Advertisement

Advertisement

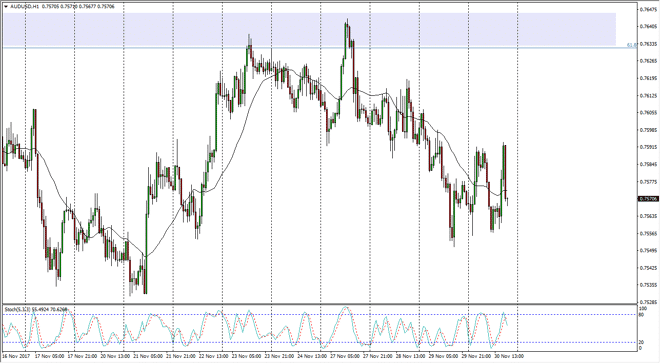

AUD/USD Price Forecast December 1, 2017, Technical Analysis

Updated: Dec 1, 2017, 04:08 GMT+00:00

The Australian dollar continues to be very volatile, especially considering that gold can’t decide which direction it wants to go. We have been consolidating and that market, and so we consolidate and this one.

The Australian dollar was very choppy during the Thursday session, reaching towards the 0.76 level a couple of times, but failing and rolling over. I currently believe that we are trying to build up enough momentum to continue the downward motion towards the 0.75 handle. This is especially true considering the gold look a bit soft during the trading session, and even though we have rallied a couple of times during the day and follow those by massive move slower, we are still essentially overbought in the stochastic oscillator, and that means that more than likely the momentum will continue to drift lower. I think that a breakdown below the 0.75 level is a significant event, and could lend this market down to the 0.7350 level after that.

Looking at this chart, you can clearly see that there is a lot of noise, and therefore you have to be able to deal with the volatility that comes with trading the Aussie dollar right now. The market is one that you should probably add to incrementally if we break down. However, if we do turn things around and break above the 0.76 handle, I think at that point the Australian dollar will more than likely go looking towards the 0.7650 level. This market is very noisy, and should continue to be so as gold simply is not providing any type of catalyst, and of course Asia is a bit of a mixed picture, so that has an effect on the Aussie as well. The US dollar could continue to strengthen if the US Congress can pass tax reform.

AUD/USD Video 01.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement