Advertisement

Advertisement

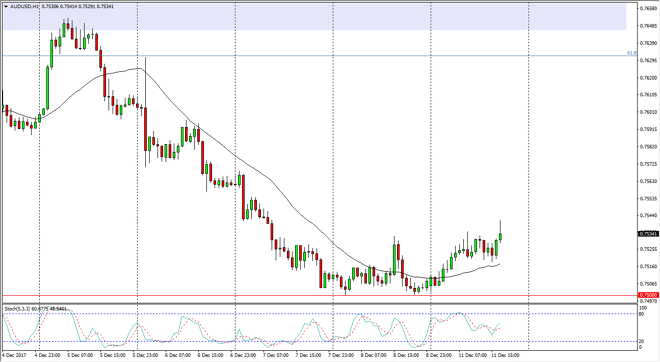

AUD/USD Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:01 GMT+00:00

The Australian dollar continues to be noisy, as we bounced along the bottom at the 0.75 handle. We were slightly positive on Monday, but quite frankly not much has changed.

With the Australian dollar rallied a bit during the day on Monday, we reached towards the 0.7550 region. We are starting to roll over a little bit as I record this, and we are most certainly in a negative market overall. Because of this, I think that if we can break down below the 0.75 level, this will only accelerate the move to the downside, as I believe that the Australian dollar will continue to struggle, especially if Chinese economic numbers this week are softer than anticipated. Beyond that, markets have been exactly exploded to the upside and with the Federal Reserve having a key interest rate height coming this week, most of the action will probably be predicated upon the statement and tone. If the Federal Reserve sounds hawkish, I think that might be enough to send this market to the downside and pilot breakdown. If we do break down below that level, I believe that the 0.7250 level underneath is massive in its importance. However, we probably go even lower than that and reach towards the 0.70 level after that.

As far as buying is concerned, I need to see gold rally as well. I think this probably won’t happen until the Federal Reserve announcement, and will only happen if the Federal Reserve somehow disappoints the market. If it does, then gold markets will probably take off, and that could be reason enough to start buying the Aussie dollar. Until then, I’m looking for exhaustion to start selling as the downtrend has been quite impressive over the last several weeks.

AUD/USD Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement