the RBA is looking at a possible 25 basis point cut in December while traders are about 70% certain the Fed will raise rates 25 basis points by the end of the month.

With the U.S. jobs situation out of the way until next month, traders will shift their focus on the U.S. consumer and the latest retail sales information on Friday, November 13. A strong report should raise the odds of a December rate hike. Throughout the week, investors will get the opportunity to react to comments from several Fed members including Chair Janet Yellen on Thursday, November 12. Traders will be looking for comments that solidify the rate hike before the end of the year.

Technically, the main trend is down according to the daily swing chart. Early in the session, the market found buyers at .7026, which was slightly above last week’s low at .7022 and a major long-term uptrending angle at .7009. The latter is the last potential support angle before the September 29 main bottom at .6936.

The first upside target today is another long-term uptrending angle at .7081. Overcoming this angle will indicate the short-covering is getting stronger.

If a short-term range forms between .7223 and .7022 then the primary upside objective becomes its retracement zone at .7122 to .7146. There is no urgency to get short on weakness at this time so expectations are that sellers will be waiting to increase their positions on a test of this retracement zone.

We could see a choppy, two-sided trade in today’s session. If the short-covering continues then .7081 will be the first objective. This is also a trigger point for an upside breakout. Downside targets include .7022 and .7009. The latter is also a trigger point for a downside breakout.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement