Advertisement

Advertisement

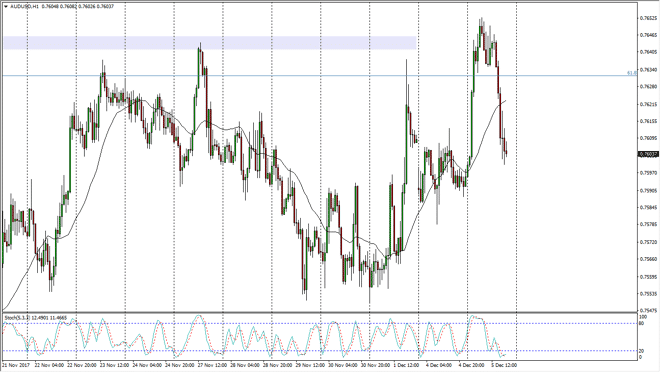

AUD/USD Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 06:52 GMT+00:00

The Australian dollar rallied significantly during the trading session on Tuesday, but found that massive amounts of resistance at the 0.7650 level.

The Australian dollar rallied significantly during the trading session on Tuesday, but found the 0.7650 level to be resistance, as it was once support. By doing so, the market rolled over from there and reach down towards the 0.76 level underneath. That’s an area that of course will attract a lot of attention as it is a large, round, psychologically significant number. But a break down below that level should send the market to the 0.75 level next. A breakdown below that level should send this market much lower. Ultimately, this is a market that will remain very volatile, because quite frankly the gold markets have quite a bit of bearish pressure in them as well, which of course is bearish for the Australian dollar.

If we do breakout to the upside, I suspect that the 0.7650 level will of course cause offer resistance, but if we can break above that level, the market then goes to the 0.7750 level next, which is even more resistant. Ultimately, a breakdown below the 0.75 level would probably accompany a breakdown in the gold markets as well. I think we continue to see a lot of noise, because there are concerns coming out of Asia, and of course gold hasn’t exactly been on fire as of late either. The US Congress looks likely to pass tax reform, so it’s going to be positive for the US dollar longer-term against the Aussie, assuming that it is a good bill. Alternately, if they do not it’s likely that the pair will go much higher. Expect choppiness, and quite frankly I would not put a lot of money to work until we get clarity.

AUD/USD Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement